Measuring Overbought And Oversold: Greed And Fear Index (GFI)

█ OVERVIEW

In his article in Oct 2022 issue of Technical Analysis of Stocks and Commodities, “Measuring Overbought And Oversold: Greed And Fear Index” author Howard Wang describes the construction of greed and fear index (GFI).

In simple terms, the GFI helps to detect selling and buying earlier in the trend rather than later in the trend:

- A high GFI implies that there is overheated buying sentiment and that traders may have overbought. A high GFI may be a good time to sell ahead of the crowd and ahead of a possible reversal.

- A very low GFI may indicate a good time to buy in advance of the crowd.

█ CALCULATION

As with the BRSI, calculation of the GFI is according to the breakout candlestick. “BOK” stands for “breakout candlestick” and is formed from five original candles:

- BOKH (BOK candles high) (BOKH is the 5 highest candles)

- BOKL (BOK candles low) (BOKL is the 5 lowest candles)

- BOKC (BOK candles close) (BOKC is the 5 last closes)

- BOKO (BOK candles open) (BOKO is the 5 last opens)

The formula for the GFI is: GFI = B⁄A

- B = Mean of (BOKC−BOKO) for 5 periods

- A = Mean of (BOKH−BOKL) for 5 periods

█ EXPLANATION

GFI ranges between +1 and −1:

- If GFI is close to +1, it indicates there is overheated buying sentiment and traders may have overbought by this point. This may be a good time to sell in advance of the crowd, in order to sell close to a top.

- If GFI is close to −1, it indicates that stop losses are being hit, indicating selling, and the market may be reaching an oversold condition. This may be a good time to buy in advance of the crowd (that is, buy the dip).

- If GFI = 0, it indicates we are at an inflection point, which means a change may be about to occur in the current buy sell activity.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

1234

Download data

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#CBOE Volatility Index (^VIX) Chicago Options - Chicago Options Delayed Price. Currency in USD

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC', '^VIX']

tickers = benchmark_tickers + ['GSK', 'BST', 'PFE', 'AZN', 'BSX', 'NUVA', 'MDT']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(f"{datetime.now()}\t {ticker}\t {hist.shape}\t {hist.index.min()}\t {hist.index.max()}")

dfs[ticker] = hist

2023-03-08 13:50:01.144419 ^GSPC (5831, 7) 2000-01-03 00:00:00-05:00 2023-03-07 00:00:00-05:00

2023-03-08 13:50:02.185163 ^VIX (5832, 7) 2000-01-03 00:00:00-05:00 2023-03-08 00:00:00-05:00

2023-03-08 13:50:03.568624 GSK (5831, 7) 2000-01-03 00:00:00-05:00 2023-03-07 00:00:00-05:00

2023-03-08 13:50:04.503930 BST (2102, 7) 2014-10-29 00:00:00-04:00 2023-03-07 00:00:00-05:00

2023-03-08 13:50:05.765909 PFE (5831, 7) 2000-01-03 00:00:00-05:00 2023-03-07 00:00:00-05:00

2023-03-08 13:50:07.133366 AZN (5831, 7) 2000-01-03 00:00:00-05:00 2023-03-07 00:00:00-05:00

2023-03-08 13:50:08.237812 BSX (5831, 7) 2000-01-03 00:00:00-05:00 2023-03-07 00:00:00-05:00

2023-03-08 13:50:09.634396 NUVA (4736, 7) 2004-05-13 00:00:00-04:00 2023-03-07 00:00:00-05:00

2023-03-08 13:50:11.039413 MDT (5831, 7) 2000-01-03 00:00:00-05:00 2023-03-07 00:00:00-05:00

ticker = '^GSPC'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2023-03-01 00:00:00-05:00 | 3963.340088 | 3971.729980 | 3939.050049 | 3951.389893 | 4249480000 | 0.0 | 0.0 |

| 2023-03-02 00:00:00-05:00 | 3938.679932 | 3990.840088 | 3928.159912 | 3981.350098 | 4244900000 | 0.0 | 0.0 |

| 2023-03-03 00:00:00-05:00 | 3998.020020 | 4048.290039 | 3995.169922 | 4045.639893 | 4084730000 | 0.0 | 0.0 |

| 2023-03-06 00:00:00-05:00 | 4055.149902 | 4078.489990 | 4044.610107 | 4048.419922 | 4000870000 | 0.0 | 0.0 |

| 2023-03-07 00:00:00-05:00 | 4048.260010 | 4050.000000 | 3980.310059 | 3986.370117 | 3922500000 | 0.0 | 0.0 |

Define Greed And Fear Index (GFI) calculation function

import sys

sys.path.append(r"/kaggle/input/technical-indicators-core")

#from core.finta import TA

from finta import TA

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

def cal_gfi(ohlc: pd.DataFrame,

period: int = 5,

) -> pd.Series:

"""

// TASC Oct 2022: Measuring Overbought And Oversold: Greed And Fear Index by Howard Wang

"""

ohlc = ohlc.copy(deep=True)

ohlc.columns = [c.lower() for c in ohlc.columns]

#step 1: get the breakout candlesticks

break_high = ohlc["high"].rolling(window=2).max()

break_low = ohlc["low"].rolling(window=2).min()

two_signs = np.sign(ohlc["close"]-ohlc["open"]).rolling(window=2).apply(np.prod)

break_open = ohlc["close"].shift(1)

break_open[two_signs>0] = (ohlc["open"].shift(1))[two_signs>0]

break_close = ohlc["close"]

df_break = pd.concat([break_open,break_high, break_low, break_close], axis=1)

df_break.columns = ['open', 'high', 'low', 'close']

#step 2: calculate the GFI

B = (df_break["close"] - df_break["open"]).rolling(window=period).mean()

A = (df_break["high"] - df_break["low"]).rolling(window=period).mean()

return pd.Series(B/A, index=ohlc.index, name=f"GFI{period}")

Calculate Greed And Fear Index (GFI)

df['GFI']=cal_gfi(df)

df['RSI']=TA.RSI(df, period = 14, column="close")

df['EMA50']=TA.EMA(df, period = 50, column="close")

df['EMA200']=TA.EMA(df, period = 200, column="close")

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | GFI | RSI | EMA50 | EMA200 | |

|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||

| 2000-01-03 00:00:00-05:00 | 1469.25 | 1478.00 | 1438.36 | 1455.22 | 931800000 | NaN | NaN | 1455.220000 | 1455.220000 |

| 2000-01-04 00:00:00-05:00 | 1455.22 | 1455.22 | 1397.43 | 1399.42 | 1009000000 | NaN | 0.000000 | 1426.762000 | 1427.180500 |

| 2000-01-05 00:00:00-05:00 | 1399.42 | 1413.27 | 1377.68 | 1402.11 | 1085500000 | NaN | 4.935392 | 1418.213826 | 1418.739960 |

| 2000-01-06 00:00:00-05:00 | 1402.11 | 1411.90 | 1392.10 | 1403.45 | 1092300000 | NaN | 7.387438 | 1414.298520 | 1414.859942 |

| 2000-01-07 00:00:00-05:00 | 1403.45 | 1441.47 | 1400.73 | 1441.47 | 1225200000 | NaN | 48.207241 | 1420.176074 | 1420.288924 |

| Open | High | Low | Close | Volume | GFI | RSI | EMA50 | EMA200 | |

|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||

| 2023-03-01 00:00:00-05:00 | 3963.34 | 3971.73 | 3939.05 | 3951.39 | 4249480000 | -0.235848 | 40.292240 | 4004.483349 | 4007.101141 |

| 2023-03-02 00:00:00-05:00 | 3938.68 | 3990.84 | 3928.16 | 3981.35 | 4244900000 | -0.174370 | 44.519159 | 4003.576159 | 4006.844911 |

| 2023-03-03 00:00:00-05:00 | 3998.02 | 4048.29 | 3995.17 | 4045.64 | 4084730000 | 0.268026 | 52.319603 | 4005.225721 | 4007.230932 |

| 2023-03-06 00:00:00-05:00 | 4055.15 | 4078.49 | 4044.61 | 4048.42 | 4000870000 | 0.245390 | 52.629750 | 4006.919615 | 4007.640773 |

| 2023-03-07 00:00:00-05:00 | 4048.26 | 4050.00 | 3980.31 | 3986.37 | 3922500000 | 0.106727 | 45.513517 | 4006.113747 | 4007.429124 |

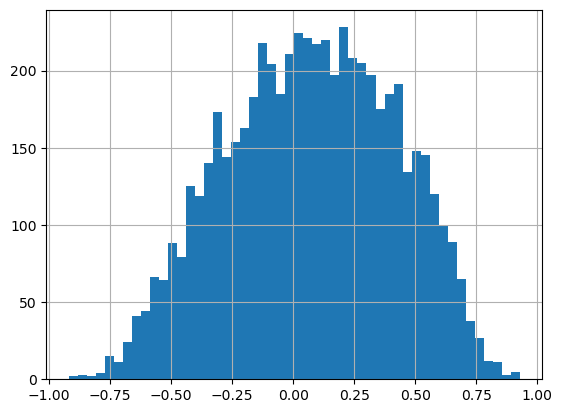

df['GFI'].hist(bins=50)

Visualize Greed And Fear Index (GFI)

#from core.visuals import *

from visuals import *

start = -500

end = df.shape[0]

df_sub = df.iloc[start:end]

# df_sub = df[(df.index<='2019-04-01') & (df.index>='2019-01-24')]

#names = {'main_title': f'{ticker}'}

names = {'main_title': f'{ticker} - Greed And Fear Index (GFI)'}

lines0, ax_cfg0 = plot_overlay_lines(data = df_sub, overlay_columns = ['EMA50', 'EMA200'])

#lines1, ax_cfg1 = plot_macd(data = df_sub, macd= 'DI_PLUS', macd_signal = 'DI_MINUS', panel =1)

lines1, shadows1, ax_cfg1 = plot_add_lines(data = df_sub, line_columns=['RSI', ],

panel =1, bands = [30, 70])

lines2, shadows2, ax_cfg2 = plot_add_lines(data = df_sub, line_columns=['GFI'],

panel =2, bands = [-0.75, 0.75])

#b_s_ = plot_buy_sell(data=df_sub, buy_column='DMI_BUY_Close', sell_column='DMI_SELL_Close')

lines_ = dict(**lines0, **lines1)

lines_.update(lines2)

#lines_.update(b_s_)

shadows_ = shadows1 + shadows2

fig_config_ = dict(figratio=(18,9), volume=False, volume_panel=2,panel_ratios=(4,2,2), tight_layout=True, returnfig=True,)

ax_cfg_ = ax_cfg0

ax_cfg_.update(ax_cfg1)

ax_cfg_.update(ax_cfg2)

names = {'main_title': f'{ticker}'}

aa_, bb_ = make_panels(main_data = df_sub[['Open', 'High', 'Low', 'Close', 'Volume']],

added_plots = lines_,

fill_betweens = shadows_,

fig_config = fig_config_,

axes_config = ax_cfg_,

names = names)

Call the function from finta.py

df_list = []

for ticker, df in dfs.items():

df = df[['Open', 'High', 'Low', 'Close', 'Volume']].round(2)

#df['GFI']=cal_gfi(df)

df['GFI']=TA.GFI(df, period = 5)

df['RSI']=TA.RSI(df, period = 14, column="close")

df['EMA50']=TA.EMA(df, period = 50, column="close")

df['EMA200']=TA.EMA(df, period = 200, column="close")

df['ticker'] = ticker

df_list.append(df)

df_all = pd.concat(df_list)

print(df_all.shape)

del df_list

gc.collect()

(47656, 10)

5507

dd = df_all.index

df_all.index = dd.date

df_all.index.name='Date'

df_all.tail(5)

| Open | High | Low | Close | Volume | GFI | RSI | EMA50 | EMA200 | ticker | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2023-03-01 | 82.40 | 82.53 | 81.67 | 82.08 | 5249100 | -0.449129 | 44.022248 | 82.552691 | 86.762242 | MDT |

| 2023-03-02 | 81.49 | 82.56 | 81.20 | 82.26 | 4985100 | -0.268898 | 44.950352 | 82.541213 | 86.717444 | MDT |

| 2023-03-03 | 82.79 | 83.63 | 82.44 | 83.41 | 4771600 | -0.007821 | 50.587132 | 82.575283 | 86.684534 | MDT |

| 2023-03-06 | 83.49 | 83.83 | 81.45 | 81.93 | 6845500 | -0.151832 | 44.300301 | 82.549978 | 86.637225 | MDT |

| 2023-03-07 | 82.09 | 82.15 | 79.51 | 79.74 | 6876000 | -0.349321 | 36.977231 | 82.439782 | 86.568596 | MDT |

df_all.to_csv('b_055_1_gfi_tasc202210.csv', index=True)