MAMA: MESA Adaptive Moving Average

Reference:

MAMA: MESA Adaptive Moving Average

The MESA Adaptive Moving Average (MAMA) adapts to price movement based on the rate change of phase as measured by the Hilbert Transform Discriminator.

The advantage of this method of adaptation is that it features a fast attack average and a slow decay average so that composite average rapidly ratchets behind price changes and holds the average value until the next ratchet occurs.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'AROC']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-08-27 13:58:24.342430 ^GSPC (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 13:58:24.638344 GSK (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 13:58:24.982461 NVO (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 13:58:25.208361 AROC (3782, 7) 2007-08-21 00:00:00 2022-08-26 00:00:00

ticker = 'AROC'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-22 | 7.59 | 7.68 | 7.50 | 7.62 | 753700 | 0.0 | 0 |

| 2022-08-23 | 7.74 | 7.90 | 7.71 | 7.80 | 732200 | 0.0 | 0 |

| 2022-08-24 | 7.78 | 7.95 | 7.74 | 7.92 | 673800 | 0.0 | 0 |

| 2022-08-25 | 7.95 | 8.00 | 7.84 | 7.92 | 857000 | 0.0 | 0 |

| 2022-08-26 | 7.85 | 7.93 | 7.76 | 7.79 | 962900 | 0.0 | 0 |

Define MAMA calculation function

def cal_mama(ohlc: pd.DataFrame, fast_limit: float = 0.5, slow_limit: float = 0.05, column: str = "close",) -> pd.DataFrame:

"""

MESA Adaptive Moving Average

The MESA Adaptive Moving Average (MAMA) adapts to price movement based on the rate change of phase as

measured by the Hilbert Transform Discriminator.

The advantage of this method of adaptation is that it features a fast attack average and a slow decay

average so that composite average rapidly ratchets behind price changes and holds the average value

until the next ratchet occurs.

source: https://www.mesasoftware.com/papers/MAMA.pdf

adapted from: https://github.com/mathiswellmann/go_ehlers_indicators/blob/bdc7bd10003c/mama.go#L110

"""

series = ohlc[column]

smooth = np.zeros(len(series))

period = np.zeros(len(series))

detrender = np.zeros(len(series))

i1 = np.zeros(len(series))

q1 = np.zeros(len(series))

ji = np.zeros(len(series))

jq = np.zeros(len(series))

i2 = np.zeros(len(series))

q2 = np.zeros(len(series))

re = np.zeros(len(series))

im = np.zeros(len(series))

smooth_period = np.zeros(len(series))

phase = np.zeros(len(series))

fama = np.zeros(len(series))

mama = np.zeros(len(series))

delta_phase = np.zeros(len(series))

alpha = np.zeros(len(series))

vals = series.values

for i in range(len(vals)):

if i<6:

mama[i] = vals[i]

fama[i] = vals[i]

continue

smooth[i] = (4*vals[i] + 3*vals[i-1] + 2*vals[i-2] + vals[i-3]) / 10

detrender[i] = (0.0962*smooth[i] + 0.5769*smooth[i-2] - 0.5769*smooth[i-4] - 0.0962*smooth[i-6]) * (0.075*period[i-1] + 0.54)

## compute InPhase and Quadrature components

q1[i] = (0.0962*detrender[i] + 0.5769*detrender[i-2] - 0.5769*detrender[i-4] - 0.0962*detrender[i-6]) * (0.075*period[i-1] + 0.54)

i1[i] = detrender[i-3]

##Advance the phase of detrender and q1 by 90 Degrees

ji[i] = (0.0962*i1[i] + 0.05769*i1[i-2] - 0.5769*i1[i-4] - 0.0962*i1[i-6]) * (0.075*period[i-1] + 0.54)

jq[i] = (0.0962*q1[i] + 0.5769*q1[i-2] - 0.5769*q1[i-4] - 0.0962*q1[i-6]) * (0.075*period[i-1] + 0.54)

##Phasor addition for 3 bar averaging

i2[i] = i1[i] - jq[i]

q2[i] = q1[i] + ji[i]

##smooth the I and Q components befor applying the discriminator

i2[i] = 0.2*i2[i] + 0.8*i2[i-1]

q2[i] = 0.2*q2[i] + 0.8*q2[i-1]

##Homodyne Discriminator

re[i] = i2[i]*i2[i-1] + q2[i]*q2[i-1]

im[i] = i2[i]*q2[i-1] - q2[i]*i2[i-1]

re[i] = 0.2*re[i] + 0.8*re[i-1]

im[i] = 0.2*im[i] + 0.8*im[i-1]

if (im[i] != 0)& (re[i] != 0):

period[i] = 360 / np.arctan(im[i]/re[i])

if (period[i] > 1.5*period[i-1]):

period[i] = 1.5 * period[i-1]

if (period[i] < 0.67*period[i-1]):

period[i] = 0.67 * period[i-1]

if (period[i] < 6):

period[i] = 6

if (period[i] > 50):

period[i] = 50

period[i] = 0.2*period[i] + 0.8*period[i-1]

smooth_period[i] = 0.33*period[i] + 0.67*smooth_period[i-1]

if (i1[i]!= 0):

phase[i] = np.arctan(q1[i] / i1[i])

delta_phase[i] = phase[i-1] - phase[i]

if (delta_phase[i] < 1):

delta_phase[i] = 1

alpha[i] = fast_limit / delta_phase[i]

if alpha[i] < slow_limit:

alpha[i] = slow_limit

mama[i] = alpha[i]*vals[i] + (1-alpha[i])*mama[i-1]

fama[i] = 0.5*alpha[i]*mama[i] + (1-0.5*alpha[i])*fama[i-1]

mama_ = pd.Series(index=series.index, data=mama, name="MAMA")

fama_ = pd.Series(index=series.index, data=fama, name="FAMA")

return pd.concat([mama_, fama_], axis=1)

def get_MAMA_signal(df):

signals = []

df.sort_index(ascending=True, inplace=True)

M_F = df['MAMA']-df['FAMA']

MAMA = df['MAMA']

for i in range(df.shape[0]):

val = 0 #not a crossing point

if M_F[i]==0:

if i<2:

val = 0

else:

if (M_F[i-1]<0):

val = 1 #from MAMA<FAMA to MAMA>FAMA

elif (M_F[i-1]>0):

val = -1 #from MAMA>FAMA to MAMA<FAMA

else:

val = 0

else:

if (i<2)|(i>=df.shape[0]-2):

val = 0

else:

if (M_F[i-1]<0) & (M_F[i]>0):

val = 2

elif (M_F[i-1]>0) & (M_F[i]<0):

val = -2

else:

val = 0

signals.append(val)

return signals

Calculate MAMA

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

help(cal_mama)

Help on function cal_mama in module __main__:

cal_mama(ohlc: pandas.core.frame.DataFrame, fast_limit: float = 0.5, slow_limit: float = 0.05, column: str = 'close') -> pandas.core.frame.DataFrame

MESA Adaptive Moving Average

The MESA Adaptive Moving Average (MAMA) adapts to price movement based on the rate change of phase as

measured by the Hilbert Transform Discriminator.

The advantage of this method of adaptation is that it features a fast attack average and a slow decay

average so that composite average rapidly ratchets behind price changes and holds the average value

until the next ratchet occurs.

source: https://www.mesasoftware.com/papers/MAMA.pdf

adapted from: https://github.com/mathiswellmann/go_ehlers_indicators/blob/bdc7bd10003c/mama.go#L110

df_ta = cal_mama(df, column="Close")

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

143

signals = get_MAMA_signal(df)

df['MAMA_signal'] = signals

df['B'] = (df["MAMA_signal"]>0) .astype(int)*(df['High']+df['Low'])/2

df['S'] = (df["MAMA_signal"]<0).astype(int)*(df['High']+df['Low'])/2

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | MAMA | FAMA | MAMA_signal | B | S | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2007-08-21 | 50.01 | 50.86 | 49.13 | 49.44 | 1029100 | 49.44 | 49.44 | 0 | 0.0 | 0.0 |

| 2007-08-22 | 48.50 | 50.70 | 47.78 | 49.29 | 996500 | 49.29 | 49.29 | 0 | 0.0 | 0.0 |

| 2007-08-23 | 49.76 | 49.82 | 47.56 | 48.03 | 742700 | 48.03 | 48.03 | 0 | 0.0 | 0.0 |

| 2007-08-24 | 47.93 | 48.77 | 47.87 | 48.58 | 416000 | 48.58 | 48.58 | 0 | 0.0 | 0.0 |

| 2007-08-27 | 48.56 | 48.81 | 46.85 | 47.47 | 447000 | 47.47 | 47.47 | 0 | 0.0 | 0.0 |

| Open | High | Low | Close | Volume | MAMA | FAMA | MAMA_signal | B | S | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2022-08-22 | 7.59 | 7.68 | 7.50 | 7.62 | 753700 | 7.659967 | 7.706288 | 0 | 0.000 | 0.0 |

| 2022-08-23 | 7.74 | 7.90 | 7.71 | 7.80 | 732200 | 7.729984 | 7.712212 | 2 | 7.805 | 0.0 |

| 2022-08-24 | 7.78 | 7.95 | 7.74 | 7.92 | 673800 | 7.824992 | 7.740407 | 0 | 0.000 | 0.0 |

| 2022-08-25 | 7.95 | 8.00 | 7.84 | 7.92 | 857000 | 7.846852 | 7.752653 | 0 | 0.000 | 0.0 |

| 2022-08-26 | 7.85 | 7.93 | 7.76 | 7.79 | 962900 | 7.818426 | 7.769096 | 0 | 0.000 | 0.0 |

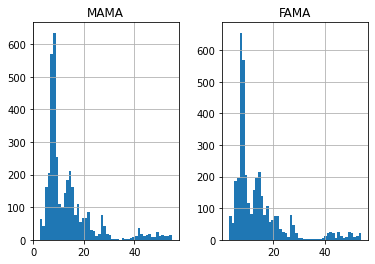

df[['MAMA','FAMA']].hist(bins=50)

array([[<AxesSubplot:title={'center':'MAMA'}>,

<AxesSubplot:title={'center':'FAMA'}>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def plot_3panels(main_data, add_data=None, mid_panel=None, chart_type='candle', names=None,

figratio=(14,9)):

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=1,

panel_ratios=(4,2), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = {

'S': mpf.make_addplot(add_data['S'], panel=0, color='blue', type='scatter', marker=r'${S}$' , markersize=100, secondary_y=False),

'B': mpf.make_addplot(add_data['B'], panel=0, color='blue', type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False),

'MAMA': mpf.make_addplot(add_data['MAMA'], panel=0, color='dodgerblue', secondary_y=False),

'FAMA': mpf.make_addplot(add_data['FAMA'], panel=0, color='tomato', secondary_y=False),

# 'AO-SIGNAL': mpf.make_addplot(mid_panel['AO']-mid_panel['SIGNAL'], type='bar',width=0.7,panel=1, color="pink",alpha=0.65,secondary_y=False),

}

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.128)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

#set legend

axes[0].legend([None]*6)

handles = axes[0].get_legend().legendHandles

# print(handles)

axes[0].legend(handles=handles[4:],labels=['MAMA', 'FAMA'])

#axes[2].set_title('AO', fontsize=10, style='italic', loc='left')

# axes[0].set_ylabel('MAMA')

# axes[0].set_ylabel(names['y_tiles'][0])

return fig, axes

start = -100

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'MAMA: MESA Adaptive Moving Average'}

aa_, bb_ = plot_3panels(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['B', 'S', 'MAMA', 'FAMA']],

None,

chart_type='hollow_and_filled',

names = names,

)