Coppock Curve

References

Definition

The Coppock Curve is a price momentum indicator to determine major lows in the stock market and is calculated as a moving average. The Coppock Curve is said to have been developed for long-term strategies involving indexes, ETFs, and other liquid instruments rather than intraday trading. The indicator can be used to identify major market trends, determine trend direction, and guide long-term investing or trading strategies.

The formula used for the Coppock Curve was developed in 1962 by Edwin S. Coppock in that year’s edition of Barron’s. The indicator was originally introduced as a long-term buy or sell indicator for major indices. It was first implemented this way to allow for indices to identify and target large trends.

Read the indicator

The Coppock Curve is an oscillating trendline that ranges both higher and lower than zero, incorporating two rates of change in its calculations:

11-period change; 14-period change.

The curve reviews the rate of change for these periods and then derives a signal line indicator that is extrapolated from this data, by using a 10-month weighted moving average. When using the curve, traders, investors, and technical analysts can look to the signal line indicator to help analyze and come to their own investment conclusions based on their findings for medium/long-term trades.

The Coppock Curve was created by an economist for medium to long-term trend analysis in indexes, ETFs, and other liquid instruments. It measures the rate of change and looks to present a clear trend for the medium and long-term.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'PFE', 'DAL']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-05 18:12:13.916297 ^GSPC (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:12:14.291295 GSK (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:12:14.592635 NVO (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:12:14.871747 PFE (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:12:15.057291 DAL (3863, 7) 2007-05-03 00:00:00 2022-09-02 00:00:00

ticker = 'GSK'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-29 | 33.080002 | 33.230000 | 32.980000 | 33.110001 | 3794600 | 0.0 | 0.0 |

| 2022-08-30 | 33.230000 | 33.290001 | 32.919998 | 32.959999 | 3994500 | 0.0 | 0.0 |

| 2022-08-31 | 32.790001 | 32.880001 | 32.459999 | 32.480000 | 4291800 | 0.0 | 0.0 |

| 2022-09-01 | 31.830000 | 31.990000 | 31.610001 | 31.690001 | 12390900 | 0.0 | 0.0 |

| 2022-09-02 | 31.600000 | 31.969999 | 31.469999 | 31.850000 | 8152600 | 0.0 | 0.0 |

Define Coppock Curve calculation function

#https://github.com/peerchemist/finta/blob/af01fa594995de78f5ada5c336e61cd87c46b151/finta/finta.py

def cal_copp(ohlc: pd.DataFrame, column: str = "close", adjust: bool = True) -> pd.Series:

"""The Coppock Curve is a momentum indicator, it signals buying opportunities when the indicator moved from negative territory to positive territory."""

roc1 = (ohlc[column].diff(14) / ohlc[column].shift(14)) * 100

roc2 = (ohlc[column].diff(11) / ohlc[column].shift(14)) * 100

return pd.Series(

(roc1 + roc2).ewm(span=10, min_periods=9, adjust=adjust).mean(),

name="COPP",

)

Calculate Coppock Curve

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_copp

<function __main__.cal_copp(ohlc: pandas.core.frame.DataFrame, column: str = 'close', adjust: bool = True) -> pandas.core.series.Series>

df_ta = cal_copp(df, column='Close')

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

80

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | COPP | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 1999-12-31 | 20.39 | 20.46 | 20.30 | 20.35 | 136724 | NaN |

| 2000-01-03 | 20.37 | 20.51 | 20.03 | 20.23 | 545423 | NaN |

| 2000-01-04 | 20.23 | 20.23 | 19.66 | 19.71 | 360150 | NaN |

| 2000-01-05 | 19.98 | 20.37 | 19.85 | 20.37 | 472451 | NaN |

| 2000-01-06 | 20.16 | 20.21 | 19.66 | 20.07 | 837407 | NaN |

| Open | High | Low | Close | Volume | COPP | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2022-08-29 | 33.08 | 33.23 | 32.98 | 33.11 | 3794600 | -25.370059 |

| 2022-08-30 | 33.23 | 33.29 | 32.92 | 32.96 | 3994500 | -23.882846 |

| 2022-08-31 | 32.79 | 32.88 | 32.46 | 32.48 | 4291800 | -22.232017 |

| 2022-09-01 | 31.83 | 31.99 | 31.61 | 31.69 | 12390900 | -21.533204 |

| 2022-09-02 | 31.60 | 31.97 | 31.47 | 31.85 | 8152600 | -20.306417 |

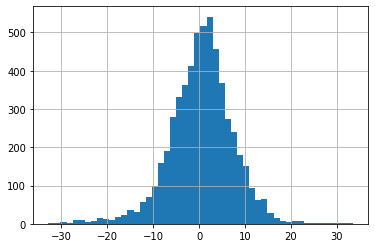

df['COPP'].hist(bins=50)

<AxesSubplot:>

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

# all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

all_colors = ['dodgerblue', 'firebrick','limegreen','skyblue','lightgreen', 'navy','yellow','plum', 'yellowgreen']

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9), fill_weights = (0, 0)):

"""

main chart type: default is candle. alternatives: ohlc, line

example:

start = 200

names = {'main_title': 'MAMA: MESA Adaptive Moving Average',

'sub_tile': 'S&P 500 (^GSPC)', 'y_tiles': ['price', 'Volume [$10^{6}$]']}

make_candle(df.iloc[-start:, :5], df.iloc[-start:][['MAMA', 'FAMA']], names = names)

"""

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2,1), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = { }

fb_bbands2_ = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),

y2=fill_weights[1]*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands2_['panel'] = 1

fb_bbands= [fb_bbands2_]

i = 0

for name_, data_ in mid_panel.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=1, width=1, color=all_colors[i], secondary_y=False)

i = i + 1

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

# axes[2].set_ylabel('WAVEPM10')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

start = -1200

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': f'Coppock Curve is a momentum indicator to identify major market trend direction for long-term trading strategies.'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['COPP']],

chart_type='hollow_and_filled',names = names,

fill_weights = (-20, 20))