Awesome Oscillator (AO)

References

Definition

- The Awesome Oscillator is an indicator used to measure market momentum created by Bill Williams.

- AO calculates the difference of a 34 Period and 5 Period Simple Moving Averages.

- The Simple Moving Averages that are used are not calculated using closing price but rather each bar’s midpoints.

- AO is generally used to affirm trends or to anticipate possible reversals.

Calculation

- MP = (High + Low)/2

- Fast SMA = 5 periods Simple Moving Average of MP

- Slow SMA = 34 periods Simple Moving Average of MP

- AO = Fast SMA - Slow SMA

Read the indicator

- The Awesome Oscillator is designed to have values that fluctuate above and below a Zero Line.

- The generated values are plotted as a histogram of red and green bars.

- A bar is green when its value is higher than the previous bar.

- A red bar indicates that a bar is lower than the previous bar.

- When AO’s values are above the Zero Line, this indicates that the short term period is trending higher than the long term period.

-

When AO’s values are below the Zero Line, the short term period is trending lower than the Longer term period. This information can be used for a variety of signals.

- Zero Line Cross: when the AO value crosses above or below the Zero Line indicates a change in momentum.

- When AO crosses above the Zero Line, short term momentum is now rising faster than the long term momentum. This can present a bullish buying opportunity.

- When AO crosses below the Zero Line, short term momentum is now falling faster then the long term momentum. This can present a bearish selling opportunity.

- Twin Peaks: Twin Peaks is a method which considers the differences between two peaks on the same side of the Zero Line.

- A Bullish Twin Peaks setup occurs when there are two peaks below the Zero Line. The second peak is higher than the first peak and followed by a green bar. The trough between the two peaks must remain below the Zero Line.

- A Bearish Twin Peaks setup occurs when there are two beaks above the Zero Line. The second peak is lower than the first peak and followed by a red bar. The trough between both peaks must remain above the Zero Line for the duration.

- Saucer: The Saucer method looks for changes in three consecutive bars, all on the same side of the Zero Line.

- A Bullish Saucer setup occurs when the AO is above the Zero Line. It entails two consecutive red bars (with the second bar being lower than the first bar) being followed by a green Bar.

- A Bearish Saucer setup occurs when the AO is below the Zero Line. It entails two consecutive green bars (with the second bar being higher than the first bar) being followed by a red bar.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'AROC']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-08-26 19:06:58.701867 ^GSPC (5700, 7) 1999-12-31 00:00:00 2022-08-25 00:00:00

2022-08-26 19:06:59.073368 GSK (5700, 7) 1999-12-31 00:00:00 2022-08-25 00:00:00

2022-08-26 19:06:59.544649 NVO (5700, 7) 1999-12-31 00:00:00 2022-08-25 00:00:00

2022-08-26 19:06:59.840465 AROC (3781, 7) 2007-08-21 00:00:00 2022-08-25 00:00:00

ticker = 'AROC'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-19 | 7.75 | 7.75 | 7.62 | 7.62 | 569100 | 0.0 | 0 |

| 2022-08-22 | 7.59 | 7.68 | 7.50 | 7.62 | 753700 | 0.0 | 0 |

| 2022-08-23 | 7.74 | 7.90 | 7.71 | 7.80 | 732200 | 0.0 | 0 |

| 2022-08-24 | 7.78 | 7.95 | 7.74 | 7.92 | 673800 | 0.0 | 0 |

| 2022-08-25 | 7.95 | 8.00 | 7.84 | 7.92 | 857000 | 0.0 | 0 |

Define Awesome Oscillator (AO) calculation function

#https://github.com/peerchemist/finta/blob/af01fa594995de78f5ada5c336e61cd87c46b151/finta/finta.py

def cal_ao(ohlc: pd.DataFrame, slow_period: int = 34, fast_period: int = 5, signal: int = 9,) -> pd.Series:

"""

Awesome Oscillator is an indicator used to measure market momentum.

AO calculates the difference of a 34 Period and 5 Period Simple Moving Averages.

The Simple Moving Averages that are used are not calculated using closing price but rather each bar's midpoints.

AO is generally used to affirm trends or to anticipate possible reversals.

1. MP = (High + Low)/2

2. Fast SMA = 5 periods Simple Moving Average of MP

3. Slow SMA = 34 periods Simple Moving Average of MP

4. AO = Fast SMA - Slow SMA

"""

ohlc = ohlc.copy()

ohlc.columns = [c.lower() for c in ohlc.columns]

mp = (ohlc["high"] + ohlc["low"]) / 2

slow = pd.Series(mp.rolling(window=slow_period).mean(), name="slow_AO")

fast = pd.Series(mp.rolling(window=fast_period).mean(), name="fast_AO")

AO = pd.Series(fast - slow, name="AO")

AO_signal = pd.Series(

AO.rolling(window=fast_period).mean(), name="SIGNAL"

)

return pd.concat([AO, AO_signal], axis=1)

def get_cross_signal(series: pd.Series, up_buy: int = 1) -> list:

signals = []

series.sort_index(ascending=True, inplace=True)

for i in range(len(series)):

val = np.nan #not a crossing point

if series[i]==0:

if i<2:

val = np.nan

else:

if (series[i-1]<0):

val = up_buy

elif (series[i-1]>0):

val = -up_buy

else:

val = np.nan

else:

if (i<2)|(i>=len(series)-2):

val = np.nan

else:

if (series[i-1]<0) & (series[i]>0):

val = up_buy

elif (series[i-1]>0) & (series[i]<0):

val = -up_buy

else:

val = np.nan

signals.append(val)

return signals

Calculate Awesome Oscillator (AO)

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_ao

<function __main__.cal_ao(ohlc: pandas.core.frame.DataFrame, slow_period: int = 34, fast_period: int = 5, signal: int = 9) -> pandas.core.series.Series>

df_ta = cal_ao(df, slow_period=34, fast_period=5, signal= 9)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

122

signals = get_cross_signal(df['AO'], 1)

df['AO_BS'] = signals

df['B'] = df['AO_BS']*(df['High']+df['Low'])/2

df['S'] = df['AO_BS']*(df['High']+df['Low'])/2

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | AO | SIGNAL | AO_BS | B | S | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2007-08-21 | 50.01 | 50.86 | 49.13 | 49.44 | 1029100 | NaN | NaN | NaN | NaN | NaN |

| 2007-08-22 | 48.50 | 50.70 | 47.78 | 49.29 | 996500 | NaN | NaN | NaN | NaN | NaN |

| 2007-08-23 | 49.76 | 49.82 | 47.56 | 48.03 | 742700 | NaN | NaN | NaN | NaN | NaN |

| 2007-08-24 | 47.93 | 48.77 | 47.87 | 48.58 | 416000 | NaN | NaN | NaN | NaN | NaN |

| 2007-08-27 | 48.56 | 48.81 | 46.85 | 47.47 | 447000 | NaN | NaN | NaN | NaN | NaN |

| Open | High | Low | Close | Volume | AO | SIGNAL | AO_BS | B | S | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2022-08-19 | 7.75 | 7.75 | 7.62 | 7.62 | 569100 | -0.157353 | -0.157476 | NaN | NaN | NaN |

| 2022-08-22 | 7.59 | 7.68 | 7.50 | 7.62 | 753700 | -0.162029 | -0.148806 | NaN | NaN | NaN |

| 2022-08-23 | 7.74 | 7.90 | 7.71 | 7.80 | 732200 | -0.153294 | -0.148265 | NaN | NaN | NaN |

| 2022-08-24 | 7.78 | 7.95 | 7.74 | 7.92 | 673800 | -0.107882 | -0.143159 | NaN | NaN | NaN |

| 2022-08-25 | 7.95 | 8.00 | 7.84 | 7.92 | 857000 | -0.069824 | -0.130076 | NaN | NaN | NaN |

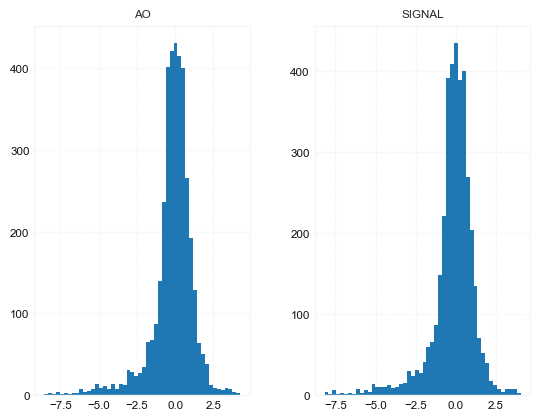

df[['AO', 'SIGNAL']].hist(bins=50)

array([[<AxesSubplot:title={'center':'AO'}>,

<AxesSubplot:title={'center':'SIGNAL'}>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def plot_macd(main_data, add_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9)):

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=False,

panel_ratios=(4,2), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = {

'S': mpf.make_addplot(add_data['S'], panel=0, color='blue', type='scatter', marker=r'${S}$' , markersize=100, secondary_y=False),

'B': mpf.make_addplot(add_data['B'], panel=0, color='blue', type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False),

'AO': mpf.make_addplot(mid_panel['AO'], panel=1, color='dodgerblue', secondary_y=False),

'SIGNAL': mpf.make_addplot(mid_panel['SIGNAL'], panel=1, color='tomato', secondary_y=False),

'AO-SIGNAL': mpf.make_addplot(mid_panel['AO']-mid_panel['SIGNAL'], type='bar',width=0.7,panel=1, color="pink",alpha=0.65,secondary_y=False),

}

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.128)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

#set legend

axes[2].legend([None]*2)

handles = axes[2].get_legend().legendHandles

# print(handles)

axes[2].legend(handles=handles,labels=['AO', 'SIGNAL'])

#axes[2].set_title('AO', fontsize=10, style='italic', loc='left')

axes[2].set_ylabel('AO')

# axes[0].set_ylabel(names['y_tiles'][0])

return fig, axes

start = -300

end = -200#df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'Awesome Oscillator: when the AO value crosses above or below the Zero Line indicates a change in momentum'}

aa_, bb_ = plot_macd(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['B', 'S']],

df.iloc[start:end][['AO', 'SIGNAL']],

chart_type='hollow_and_filled',

names = names,

)