Connors RSI (CRSI)

References

- tradingview: Connors RSI (CRSI)

- traders.com: RSI Can Be Improved

- tradingview: Stochastic-Connors-RSI

Definition

- Connors RSI (CRSI) is a technical analysis indicator created by Larry Connors that is actually a composite of three separate components.

- Connors RSI was developed by Connors Research.

- The three components; The RSI, UpDown Length, and Rate-of-Change, combine to form a momentum oscillator. Connors RSI outputs a value between 0 and 100, which is then used to identify short-term overbought and oversold conditions.

Calculation

There are three major components to Connors RSI

- RSI = Standard RSI developed by Wilder. This is typically a short-term RSI. In this example it is a 3 Period RSI.

- UpDown Length = The number of consecutive days that a security price has either closed up (higher than previous day) or closed down (lower than previous days). Closing up values represented in positive numbers and closing down is represented with negative numbers. If a security closes at the same price on back to back days, the UpDown Length is 0. Connors RSI then applies a short-term RSI to the UpDown Streak Value. In this example it is a 2 period RSI.

- ROC = The Rate-of-Change. The ROC takes a user-defined look-back period and calculates a percentage of the number of values within that look back period that are below the current day price change percentage.

The final CRSI calculation then simply finding the average value of the three components.

CRSI(3,2,100) = [ RSI(3) + RSI(UpDown Length,2) + ROC(100) ] / 3

Read the indicator

Connors RSI (CRSI) uses the above formula to generate a value between 0 and 100. This is primarily used to identify overbought and oversold levels. Connor’s original definition of these levels is that a value over 90 should be considered overbought and a value under 10 should be considered oversold. On occasion, signals occur during slight corrections during a trend. For example, when the market is in an uptrend, Connors RSI might generate short term sell signals. When the market is in a downtrend, Connors RSI might generate short term buy signals.

A technical analyst should also be aware of the value of adapting or tweaking the Connor RSI. One of the issues with Connor RSI is that signals oftentimes occur early. For example, in an uptrend, a sell signal may present itself. However, the market continues to rise, thus a false signal. One potential safeguard against potential false signals would be combining the Connors RSI with additional technical analysis tools such as basic chart pattern analysis or additional indicators used to measure trend strength.

Another issue worth noting regarding the Connor RSI, is the placement of the overbought and oversold thresholds levels. For some trading instruments, the thresholds for overbought may need to be raised even higher and for oversold even lower. For example 95 and 5 respectively. These levels should generally be set after research and historical analysis. Making sure thresholds are in the proper place, should also help to cut down on false signals.

- Connors RSI is designed to define overbought and oversold levels and therefore trade signals based on those levels.

- A bullish signal occurs when Connors RSI enters oversold territory.

- A bearish signal occurs when Connors RSI enters overbought territory.

Connors RSI indicator is a tool that takes a well established indicator, The Relative Strength Index (RSI) and applies it to its own theories. It can be a good way to define overbought and oversold levels and identify possible trading opportunities. That being said, Connors RSI does have a tendency to produce false signals. Therefore an astute technical analyst should experiment with what parameters work best for the security being traded. Also, combining Connors RSI with additional indicators will potentially increase its efficiency.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'PFE', 'DAL']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-10 23:39:47.402768 ^GSPC (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 23:39:47.758161 GSK (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 23:39:48.036020 NVO (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 23:39:48.388309 PFE (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 23:39:48.621798 DAL (3867, 7) 2007-05-03 00:00:00 2022-09-09 00:00:00

ticker = 'DAL'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-09-02 | 31.440001 | 31.830000 | 30.700001 | 30.940001 | 8626500 | 0.0 | 0 |

| 2022-09-06 | 31.340000 | 31.650000 | 30.660000 | 31.190001 | 7630800 | 0.0 | 0 |

| 2022-09-07 | 31.290001 | 32.340000 | 31.270000 | 32.230000 | 9035900 | 0.0 | 0 |

| 2022-09-08 | 31.719999 | 32.490002 | 31.549999 | 32.119999 | 11085400 | 0.0 | 0 |

| 2022-09-09 | 32.430000 | 32.759998 | 32.240002 | 32.660000 | 10958900 | 0.0 | 0 |

Define Connors RSI (CRSI) calculation function

def cal_rsi(

ohlc: pd.DataFrame,

period: int = 14,

column: str = "close",

adjust: bool = True,

) -> pd.Series:

## get the price diff

delta = ohlc[column].diff()

## positive gains (up) and negative gains (down) Series

up, down = delta.copy(), delta.copy()

up[up < 0] = 0

down[down > 0] = 0

# EMAs of ups and downs

_gain = up.ewm(alpha=1.0 / period, adjust=adjust).mean()

_loss = down.abs().ewm(alpha=1.0 / period, adjust=adjust).mean()

RS = _gain / _loss

return pd.Series(100 - (100 / (1 + RS)), name=f"RSI{period}")

def cal_crsi(

ohlc: pd.DataFrame,

rsi_period: int = 3,

updown_period: int = 2,

roc_period: int = 100,

column: str = "close",

adjust: bool = True,

) -> pd.Series:

"""

source: https://www.tradingview.com/script/iQQ4YgIY-Filtered-Connors-RSI-FCRSI/

CRSI(3,2,100) = [ RSI(3) + RSI(UpDown Length,2) + ROC(100) ] / 3

"""

def updown(s):

ud = np.zeros(len(s))

for i in range(1, len(s)):

if s[i] > s[i-1]:

if ud[i-1] >= 0:

ud[i] = ud[i-1] + 1

else:

ud[i] = 1

elif s[i] < s[i-1]:

if ud[i-1]<=0:

ud[i] = ud[i-1] - 1

else:

ud[i] = -1

else:

ud[i] = 0

return ud

rsi3 = cal_rsi(ohlc, period=rsi_period, column=column, adjust=True)

ohlc['updown'] = updown(ohlc[column])

ud_rsi = cal_rsi(ohlc, period=updown_period, column='updown', adjust=True)

roc = ohlc[column].diff() / ohlc[column].shift(1) * 100

pct_rank = roc.rolling(window=roc_period, min_periods=roc_period).apply(lambda x: (x[:-1]<=x[-1]).sum()/roc_period)

crsi = (rsi3 + ud_rsi + pct_rank)/3

return pd.Series(crsi, name=f"CRSI")

Calculate Connors RSI (CRSI)

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_rsi

<function __main__.cal_rsi(ohlc: pandas.core.frame.DataFrame, period: int = 14, column: str = 'close', adjust: bool = True) -> pandas.core.series.Series>

cal_crsi

<function __main__.cal_crsi(ohlc: pandas.core.frame.DataFrame, rsi_period: int = 3, updown_period: int = 2, roc_period: int = 100, column: str = 'close', adjust: bool = True) -> pandas.core.series.Series>

df['RSI'] = cal_rsi(df, period =3, column='Close')

df['CRSI'] = cal_crsi(df, rsi_period=3, updown_period=2, roc_period=100, column="Close")

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | RSI | updown | CRSI | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 2007-05-03 | 19.32 | 19.50 | 18.25 | 18.40 | 8052800 | NaN | 0.0 | NaN |

| 2007-05-04 | 18.88 | 18.96 | 18.39 | 18.64 | 5437300 | 100.000000 | 1.0 | NaN |

| 2007-05-07 | 18.83 | 18.91 | 17.94 | 18.08 | 2646300 | 22.222222 | -1.0 | NaN |

| 2007-05-08 | 17.76 | 17.76 | 17.14 | 17.44 | 4166100 | 9.523810 | -2.0 | NaN |

| 2007-05-09 | 17.54 | 17.94 | 17.44 | 17.58 | 7541100 | 23.809524 | 1.0 | NaN |

| Open | High | Low | Close | Volume | RSI | updown | CRSI | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 2022-09-02 | 31.44 | 31.83 | 30.70 | 30.94 | 8626500 | 12.313048 | -1.0 | 20.842173 |

| 2022-09-06 | 31.34 | 31.65 | 30.66 | 31.19 | 7630800 | 36.105527 | 1.0 | 36.171756 |

| 2022-09-07 | 31.29 | 32.34 | 31.27 | 32.23 | 9035900 | 76.274979 | 2.0 | 52.527472 |

| 2022-09-08 | 31.72 | 32.49 | 31.55 | 32.12 | 11085400 | 69.357083 | -1.0 | 32.749111 |

| 2022-09-09 | 32.43 | 32.76 | 32.24 | 32.66 | 10958900 | 81.627385 | 1.0 | 47.978513 |

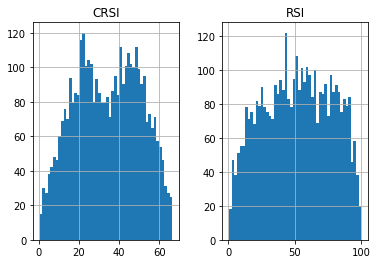

df[['CRSI', 'RSI']].hist(bins=50)

array([[<AxesSubplot:title={'center':'CRSI'}>,

<AxesSubplot:title={'center':'RSI'}>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

# all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

all_colors = ['dodgerblue', 'firebrick','limegreen','skyblue','lightgreen', 'navy','yellow','plum', 'yellowgreen']

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9), fill_weights = (0, 0)):

"""

main chart type: default is candle. alternatives: ohlc, line

example:

start = 200

names = {'main_title': 'MAMA: MESA Adaptive Moving Average',

'sub_tile': 'S&P 500 (^GSPC)', 'y_tiles': ['price', 'Volume [$10^{6}$]']}

make_candle(df.iloc[-start:, :5], df.iloc[-start:][['MAMA', 'FAMA']], names = names)

"""

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2,1), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = { }

fb_bbands2_ = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),

y2=fill_weights[1]*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands2_['panel'] = 1

fb_bbands= [fb_bbands2_]

i = 0

for name_, data_ in mid_panel.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=1, width=1, color=all_colors[i], secondary_y=False)

i = i + 1

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

# axes[2].set_ylabel('WAVEPM10')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

start = -50

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'Connors Relative Strength Index (CRSI)'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['CRSI', 'RSI']],

chart_type='hollow_and_filled',names = names,

fill_weights = (30, 70))