Bollinger Bands Introduction

References

- tradingview: Bollinger Bands (BB)

- tradingview: Bollinger Bands %B

- tradingview: Bollinger Bands Width (BBW)

Bollinger Bands (BB)

Definition

- Bollinger Bands (BB) were created by John Bollinger in the early 1980’s to fill the need to visualize changes in volatility.

- Bollinger Bands consist of three lines:

- the middle line is 20-day Simple Moving Average (SMA). (20 days can be replaced by other periods, such as 10 days)

- the upper line is several - typically 2 - standard deviations above the middle line

- the lower line is same number of standard deviations below the middle line

Calculation

- Middle Band – 20 Day Simple Moving Average

- Upper Band – 20 Day Simple Moving Average + (Standard Deviation x 2)

- Lower Band – 20 Day Simple Moving Average - (Standard Deviation x 2)

- MOBO bands are based on a zone of 0.80 standard deviation with a 10 period look-back. If the price breaks out of the MOBO band it can signify a trend move or price spike contains 42% of price movements(noise) within bands.

Bollinger Bands %B

Percent Bandwidth (%B)

Definition

- Bollinger Bands %B or Percent Bandwidth (%B) is an indicator derived from the standard Bollinger Bands (BB).

- John Bollinger introduced %B in 2010.

Calculation

%B = (Current Price - Lower Band) / (Upper Band - Lower Band)

Read the indicator

- %B Above 1 = Price is Above the Upper Band

- %B Equal to 1 = Price is at the Upper Band

- %B Above .50 = Price is Above the Middle Line

- %B Below .50 = Price is Below the Middle Line

- %B Equal to 0 = Price is at the Lower Band

- %B Below 0 = Price is Below the Lower Band

Bollinger Bands Width (BBW)

Definition

- Bollinger Bands Width (BBW) is derived from the standard Bollinger Bands.

- John Bollinger introduced Bollinger Bands Width in 2010.

Calculation - Bollinger Bands Width = (Upper Band - Lower Band) / Middle Band

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'GKOS']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-09 18:47:27.422799 ^GSPC (5709, 7) 1999-12-31 00:00:00 2022-09-08 00:00:00

2022-09-09 18:47:27.705493 GSK (5709, 7) 1999-12-31 00:00:00 2022-09-08 00:00:00

2022-09-09 18:47:28.061476 NVO (5709, 7) 1999-12-31 00:00:00 2022-09-08 00:00:00

2022-09-09 18:47:28.263999 GKOS (1815, 7) 2015-06-25 00:00:00 2022-09-08 00:00:00

ticker = 'GSK'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-09-01 | 31.830000 | 31.990000 | 31.610001 | 31.690001 | 12390900 | 0.0 | 0.0 |

| 2022-09-02 | 31.600000 | 31.969999 | 31.469999 | 31.850000 | 8152600 | 0.0 | 0.0 |

| 2022-09-06 | 31.650000 | 31.760000 | 31.370001 | 31.469999 | 5613900 | 0.0 | 0.0 |

| 2022-09-07 | 31.209999 | 31.590000 | 31.160000 | 31.490000 | 4822000 | 0.0 | 0.0 |

| 2022-09-08 | 30.910000 | 31.540001 | 30.830000 | 31.510000 | 6619300 | 0.0 | 0.0 |

Define Bollinger Bands calculation function

#https://github.com/peerchemist/finta/blob/af01fa594995de78f5ada5c336e61cd87c46b151/finta/finta.py#L935

def cal_bbands(ohlc: pd.DataFrame, period: int = 20, column: str = "close",

MA: pd.Series = None, std_multiplier: float = 2) -> pd.DataFrame:

"""

Developed by John Bollinger, Bollinger Bands® are volatility bands placed above and below a moving average.

Volatility is based on the standard deviation, which changes as volatility increases and decreases.

The bands automatically widen when volatility increases and narrow when volatility decreases.

This method allows input of some other form of moving average like EMA or KAMA around which BBAND will be formed.

Pass desired moving average as <MA> argument. For example BBANDS(MA=TA.KAMA(20)).

"MOBO bands are based on a zone of 0.80 standard deviation with a 10 period look-back"

If the price breaks out of the MOBO band it can signify a trend move or price spike

Contains 42% of price movements(noise) within bands.

BBANDS(ohlc, period=10, std_multiplier=0.8, column=column)

BBWIDTH: Bandwidth tells how wide the Bollinger Bands are on a normalized basis.

%b (pronounced 'percent b') is derived from the formula for Stochastics and shows where price is in relation to the bands.

%b equals 1 at the upper band and 0 at the lower band.

"""

ohlc = ohlc.copy(deep=True)

ohlc.columns = [c.lower() for c in ohlc.columns]

std = ohlc[column].rolling(window=period).std()

if not isinstance(MA, pd.Series):

middle_band = pd.Series( ohlc[column].rolling(window=period).mean(), name="BB_MIDDLE")

else:

middle_band = pd.Series(MA, name="BB_MIDDLE")

upper_bb = pd.Series(middle_band + (std_multiplier * std), name="BB_UPPER")

lower_bb = pd.Series(middle_band - (std_multiplier * std), name="BB_LOWER")

width_bb = pd.Series((upper_bb - lower_bb)/middle_band, name='BBWIDTH')

percent_b = pd.Series(

(ohlc["close"] - lower_bb) / (upper_bb - lower_bb),

name="pct_b",

)

return pd.concat([upper_bb, middle_band, lower_bb, width_bb, percent_b], axis=1)

Calculate Bollinger Bands

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_bbands

<function __main__.cal_bbands(ohlc: pandas.core.frame.DataFrame, period: int = 20, column: str = 'close', MA: pandas.core.series.Series = None, std_multiplier: float = 2) -> pandas.core.frame.DataFrame>

df_ta = cal_bbands(df, period = 20, column = 'close', std_multiplier=2)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

122

df_ta = cal_bbands(df, period = 10, column = 'close', std_multiplier=0.8)

df_ta.columns=[f'MOBO_{c}' for c in df_ta.columns]

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

21

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | BB_UPPER | BB_MIDDLE | BB_LOWER | BBWIDTH | pct_b | MOBO_BB_UPPER | MOBO_BB_MIDDLE | MOBO_BB_LOWER | MOBO_BBWIDTH | MOBO_pct_b | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||

| 1999-12-31 | 19.60 | 19.67 | 19.52 | 19.56 | 139400 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2000-01-03 | 19.58 | 19.71 | 19.25 | 19.45 | 556100 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2000-01-04 | 19.45 | 19.45 | 18.90 | 18.95 | 367200 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2000-01-05 | 19.21 | 19.58 | 19.08 | 19.58 | 481700 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2000-01-06 | 19.38 | 19.43 | 18.90 | 19.30 | 853800 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| Open | High | Low | Close | Volume | BB_UPPER | BB_MIDDLE | BB_LOWER | BBWIDTH | pct_b | MOBO_BB_UPPER | MOBO_BB_MIDDLE | MOBO_BB_LOWER | MOBO_BBWIDTH | MOBO_pct_b | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||

| 2022-09-01 | 31.83 | 31.99 | 31.61 | 31.69 | 12390900 | 39.888247 | 34.9440 | 29.999753 | 0.282981 | 0.170931 | 33.847434 | 33.253 | 32.658566 | 0.035752 | -0.814696 |

| 2022-09-02 | 31.60 | 31.97 | 31.47 | 31.85 | 8152600 | 39.017011 | 34.5310 | 30.044989 | 0.259825 | 0.201182 | 33.674094 | 33.032 | 32.389906 | 0.038877 | -0.420425 |

| 2022-09-06 | 31.65 | 31.76 | 31.37 | 31.47 | 5613900 | 38.032892 | 34.1115 | 30.190108 | 0.229916 | 0.163194 | 33.455731 | 32.774 | 32.092269 | 0.041602 | -0.456390 |

| 2022-09-07 | 31.21 | 31.59 | 31.16 | 31.49 | 4822000 | 36.843798 | 33.7070 | 30.570202 | 0.186121 | 0.146614 | 33.243774 | 32.550 | 31.856226 | 0.042628 | -0.263937 |

| 2022-09-08 | 30.91 | 31.54 | 30.83 | 31.51 | 6619300 | 35.993101 | 33.3890 | 30.784899 | 0.155986 | 0.139223 | 33.026915 | 32.348 | 31.669085 | 0.041976 | -0.117161 |

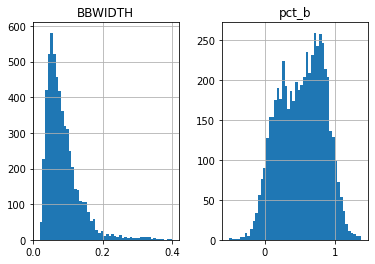

df[['BBWIDTH', 'pct_b']].hist(bins=50)

array([[<AxesSubplot:title={'center':'BBWIDTH'}>,

<AxesSubplot:title={'center':'pct_b'}>]], dtype=object)

df.columns

Index(['Open', 'High', 'Low', 'Close', 'Volume', 'BB_UPPER', 'BB_MIDDLE',

'BB_LOWER', 'BBWIDTH', 'pct_b', 'MOBO_BB_UPPER', 'MOBO_BB_MIDDLE',

'MOBO_BB_LOWER', 'MOBO_BBWIDTH', 'MOBO_pct_b'],

dtype='object')

import pandas as pd

import numpy as np

import copy

import os

import json

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

# all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

#https://matplotlib.org/stable/gallery/lines_bars_and_markers/marker_reference.html

def make_bbands(main_data, add_data, mid_panel,

chart_type='candle', names=None,

figratio=(14,9),

fill_weights = (0, 0) ):

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

'figure.figsize': (16, 16),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=False,

panel_ratios=(6, 2, 2), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = {

'BB_UPPER': mpf.make_addplot(add_data['BB_UPPER'], panel=0, color='dodgerblue', width=1, secondary_y=False),

'BB_LOWER': mpf.make_addplot(add_data['BB_LOWER'], panel=0, color='green', width=1, secondary_y=False),

'BB_MIDDLE': mpf.make_addplot(add_data['BB_MIDDLE'], panel=0, color='tomato', width=1, secondary_y=False),

'BBWIDTH': mpf.make_addplot(mid_panel['BBWIDTH'], panel=1, color='dodgerblue', width=1, secondary_y=False),

'%B': mpf.make_addplot(mid_panel['pct_b'], panel=2, color='dodgerblue', width=1, secondary_y=False),

}

fb_1 = dict(y1=add_data['BB_UPPER'].values,

y2=add_data['BB_LOWER'].values,color="lightskyblue",alpha=0.1,interpolate=True)

fb_1['panel'] = 0

fb_2 = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),

y2=fill_weights[1]*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_2['panel'] = 1

fb_3 = dict(y1=0*np.ones(mid_panel.shape[0]),

y2=1*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_3['panel'] = 2

fb_bbands= [fb_1, fb_2, fb_3 ]

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands,

)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1295)

axes[0].set_title(names['sub_tile'], fontsize=9, style='italic', loc='left')

axes[0].legend([None]*5)

handles = axes[0].get_legend().legendHandles

axes[0].legend(handles=handles[2:],labels=['BB_UPPER', 'BB_LOWER', 'BB_MIDDLE'])

axes[2].set_title('BBWIDTH', fontsize=9, style='italic', loc='left')

#axes[2].set_ylabel('CCI')

axes[2].legend([None]*1)

handles = axes[2].get_legend().legendHandles

axes[2].legend(handles=handles,labels=['BBWIDTH'])

axes[4].set_title('%B', fontsize=9, style='italic', loc='left')

#axes[4].set_ylabel('Decycler oscillator')

axes[4].legend([None]*3)

handles = axes[4].get_legend().legendHandles

axes[4].legend(handles=handles,labels=['%B'])

return fig, axes

start = -300

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'Bollinger Bands'}

aa_, bb_ = make_bbands(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['BB_UPPER', 'BB_MIDDLE','BB_LOWER']],

df.iloc[start:end][['BBWIDTH', 'pct_b']],

chart_type='hollow_and_filled',

names = names,

figratio=(18,10),

fill_weights = (0.25, 0.4)

)