Wave PM (Whistler Active Volatility Energy Price Mass)

References

Definition

- The Wave PM (Whistler Active Volatility Energy Price Mass) indicator is an oscillator described in the Mark Whistler’s book “Volatility Illuminated”.

- it was designed to help read cycles of volatility. Read when a strong trend is about to start and end, along with the potential duration of lateral chop.

- it is not a directional oscillator

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'PFE', 'DAL']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-05 18:05:09.006954 ^GSPC (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:05:09.398440 GSK (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:05:09.787225 NVO (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:05:10.271711 PFE (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:05:10.547051 DAL (3863, 7) 2007-05-03 00:00:00 2022-09-02 00:00:00

ticker = 'DAL'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-29 | 32.200001 | 32.349998 | 31.850000 | 32.029999 | 8758400 | 0.0 | 0 |

| 2022-08-30 | 32.250000 | 32.450001 | 31.469999 | 31.719999 | 7506400 | 0.0 | 0 |

| 2022-08-31 | 31.969999 | 32.020000 | 31.059999 | 31.070000 | 7450000 | 0.0 | 0 |

| 2022-09-01 | 30.650000 | 31.139999 | 29.940001 | 31.090000 | 8572700 | 0.0 | 0 |

| 2022-09-02 | 31.440001 | 31.830000 | 30.700001 | 30.940001 | 8626500 | 0.0 | 0 |

Define Wave PM calculation function

def cal_wavepm(ohlc: pd.DataFrame, period: int = 14, lookback_period: int = 100, column: str = "close") -> pd.Series:

"""

The Wave PM (Whistler Active Volatility Energy Price Mass) indicator is an oscillator described in the Mark

Whistler’s book “Volatility Illuminated”.

:param DataFrame ohlc: data

:param int period: period for moving average

:param int lookback_period: period for oscillator lookback

:return Series: WAVE PM

"""

ma = ohlc[column].rolling(window=period).mean()

std = ohlc[column].rolling(window=period).std(ddof=0)

def tanh(x):

two = np.where(x > 0, -2, 2)

what = two * x

ex = np.exp(what)

j = 1 - ex

k = ex - 1

l = np.where(x > 0, j, k)

output = l / (1 + ex)

return output

def osc(input_dev, mean, power):

variance = pd.Series(power).rolling(window=lookback_period).sum() / lookback_period

calc_dev = np.sqrt(variance) * mean

y = (input_dev / calc_dev)

oscLine = tanh(y)

return oscLine

dev = 3.2 * std

power = np.power(dev / ma, 2)

wavepm = osc(dev, ma, power)

return pd.Series(wavepm, name=f"WAVEPM{period}")

Calculate Wave PM

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_wavepm

<function __main__.cal_wavepm(ohlc: pandas.core.frame.DataFrame, period: int = 14, lookback_period: int = 100, column: str = 'close') -> pandas.core.series.Series>

df_ta = cal_wavepm(df, period=10, lookback_period=90, column='Close')

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

610

df_ta = cal_wavepm(df, period=14, lookback_period=120, column='Close')

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

21

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | WAVEPM10 | WAVEPM14 | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2007-05-03 | 19.32 | 19.50 | 18.25 | 18.40 | 8052800 | NaN | NaN |

| 2007-05-04 | 18.88 | 18.96 | 18.39 | 18.64 | 5437300 | NaN | NaN |

| 2007-05-07 | 18.83 | 18.91 | 17.94 | 18.08 | 2646300 | NaN | NaN |

| 2007-05-08 | 17.76 | 17.76 | 17.14 | 17.44 | 4166100 | NaN | NaN |

| 2007-05-09 | 17.54 | 17.94 | 17.44 | 17.58 | 7541100 | NaN | NaN |

| Open | High | Low | Close | Volume | WAVEPM10 | WAVEPM14 | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-29 | 32.20 | 32.35 | 31.85 | 32.03 | 8758400 | 0.626965 | 0.479660 |

| 2022-08-30 | 32.25 | 32.45 | 31.47 | 31.72 | 7506400 | 0.599117 | 0.539114 |

| 2022-08-31 | 31.97 | 32.02 | 31.06 | 31.07 | 7450000 | 0.633094 | 0.610828 |

| 2022-09-01 | 30.65 | 31.14 | 29.94 | 31.09 | 8572700 | 0.609835 | 0.649787 |

| 2022-09-02 | 31.44 | 31.83 | 30.70 | 30.94 | 8626500 | 0.640151 | 0.661071 |

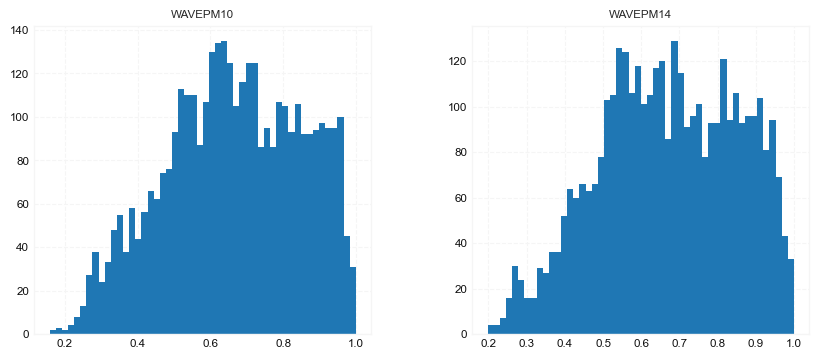

df[['WAVEPM10', 'WAVEPM14']].hist(bins=50, figsize=(10, 4))

array([[<AxesSubplot:title={'center':'WAVEPM10'}>,

<AxesSubplot:title={'center':'WAVEPM14'}>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

# all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

all_colors = ['dodgerblue', 'firebrick','limegreen','skyblue','lightgreen', 'navy','yellow','plum', 'yellowgreen']

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9), fill_weights = (0, 0)):

"""

main chart type: default is candle. alternatives: ohlc, line

example:

start = 200

names = {'main_title': 'MAMA: MESA Adaptive Moving Average',

'sub_tile': 'S&P 500 (^GSPC)', 'y_tiles': ['price', 'Volume [$10^{6}$]']}

make_candle(df.iloc[-start:, :5], df.iloc[-start:][['MAMA', 'FAMA']], names = names)

"""

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2,1), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = { }

fb_bbands2_ = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),

y2=fill_weights[1]*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands2_['panel'] = 1

fb_bbands= [fb_bbands2_]

i = 0

for name_, data_ in mid_panel.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=1, width=1, color=all_colors[i], secondary_y=False)

i = i + 1

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

# axes[2].set_ylabel('WAVEPM10')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

start = -500

end = -400

names = {'main_title': f'{ticker}',

'sub_tile': 'Wave PM (Whistler Active Volatility Energy Price Mass): 0.9 - Danger, 0.7 - Breakout, 0.5 - Consolidation, 0.35 - Gear Change'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['WAVEPM10', 'WAVEPM14']],

chart_type='hollow_and_filled',names = names,

fill_weights = (0.35, .9))