Schaff Trend Cycle (Oscillator)

References

- [chrt-ti-schaff-trend-cycle](https://library.tradingtechnologies.com/trade/chrt-ti-schaff-trend-cycle.html#:~:text=The%20Schaff%20Trend%20Cycle%20(STC,75%20levels%20downward%20(sell).)

- tradingview: Schaff Trend Cycle

Definition

- The Schaff Trend Cycle (STC) indicator is an oscillator that provides buy and sell signals for trading and identifies market trends.

- STC detects up and down trends long before the MACD . It does this by using the same exponential moving averages (EMAs), but adds a cycle component to factor instrument cycle trends. STC gives more accuracy and reliability than the MACD .

- STC indicator generates its BUY signal when the signal line turns up from 25 (to indicate a bullish reversal is happening and signaling that it is time to go long), or turns down from 75 (to indicate a downside reversal is unfolding and so it’s time for a short sale).

- This indicator was originally developed by Doug Schaff in the 1990s (published in 2008).

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'ITCI', 'GKOS']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-08-24 23:55:22.563286 ^GSPC (5699, 7) 1999-12-31 00:00:00 2022-08-24 00:00:00

2022-08-24 23:55:22.987867 GSK (5699, 7) 1999-12-31 00:00:00 2022-08-24 00:00:00

2022-08-24 23:55:23.316568 NVO (5699, 7) 1999-12-31 00:00:00 2022-08-24 00:00:00

2022-08-24 23:55:23.566454 ITCI (2174, 7) 2014-01-07 00:00:00 2022-08-24 00:00:00

2022-08-24 23:55:23.878489 GKOS (1805, 7) 2015-06-25 00:00:00 2022-08-24 00:00:00

ticker = 'GKOS'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-18 | 50.549999 | 51.250000 | 49.900002 | 51.119999 | 398900 | 0 | 0 |

| 2022-08-19 | 50.730000 | 50.730000 | 49.250000 | 50.080002 | 392000 | 0 | 0 |

| 2022-08-22 | 49.290001 | 50.110001 | 48.810001 | 49.049999 | 243200 | 0 | 0 |

| 2022-08-23 | 49.509998 | 49.759998 | 48.439999 | 49.410000 | 260300 | 0 | 0 |

| 2022-08-24 | 50.290001 | 52.430000 | 49.269199 | 52.400002 | 157512 | 0 | 0 |

Define Schaff Trend Cycle (Oscillator) calculation function

def cal_stc(

ohlc: pd.DataFrame,

fast_period: int = 23,

slow_period: int = 50,

k_period: int = 10,

d_period: int = 3,

column: str = "close",

adjust: bool = True

) -> pd.Series:

"""

The Schaff Trend Cycle (Oscillator) can be viewed as Double Smoothed

Stochastic of the MACD.

Schaff Trend Cycle - Three input values are used with the STC:

– Sh: shorter-term Exponential Moving Average with a default period of 23

– Lg: longer-term Exponential Moving Average with a default period of 50

– Cycle, set at half the cycle length with a default value of 10. (Stoch K-period)

- Smooth, set at smoothing at 3 (Stoch D-period)

The STC is calculated in the following order:

EMA1 = EMA (Close, fast_period);

EMA2 = EMA (Close, slow_period);

MACD = EMA1 – EMA2.

Second, the 10-period Stochastic from the MACD values is calculated:

STOCH_K, STOCH_D = StochasticFull(MACD, k_period, d_period) // Stoch of MACD

STC = average(STOCH_D, d_period) // second smoothed

In case the STC indicator is decreasing, this indicates that the trend cycle

is falling, while the price tends to stabilize or follow the cycle to the downside.

In case the STC indicator is increasing, this indicates that the trend cycle

is up, while the price tends to stabilize or follow the cycle to the upside.

"""

EMA_fast = pd.Series(

ohlc[column].ewm(ignore_na=False, span=fast_period, adjust=adjust).mean(),

name="EMA_fast",

)

EMA_slow = pd.Series(

ohlc[column].ewm(ignore_na=False, span=slow_period, adjust=adjust).mean(),

name="EMA_slow",

)

MACD = pd.Series((EMA_fast - EMA_slow), name="MACD")

STOK = pd.Series((

(MACD - MACD.rolling(window=k_period).min())

/ (MACD.rolling(window=k_period).max() - MACD.rolling(window=k_period).min())

) * 100)

STOD = STOK.rolling(window=d_period).mean()

STOD_DoubleSmooth = STOD.rolling(window=d_period).mean() # "double smoothed"

return pd.Series(STOD_DoubleSmooth, name=f"STC")

Calculate Schaff Trend Cycle (Oscillator)

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_stc

<function __main__.cal_stc(ohlc: pandas.core.frame.DataFrame, fast_period: int = 23, slow_period: int = 50, k_period: int = 10, d_period: int = 3, column: str = 'close', adjust: bool = True) -> pandas.core.series.Series>

df_ta = cal_stc(df, slow_period=50, fast_period=23, k_period=10, d_period=3, column='Close')

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

122

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | STC | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2015-06-25 | 29.11 | 31.95 | 28.00 | 31.22 | 7554700 | NaN |

| 2015-06-26 | 30.39 | 30.39 | 27.51 | 28.00 | 1116500 | NaN |

| 2015-06-29 | 27.70 | 28.48 | 27.51 | 28.00 | 386900 | NaN |

| 2015-06-30 | 27.39 | 29.89 | 27.39 | 28.98 | 223900 | NaN |

| 2015-07-01 | 28.83 | 29.00 | 27.87 | 28.00 | 150000 | NaN |

| Open | High | Low | Close | Volume | STC | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2022-08-18 | 50.55 | 51.25 | 49.90 | 51.12 | 398900 | 6.333123 |

| 2022-08-19 | 50.73 | 50.73 | 49.25 | 50.08 | 392000 | 3.932477 |

| 2022-08-22 | 49.29 | 50.11 | 48.81 | 49.05 | 243200 | 1.531830 |

| 2022-08-23 | 49.51 | 49.76 | 48.44 | 49.41 | 260300 | 0.000000 |

| 2022-08-24 | 50.29 | 52.43 | 49.27 | 52.40 | 157512 | 0.763749 |

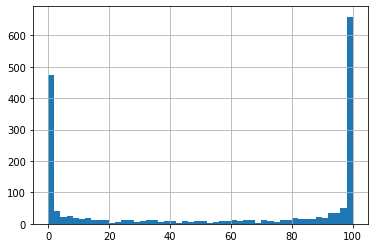

df['STC'].hist(bins=50)

<AxesSubplot:>

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9), fill_weights = (0, 0)):

"""

main chart type: default is candle. alternatives: ohlc, line

example:

start = 200

names = {'main_title': 'MAMA: MESA Adaptive Moving Average',

'sub_tile': 'S&P 500 (^GSPC)', 'y_tiles': ['price', 'Volume [$10^{6}$]']}

make_candle(df.iloc[-start:, :5], df.iloc[-start:][['MAMA', 'FAMA']], names = names)

"""

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2,1), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = {

'STC': mpf.make_addplot(mid_panel['STC'], panel=1, color='dodgerblue', width=1, secondary_y=False),

}

fb_stc_up = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),y2=mid_panel['STC'].values,where=mid_panel['STC']<fill_weights[0],color="#e06666",alpha=0.6,interpolate=True)

fb_stc_dn = dict(y1=fill_weights[1]*np.ones(mid_panel.shape[0]),y2=mid_panel['STC'].values,where=mid_panel['STC']>fill_weights[1],color="#93c47d",alpha=0.6,interpolate=True)

fb_stc_up['panel'] = 1

fb_stc_dn['panel'] = 1

fb_stc_bbands = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),

y2=fill_weights[1]*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_stc_bbands['panel'] = 1

fb_bbands= [fb_stc_up, fb_stc_dn, fb_stc_bbands]

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

axes[2].set_ylabel('STC')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

start = -100

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'Schaff Trend Cycle: BUY when the signal line turns up from 25, SELL when the signal line turns down from 75.'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['STC']],

chart_type='hollow_and_filled',names = names,

fill_weights = (25, 75))