Aroon

References

Definition

The Aroon indicators

measure the number of periods since price recorded an x-day high or low. AroonUp is based on price highs, while Aroon-Down is based on price lows. The Aroon indicators are shown in percentage terms and fluctuate between 0 and 100. View on a particular stock is bullish Aroon-Up is above 50 and Aroon-Down is below 50. This indicates a greater propensity for new x-day highs than lows. The converse is true for a downtrend. The view on a stock is bearish when Aroon-Up is below 50 and Aroon-Down is above 50. The calculation of the Aroon indicator is mentioned in the link in the bibliography.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'PFE']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-07 09:41:17.067982 ^GSPC (5707, 7) 1999-12-31 00:00:00 2022-09-06 00:00:00

2022-09-07 09:41:17.398588 GSK (5707, 7) 1999-12-31 00:00:00 2022-09-06 00:00:00

2022-09-07 09:41:17.789028 NVO (5707, 7) 1999-12-31 00:00:00 2022-09-06 00:00:00

2022-09-07 09:41:18.193807 PFE (5707, 7) 1999-12-31 00:00:00 2022-09-06 00:00:00

ticker = 'GSK'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-30 | 33.230000 | 33.290001 | 32.919998 | 32.959999 | 3994500 | 0.0 | 0.0 |

| 2022-08-31 | 32.790001 | 32.880001 | 32.459999 | 32.480000 | 4291800 | 0.0 | 0.0 |

| 2022-09-01 | 31.830000 | 31.990000 | 31.610001 | 31.690001 | 12390900 | 0.0 | 0.0 |

| 2022-09-02 | 31.600000 | 31.969999 | 31.469999 | 31.850000 | 8152600 | 0.0 | 0.0 |

| 2022-09-06 | 31.650000 | 31.760000 | 31.370001 | 31.469999 | 5613900 | 0.0 | 0.0 |

Define Aroon calculation function

def cal_aroon(ohlc: pd.DataFrame, period: int = 10) -> pd.DataFrame:

"""

The Aroon indicators measure the number of periods since price recorded an x-day high or low. AroonUp is based on price highs, while Aroon-Down is based on price lows. The Aroon indicators are shown

in percentage terms and fluctuate between 0 and 100. View on a particular stock is bullish Aroon-Up

is above 50 and Aroon-Down is below 50. This indicates a greater propensity for new x-day highs than

lows. The converse is true for a downtrend. The view on a stock is bearish when Aroon-Up is below

50 and Aroon-Down is above 50. The calculation of the Aroon indicator is mentioned in the link in

the bibliography.

the ohlc datafrome is sorted by 'Date' ascending

Note the following calculation is wrong in that if there are more than 1 max in the rolling period,

it will get the first (i.e. the earlies in date) max instead of most recent (i.e. the last) max

periods = 10

aroon_up = df['High'].rolling(periods+1).apply(lambda x: x.argmax(), raw=True) / periods * 100

aroon_down = df['Low'].rolling(periods+1).apply(lambda x: x.argmin(), raw=True) / periods * 100

"""

ohlc = ohlc.copy()

ohlc.columns = [c.lower() for c in ohlc.columns]

high = ohlc["high"]

low = ohlc["low"]

hh_loc = high.rolling(period + 1).apply(lambda x: np.argmax(x[::-1]), raw=True)

ll_loc = low.rolling(period + 1).apply(lambda x: np.argmin(x[::-1]), raw=True)

aroon_up = 100*(1 - hh_loc/period)

aroon_down = 100*(1 - ll_loc/period)

aroon = aroon_up - aroon_down

return pd.DataFrame(data={'AROON_UP': aroon_up,

'AROON_DOWN': aroon_down,

'AROON': aroon,

},

index = ohlc.index)

Calculate AROON

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

help(cal_aroon)

Help on function cal_aroon in module __main__:

cal_aroon(ohlc: pandas.core.frame.DataFrame, period: int = 10) -> pandas.core.frame.DataFrame

The Aroon indicators measure the number of periods since price recorded an x-day high or low. AroonUp is based on price highs, while Aroon-Down is based on price lows. The Aroon indicators are shown

in percentage terms and fluctuate between 0 and 100. View on a particular stock is bullish Aroon-Up

is above 50 and Aroon-Down is below 50. This indicates a greater propensity for new x-day highs than

lows. The converse is true for a downtrend. The view on a stock is bearish when Aroon-Up is below

50 and Aroon-Down is above 50. The calculation of the Aroon indicator is mentioned in the link in

the bibliography.

the ohlc datafrome is sorted by 'Date' ascending

Note the following calculation is wrong in that if there are more than 1 max in the rolling period,

it will get the first (i.e. the earlies in date) max instead of most recent (i.e. the last) max

periods = 10

aroon_up = df['High'].rolling(periods+1).apply(lambda x: x.argmax(), raw=True) / periods * 100

aroon_down = df['Low'].rolling(periods+1).apply(lambda x: x.argmin(), raw=True) / periods * 100

df_ta = cal_aroon(df, period = 14)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

11055

from core.finta import TA

help(TA.BBANDS)

Help on function BBANDS in module core.finta:

BBANDS(ohlc: pandas.core.frame.DataFrame, period: int = 20, MA: pandas.core.series.Series = None, column: str = 'close', std_multiplier: float = 2) -> pandas.core.frame.DataFrame

Developed by John Bollinger, Bollinger Bands® are volatility bands placed above and below a moving average.

Volatility is based on the standard deviation, which changes as volatility increases and decreases.

The bands automatically widen when volatility increases and narrow when volatility decreases.

This method allows input of some other form of moving average like EMA or KAMA around which BBAND will be formed.

Pass desired moving average as <MA> argument. For example BBANDS(MA=TA.KAMA(20)).

df_ta = TA.BBANDS(df, period = 20, column="close", std_multiplier=1.95)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

63

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | AROON_UP | AROON_DOWN | AROON | BB_UPPER | BB_MIDDLE | BB_LOWER | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||

| 1999-12-31 | 19.60 | 19.67 | 19.52 | 19.56 | 139400 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2000-01-03 | 19.58 | 19.71 | 19.25 | 19.45 | 556100 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2000-01-04 | 19.45 | 19.45 | 18.90 | 18.95 | 367200 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2000-01-05 | 19.21 | 19.58 | 19.08 | 19.58 | 481700 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2000-01-06 | 19.38 | 19.43 | 18.90 | 19.30 | 853800 | NaN | NaN | NaN | NaN | NaN | NaN |

| Open | High | Low | Close | Volume | AROON_UP | AROON_DOWN | AROON | BB_UPPER | BB_MIDDLE | BB_LOWER | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||

| 2022-08-30 | 33.23 | 33.29 | 32.92 | 32.96 | 3994500 | 0.000000 | 100.0 | -100.000000 | 41.099946 | 35.7605 | 30.421054 |

| 2022-08-31 | 32.79 | 32.88 | 32.46 | 32.48 | 4291800 | 7.142857 | 100.0 | -92.857143 | 40.446679 | 35.3665 | 30.286321 |

| 2022-09-01 | 31.83 | 31.99 | 31.61 | 31.69 | 12390900 | 0.000000 | 100.0 | -100.000000 | 39.764640 | 34.9440 | 30.123360 |

| 2022-09-02 | 31.60 | 31.97 | 31.47 | 31.85 | 8152600 | 7.142857 | 100.0 | -92.857143 | 38.904860 | 34.5310 | 30.157140 |

| 2022-09-06 | 31.65 | 31.76 | 31.37 | 31.47 | 5613900 | 0.000000 | 100.0 | -100.000000 | 37.934857 | 34.1115 | 30.288143 |

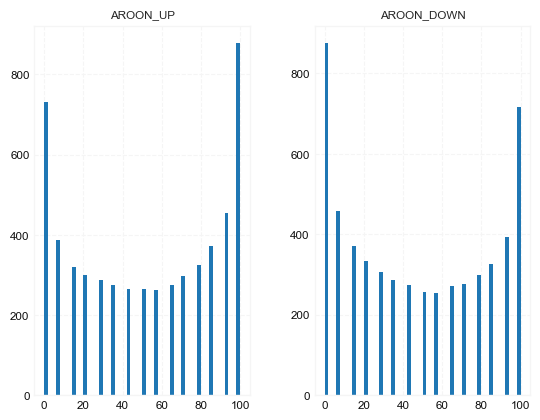

df[['AROON_UP', 'AROON_DOWN']].hist(bins=50)

array([[<AxesSubplot:title={'center':'AROON_UP'}>,

<AxesSubplot:title={'center':'AROON_DOWN'}>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

# all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

all_colors = ['dodgerblue', 'firebrick','limegreen','skyblue','lightgreen', 'navy','yellow','plum', 'yellowgreen']

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, add_data, mid_panel=None, chart_type='candle', names=None, figratio=(14,9)):

"""

main chart type: default is candle. alternatives: ohlc, line

example:

start = 200

names = {'main_title': 'MAMA: MESA Adaptive Moving Average',

'sub_tile': 'S&P 500 (^GSPC)', 'y_tiles': ['price', 'Volume [$10^{6}$]']}

make_candle(df.iloc[-start:, :5], df.iloc[-start:][['MAMA', 'FAMA']], names = names)

"""

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=False, volume_panel=1,

panel_ratios=(4,2), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = { }

for name_, data_ in add_data.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=0, width=1, secondary_y=False)

fb_bbands_ = dict(y1=add_data.iloc[:, 0].values,

y2=add_data.iloc[:, 1].values,color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands_['panel'] = 0

fb_bbands= [fb_bbands_]

if mid_panel is not None:

i = 0

for name_, data_ in mid_panel.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=1, color=all_colors[i])

i = i + 1

fb_bbands2_ = dict(y1=np.zeros(mid_panel.shape[0]),

y2=0.8+np.zeros(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands2_['panel'] = 1

fb_bbands.append(fb_bbands2_)

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

# axes[0].legend([None]*5)

# handles = axes[0].get_legend().legendHandles

# axes[0].legend(handles=handles[2:],labels=list(added_plots.keys()))

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

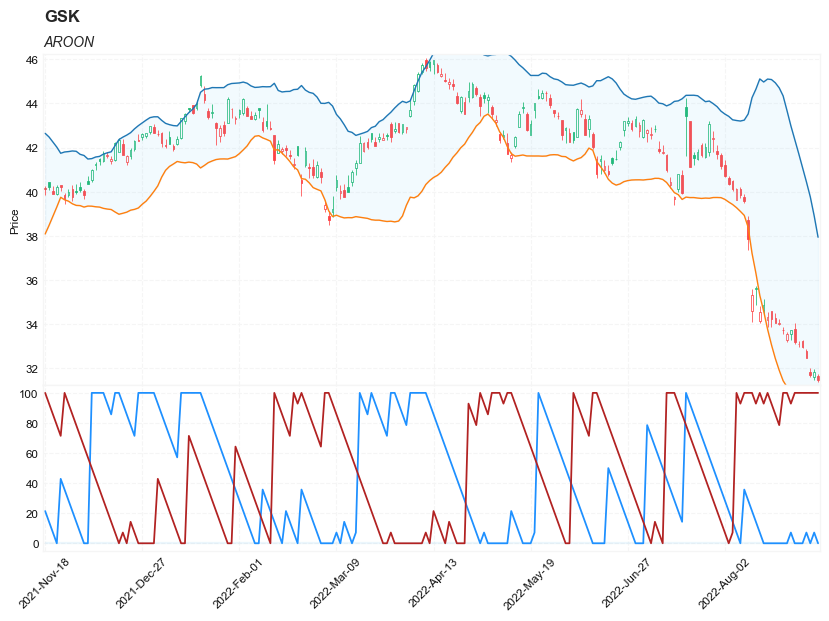

start = -200

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'AROON'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['BB_UPPER', 'BB_LOWER' ]],

df.iloc[start:end][['AROON_UP', 'AROON_DOWN']],

chart_type='hollow_and_filled',names = names)

start = -100

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'AROON'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['BB_UPPER', 'BB_LOWER' ]],

df.iloc[start:end][['AROON',]],

chart_type='hollow_and_filled',names = names)