Williams %R (%R)

References

Definition

- Williams %R (%R) is a momentum-based oscillator created by Larry Williams.

- It is used to identify overbought and oversold conditions.

- The %R is based on a comparison between the current close and the highest high for a user defined look back period.

- %R Oscillates between 0 and -100 (note the negative values):

- readings closer to 0 indicating more overbought conditions

- readings closer to -100 indicating oversold.

Calculation

%R = (Highest High - Current Close) / (Highest High - Lowest Low) x -100

- Highest High = Highest High for the user defined look-back period.

- Lowest Low = Lowest Low for the user defined look-back period.

Read the indicator

- Overbought/Oversold

- Overbought conditions (traditionally defined as values between 0 and -20) can indicate either a trend reversal or in many cases, a strengthening of the current trend.

- Oversold conditions (traditionally defined as values between -80 and -100) can indicate either a trend reversal or in many cases, a strengthening of the current trend.

- Momentum Failures

- Momentum failure occur when %R readings reach overbought or oversold conditions for an extended period of time. Upon leaving overbought/oversold territory, %R makes a move back towards the overbought/oversold levels but fails to re-enter the territory.

The traditional 0 to -20 (overbought) and -80 to -100 (oversold) were set by Larry Williams (the creator of the indicator). Depending on multiple factors such as volatility or market news, these standard levels may not be appropriate for every situation. As with most technical analysis tools, the %R is best when used as part of a larger trading system and not necessarily as a stand-alone indicator.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'PFE', 'DAL']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-05 18:14:35.339560 ^GSPC (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:14:35.623208 GSK (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:14:35.985809 NVO (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:14:36.355315 PFE (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-05 18:14:36.605538 DAL (3863, 7) 2007-05-03 00:00:00 2022-09-02 00:00:00

ticker = 'DAL'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-29 | 32.200001 | 32.349998 | 31.850000 | 32.029999 | 8758400 | 0.0 | 0 |

| 2022-08-30 | 32.250000 | 32.450001 | 31.469999 | 31.719999 | 7506400 | 0.0 | 0 |

| 2022-08-31 | 31.969999 | 32.020000 | 31.059999 | 31.070000 | 7450000 | 0.0 | 0 |

| 2022-09-01 | 30.650000 | 31.139999 | 29.940001 | 31.090000 | 8572700 | 0.0 | 0 |

| 2022-09-02 | 31.440001 | 31.830000 | 30.700001 | 30.940001 | 8626500 | 0.0 | 0 |

Define Williams %R calculation function

#https://github.com/peerchemist/finta/blob/af01fa594995de78f5ada5c336e61cd87c46b151/finta/finta.py

def cal_williams(ohlc: pd.DataFrame, period: int = 14) -> pd.Series:

"""

Williams %R, or just %R, is a technical analysis oscillator showing the current closing price

in relation to the high and low of the past N days (for a given N).

It was developed by a publisher and promoter of trading materials, Larry Williams.

Its purpose is to tell whether a stock or commodity market is trading near the high or the low, or somewhere in between,

of its recent trading range.

The oscillator is on a negative scale, from −100 (lowest) up to 0 (highest).

"""

ohlc = ohlc.copy(deep=True)

ohlc.columns = [c.lower() for c in ohlc.columns]

highest_high = ohlc["high"].rolling(center=False, window=period).max()

lowest_low = ohlc["low"].rolling(center=False, window=period).min()

WR = pd.Series(

(highest_high - ohlc["close"]) / (highest_high - lowest_low),

name=f"WilliamsR{period}",

)

return WR * -100

Calculate Williams %R

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_williams

<function __main__.cal_williams(ohlc: pandas.core.frame.DataFrame, period: int = 14) -> pandas.core.series.Series>

df_ta = cal_williams(df, period = 14)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

80

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | WilliamsR14 | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2007-05-03 | 19.32 | 19.50 | 18.25 | 18.40 | 8052800 | NaN |

| 2007-05-04 | 18.88 | 18.96 | 18.39 | 18.64 | 5437300 | NaN |

| 2007-05-07 | 18.83 | 18.91 | 17.94 | 18.08 | 2646300 | NaN |

| 2007-05-08 | 17.76 | 17.76 | 17.14 | 17.44 | 4166100 | NaN |

| 2007-05-09 | 17.54 | 17.94 | 17.44 | 17.58 | 7541100 | NaN |

| Open | High | Low | Close | Volume | WilliamsR14 | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2022-08-29 | 32.20 | 32.35 | 31.85 | 32.03 | 8758400 | -95.431472 |

| 2022-08-30 | 32.25 | 32.45 | 31.47 | 31.72 | 7506400 | -94.212963 |

| 2022-08-31 | 31.97 | 32.02 | 31.06 | 31.07 | 7450000 | -99.788584 |

| 2022-09-01 | 30.65 | 31.14 | 29.94 | 31.09 | 8572700 | -80.341880 |

| 2022-09-02 | 31.44 | 31.83 | 30.70 | 30.94 | 8626500 | -82.905983 |

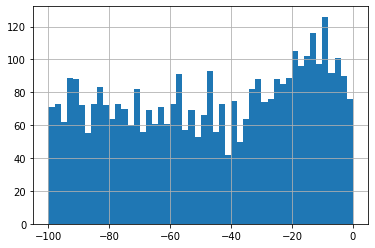

df['WilliamsR14'].hist(bins=50)

<AxesSubplot:>

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

# all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

all_colors = ['dodgerblue', 'firebrick','limegreen','skyblue','lightgreen', 'navy','yellow','plum', 'yellowgreen']

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9), fill_weights = (0, 0)):

"""

main chart type: default is candle. alternatives: ohlc, line

example:

start = 200

names = {'main_title': 'MAMA: MESA Adaptive Moving Average',

'sub_tile': 'S&P 500 (^GSPC)', 'y_tiles': ['price', 'Volume [$10^{6}$]']}

make_candle(df.iloc[-start:, :5], df.iloc[-start:][['MAMA', 'FAMA']], names = names)

"""

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2,1), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = { }

fb_bbands2_ = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),

y2=fill_weights[1]*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands2_['panel'] = 1

fb_bbands= [fb_bbands2_]

i = 0

for name_, data_ in mid_panel.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=1, width=1, color=all_colors[i], secondary_y=False)

i = i + 1

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

# axes[2].set_ylabel('WAVEPM10')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

start = -100

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'Williams %R (%R): reading 0 to -20 (overbought) and -80 to -100 (oversold)'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['WilliamsR14']],

chart_type='hollow_and_filled',names = names,

fill_weights = (-80, -20))