Psychological Line (PSY)

References

Definition

Psychological line (PSY), as an indicator, is the ratio of the number of rising periods over the total number of periods. It reflects the buying power in relation to the selling power.

If PSY is above 50%, it indicates that buyers are in control. Likewise, if it is below 50%, it indicates the sellers are in control. If the PSY moves along the 50% area, it indicates balance between the buyers and sellers and therefore there is no direction movement for the market.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'GKOS']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-08-27 19:18:31.874246 ^GSPC (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 19:18:32.234071 GSK (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 19:18:32.579770 NVO (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 19:18:32.733716 GKOS (1807, 7) 2015-06-25 00:00:00 2022-08-26 00:00:00

ticker = 'GKOS'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-22 | 49.290001 | 50.110001 | 48.810001 | 49.049999 | 243200 | 0 | 0 |

| 2022-08-23 | 49.509998 | 49.759998 | 48.439999 | 49.410000 | 260300 | 0 | 0 |

| 2022-08-24 | 50.290001 | 52.680000 | 49.269001 | 52.000000 | 628200 | 0 | 0 |

| 2022-08-25 | 52.820000 | 52.840000 | 52.040001 | 52.590000 | 349400 | 0 | 0 |

| 2022-08-26 | 52.310001 | 52.580002 | 49.480000 | 49.889999 | 550400 | 0 | 0 |

Define PSY calculation function

def cal_psy(ohlc: pd.DataFrame, period: int = 12, ma_period: int = 6, column: str = "close") -> pd.DataFrame:

"""

PSY

reference:

- https://github.com/mpquant/MyTT/blob/ea4f14857ecc46a3739a75ce2e6974b9057a6102/MyTT.py#L71

def PSY(CLOSE,N=12, M=6):

PSY=COUNT(CLOSE>REF(CLOSE,1),N)/N*100

PSYMA=MA(PSY,M)

return RD(PSY),RD(PSYMA)

"""

psy = (ohlc[column]>ohlc[column].shift(1)).rolling(period).sum()/period*100

psy_ma = psy.rolling(ma_period).mean()

return pd.DataFrame(data={'PSY': psy.values, 'PSY_MA': psy_ma.values, }, index=ohlc.index)

Calculate PSY

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_psy

<function __main__.cal_psy(ohlc: pandas.core.frame.DataFrame, period: int = 12, ma_period: int = 6, column: str = 'close') -> pandas.core.frame.DataFrame>

df_ta = cal_psy(df, period = 20, ma_period = 9, column = "Close")

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

80

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | PSY | PSY_MA | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2015-06-25 | 29.11 | 31.95 | 28.00 | 31.22 | 7554700 | NaN | NaN |

| 2015-06-26 | 30.39 | 30.39 | 27.51 | 28.00 | 1116500 | NaN | NaN |

| 2015-06-29 | 27.70 | 28.48 | 27.51 | 28.00 | 386900 | NaN | NaN |

| 2015-06-30 | 27.39 | 29.89 | 27.39 | 28.98 | 223900 | NaN | NaN |

| 2015-07-01 | 28.83 | 29.00 | 27.87 | 28.00 | 150000 | NaN | NaN |

| Open | High | Low | Close | Volume | PSY | PSY_MA | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-22 | 49.29 | 50.11 | 48.81 | 49.05 | 243200 | 55.0 | 58.333333 |

| 2022-08-23 | 49.51 | 49.76 | 48.44 | 49.41 | 260300 | 60.0 | 58.333333 |

| 2022-08-24 | 50.29 | 52.68 | 49.27 | 52.00 | 628200 | 60.0 | 58.888889 |

| 2022-08-25 | 52.82 | 52.84 | 52.04 | 52.59 | 349400 | 60.0 | 59.444444 |

| 2022-08-26 | 52.31 | 52.58 | 49.48 | 49.89 | 550400 | 55.0 | 58.888889 |

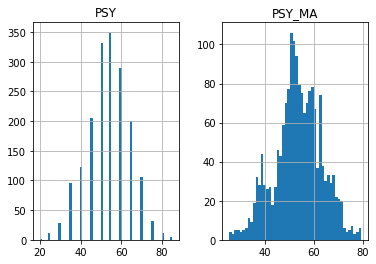

df[['PSY', 'PSY_MA']].hist(bins=50)

array([[<AxesSubplot:title={'center':'PSY'}>,

<AxesSubplot:title={'center':'PSY_MA'}>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9)):

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2,1), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = {

'PSY': mpf.make_addplot(mid_panel['PSY'], panel=1, color='dodgerblue', width=1, secondary_y=False),

'PSY_MA': mpf.make_addplot(mid_panel['PSY_MA'], panel=1, color='orange', width=1, secondary_y=False),

}

fb_psy_up = dict(y1=50*np.ones(mid_panel.shape[0]),y2=mid_panel['PSY'].values,where=mid_panel['PSY'].values<50,color="#93c47d",alpha=0.6,interpolate=True)

fb_psy_dn = dict(y1=50*np.ones(mid_panel.shape[0]),y2=mid_panel['PSY'].values,where=mid_panel['PSY'].values>50,color="#e06666",alpha=0.6,interpolate=True)

fb_psy_up['panel'] = 1

fb_psy_dn['panel'] = 1

fb_bbands= [fb_psy_up, fb_psy_dn]

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands

)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.135)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

axes[2].set_ylabel('PSY')

axes[2].legend([None]*3)

handles = axes[2].get_legend().legendHandles

axes[2].legend(handles=handles,labels=list(added_plots.keys()))

return fig, axes

start = -200

end = -100#df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'PSY: buy when PSY line cross to below 50; sell whey PSY line cross to above 50'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['PSY', 'PSY_MA']],

chart_type='hollow_and_filled',

names = names,

)