KDJ

References

Definition

- KDJ, also known as random index, is a technical index widely used in short-term trend analysis of futures and stock markets.

- KDJ is calculated on the basis of the highest price, the lowest price and the closing price. It can reflect the intensity of price fluctuations, overbought and oversold, and give trading signals before prices rise or fall.

- KDJ is sensitive to price changes, which may generate wrong trading signals in very volatile markets, causing prices not to rise or fall with the signals, thus causing traders to make misjudgments.

Calculation

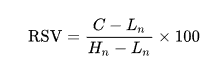

step 1: calculate the immature random value (RSV)

- Hn denotes the highest price, Ln denotes the lowest price, C denotes the closing price

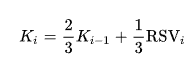

step 2: calculate the %K line:

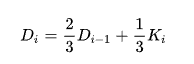

step 3: calculate the %D line:

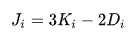

step 4: calculate the %J line:

Read the indicator

-

KDJ values range from 0 to 100 (J values sometimes exceed). Generally speaking, an overbought signal occurs when the D value is more than 70 and an oversell signal occurs when the D value is less than 30.

- Gold fork

- When the K line breaks through the D line on the graph, it is commonly known as the golden fork, which is a buy signal. In addition, when the K-line and D-line cross upward below 20, the short-term buy signal is more accurate; if the K value is below 50 and crosses twice above D value to form a higher golden fork “W” shape, then the stock price may rise considerably and the market prospect is promising.

- Dead fork

- When the K value gets smaller and smaller, and then falls below the D line from above, it is often called a dead fork and is regarded as a sell signal. In addition, when K-line and D-line cross downward at gate 80, the short-term sell signal is more accurate. If the K value is above 50, crossing below the D line twice in the trend, and from the low dead cross “M” shape, the market outlook may have a considerable decline in stock prices.

- Bottom and top

- J-line is a sensitive line of direction. When the J value is greater than 90, especially for more than 5 consecutive days, the stock price will form at least a short-term peak. On the contrary, when the J value is less than 10:00, especially for several consecutive days, the stock price will form at least a short-term bottom.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'AROC']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-10 21:20:33.417662 ^GSPC (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 21:20:33.761677 GSK (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 21:20:34.092952 NVO (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 21:20:34.340454 AROC (3791, 7) 2007-08-21 00:00:00 2022-09-09 00:00:00

ticker = 'GSK'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-09-02 | 31.600000 | 31.969999 | 31.469999 | 31.850000 | 8152600 | 0.0 | 0.0 |

| 2022-09-06 | 31.650000 | 31.760000 | 31.370001 | 31.469999 | 5613900 | 0.0 | 0.0 |

| 2022-09-07 | 31.209999 | 31.590000 | 31.160000 | 31.490000 | 4822000 | 0.0 | 0.0 |

| 2022-09-08 | 30.910000 | 31.540001 | 30.830000 | 31.510000 | 6620900 | 0.0 | 0.0 |

| 2022-09-09 | 31.950001 | 31.969999 | 31.730000 | 31.889999 | 3556800 | 0.0 | 0.0 |

Define KDJ calculation function

def cal_kdj(ohlc: pd.DataFrame, period: int = 14) -> pd.DataFrame:

"""

KDJ

reference: https://www.futunn.com/en/learn/detail-what-is-kdj-64858-0

"""

ohlc = ohlc.copy(deep=True)

ohlc.columns = [c.lower() for c in ohlc.columns]

highest_high = ohlc["high"].rolling(center=False, window=period).max()

lowest_low = ohlc["low"].rolling(center=False, window=period).min()

rsv = (ohlc["close"] - lowest_low) / (highest_high - lowest_low) * 100

rsv = rsv.values

k_ = np.zeros(len(ohlc))

d_ = np.zeros(len(ohlc))

for i in range(len(ohlc)):

if i < period:

k_[i] = 0

d_[i] = 0

else:

k_[i] = (2/3)*k_[i-1] + (1/3)*rsv[i]

d_[i] = (2/3)*d_[i-1] + (1/3)*k_[i]

j_ = 3*k_ - 2*d_

return pd.DataFrame(data={'K': k_, 'D': d_, 'J': j_}, index=ohlc.index)

def cal_kdj2(ohlc: pd.DataFrame, period: int = 14, m1: int = 3, m2: int = 3) -> pd.DataFrame:

"""

KDJ

reference:

- https://www.futunn.com/en/learn/detail-what-is-kdj-64858-0

- https://github.com/mpquant/MyTT/blob/ea4f14857ecc46a3739a75ce2e6974b9057a6102/MyTT.py#L145

"""

ohlc = ohlc.copy(deep=True)

ohlc.columns = [c.lower() for c in ohlc.columns]

highest_high = ohlc["high"].rolling(center=False, window=period).max()

lowest_low = ohlc["low"].rolling(center=False, window=period).min()

rsv = (ohlc["close"] - lowest_low) / (highest_high - lowest_low) * 100

k_ = rsv.ewm(span=m1*2-1, adjust=False).mean()

d_ = k_.ewm(span=m2*2-1, adjust=False).mean()

j_ = 3*k_ - 2*d_

return pd.DataFrame(data={'K': k_, 'D': d_, 'J': j_})

Calculate KDJ

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_kdjdf_ta = cal_kdj(df, period = 14) df = df.merge(df_ta, left_index = True, right_index = True, how=’inner’ )

del df_ta gc.collect()

cal_kdj2

<function __main__.cal_kdj2(ohlc: pandas.core.frame.DataFrame, period: int = 14, m1: int = 3, m2: int = 3) -> pandas.core.frame.DataFrame>

df_ta = cal_kdj2(df, period = 14, m1 = 3, m2 = 3)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

143

df_ta = cal_kdj2(df, period = 9, m1 = 5, m2 = 3) df = df.merge(df_ta, left_index = True, right_index = True, how=’inner’ )

del df_ta gc.collect()

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | K | D | J | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 1999-12-31 | 19.60 | 19.67 | 19.52 | 19.56 | 139400 | NaN | NaN | NaN |

| 2000-01-03 | 19.58 | 19.71 | 19.25 | 19.45 | 556100 | NaN | NaN | NaN |

| 2000-01-04 | 19.45 | 19.45 | 18.90 | 18.95 | 367200 | NaN | NaN | NaN |

| 2000-01-05 | 19.21 | 19.58 | 19.08 | 19.58 | 481700 | NaN | NaN | NaN |

| 2000-01-06 | 19.38 | 19.43 | 18.90 | 19.30 | 853800 | NaN | NaN | NaN |

| Open | High | Low | Close | Volume | K | D | J | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 2022-09-02 | 31.60 | 31.97 | 31.47 | 31.85 | 8152600 | 4.883618 | 3.605564 | 7.439726 |

| 2022-09-06 | 31.65 | 31.76 | 31.37 | 31.47 | 5613900 | 4.287737 | 3.832955 | 5.197301 |

| 2022-09-07 | 31.21 | 31.59 | 31.16 | 31.49 | 4822000 | 6.056166 | 4.574025 | 9.020447 |

| 2022-09-08 | 30.91 | 31.54 | 30.83 | 31.51 | 6620900 | 10.230522 | 6.459524 | 17.772518 |

| 2022-09-09 | 31.95 | 31.97 | 31.73 | 31.89 | 3556800 | 17.151732 | 10.023594 | 31.408009 |

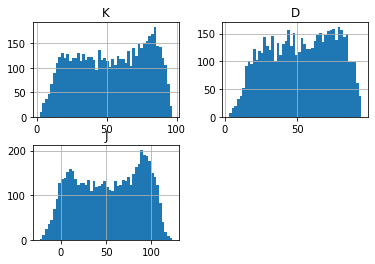

df[['K', 'D', 'J']].hist(bins=50)

array([[<AxesSubplot:title={'center':'K'}>,

<AxesSubplot:title={'center':'D'}>],

[<AxesSubplot:title={'center':'J'}>, <AxesSubplot:>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9), fill_weights = (0, 0)):

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2,1), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = {

'K': mpf.make_addplot(mid_panel['K'], panel=1, color='orange', width=1, secondary_y=False),

'D': mpf.make_addplot(mid_panel['D'], panel=1, color='dodgerblue', width=1, secondary_y=False),

'J': mpf.make_addplot(mid_panel['J'], panel=1, color='darkviolet', width=1, secondary_y=False),

}

fb_bbands2_ = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),

y2=fill_weights[1]*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands2_['panel'] = 1

fb_bbands= [fb_bbands2_]

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands

)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1375)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

axes[2].set_ylabel('KDJ')

axes[2].legend([None]*3)

handles = axes[2].get_legend().legendHandles

axes[2].legend(handles=handles,labels=list(added_plots.keys()))

return fig, axes

start = -200

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'KDJ: an overbought signal occurs when the D value is more than 70 and an oversell signal occurs when the D value is less than 30'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['K', 'D', 'J']],

chart_type='hollow_and_filled',

names = names,

fill_weights = (30, 70)

)