Commodity Channel Index (CCI)

References

Definition

- The Commodity Channel Index (CCI) is a momentum oscillator

- primarily to identify overbought and oversold levels by measuring an instrument’s variations away from its statistical mean.

- CCI is often used to find reversals and divergences.

Calculation

A typical 20 Period CCI as example:

CCI = (Typical Price - 20 Period SMA of TP) / (.015 x Mean Deviation)

- Typical Price (TP) = (High + Low + Close)/3

- Constant = .015

- The Constant is set at .015 for scaling purposes.

- By including the constant, the majority of CCI values will fall within the 100 to -100 range.

- There are three steps to calculating the Mean Deviation.

- step 1: Subtract the most recent 20 Period Simple Moving from each typical price (TP) for the Period.

- step 2: Sum absolute value of numbers from

step 1. - step 3: Divide the value generated in

step 2by the total number of Periods (20 in this case).

Read the indicator

- The Commodity Channel Index indicator takes a security’s change in price and compares that to its average change in price.

- CCI’s calculation produces positive and negative values that oscillate above and below a Zero Line.

- Typically a value of 100 is identified as overbought and a reading of -100 is identified as being oversold. However,

- Actual overbought and oversold thresholds can vary depending on the financial instrument being traded. For example, a more volatile instrument may have thresholds at 200 and -200.

- when using CCI, overbought and oversold conditions can often be a sign of strength, meaning the current trend may be strengthening and continuing.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'NVO', 'AROC', 'GKOS']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-08-27 18:32:21.399573 ^GSPC (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 18:32:21.790691 GSK (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 18:32:22.131409 NVO (5701, 7) 1999-12-31 00:00:00 2022-08-26 00:00:00

2022-08-27 18:32:22.407223 AROC (3782, 7) 2007-08-21 00:00:00 2022-08-26 00:00:00

2022-08-27 18:32:22.650068 GKOS (1807, 7) 2015-06-25 00:00:00 2022-08-26 00:00:00

ticker = 'GKOS'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-22 | 49.290001 | 50.110001 | 48.810001 | 49.049999 | 243200 | 0 | 0 |

| 2022-08-23 | 49.509998 | 49.759998 | 48.439999 | 49.410000 | 260300 | 0 | 0 |

| 2022-08-24 | 50.290001 | 52.680000 | 49.269001 | 52.000000 | 628200 | 0 | 0 |

| 2022-08-25 | 52.820000 | 52.840000 | 52.040001 | 52.590000 | 349400 | 0 | 0 |

| 2022-08-26 | 52.310001 | 52.580002 | 49.480000 | 49.889999 | 550400 | 0 | 0 |

Define CCI calculation function

#https://github.com/peerchemist/finta/blob/af01fa594995de78f5ada5c336e61cd87c46b151/finta/finta.py

#https://www.tradingview.com/support/solutions/43000502001-commodity-channel-index-cci/

def cal_cci(ohlc: pd.DataFrame, period: int = 20, constant: float = 0.015) -> pd.Series:

"""

Commodity Channel Index (CCI) is a versatile indicator that can be used to identify a new trend or warn of extreme conditions.

CCI measures the current price level relative to an average price level over a given period of time.

The CCI typically oscillates above and below a zero line. Normal oscillations will occur within the range of +100 and −100.

Readings above +100 imply an overbought condition, while readings below −100 imply an oversold condition.

As with other overbought/oversold indicators, this means that there is a large probability that the price will correct to more representative levels.

source: https://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:commodity_channel_index_cci

:param pd.DataFrame ohlc: 'open, high, low, close' pandas DataFrame

:period: int - number of periods to take into consideration

:factor float: the constant at .015 to ensure that approximately 70 to 80 percent of CCI values would fall between -100 and +100.

:return pd.Series: result is pandas.Series

"""

ohlc = ohlc.copy()

ohlc.columns = [c.lower() for c in ohlc.columns]

tp = pd.Series((ohlc["high"] + ohlc["low"] + ohlc["close"]) / 3, name="TP")

tp_rolling = tp.rolling(window=period, min_periods=0)

# calculate MAD (Mean Deviation)

# https://www.khanacademy.org/math/statistics-probability/summarizing-quantitative-data/other-measures-of-spread/a/mean-absolute-deviation-mad-review

mad = tp_rolling.apply(lambda s: abs(s - s.mean()).mean(), raw=True)

cci = (tp - tp_rolling.mean()) / (constant * mad)

return pd.Series(cci, name=f"CCI{period}")

Calculate CCI

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_cci

<function __main__.cal_cci(ohlc: pandas.core.frame.DataFrame, period: int = 20, constant: float = 0.015) -> pandas.core.series.Series>

df_ta = cal_cci(df, period = 20)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

41288

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | CCI20 | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2015-06-25 | 29.11 | 31.95 | 28.00 | 31.22 | 7554700 | NaN |

| 2015-06-26 | 30.39 | 30.39 | 27.51 | 28.00 | 1116500 | -66.666667 |

| 2015-06-29 | 27.70 | 28.48 | 27.51 | 28.00 | 386900 | -73.012048 |

| 2015-06-30 | 27.39 | 29.89 | 27.39 | 28.98 | 223900 | -17.511521 |

| 2015-07-01 | 28.83 | 29.00 | 27.87 | 28.00 | 150000 | -55.226824 |

| Open | High | Low | Close | Volume | CCI20 | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2022-08-22 | 49.29 | 50.11 | 48.81 | 49.05 | 243200 | -138.051710 |

| 2022-08-23 | 49.51 | 49.76 | 48.44 | 49.41 | 260300 | -130.773177 |

| 2022-08-24 | 50.29 | 52.68 | 49.27 | 52.00 | 628200 | -18.327666 |

| 2022-08-25 | 52.82 | 52.84 | 52.04 | 52.59 | 349400 | 46.610856 |

| 2022-08-26 | 52.31 | 52.58 | 49.48 | 49.89 | 550400 | -47.302901 |

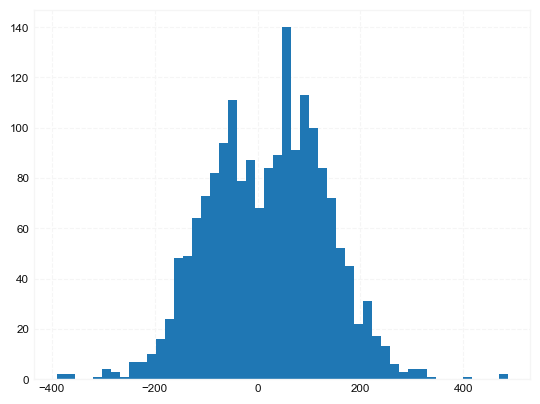

df['CCI20'].hist(bins=50)

<AxesSubplot:>

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, mid_panel, chart_type='candle', names=None,

figratio=(14,9), fill_weights = (0, 0)):

"""

main chart type: default is candle. alternatives: ohlc, line

example:

start = 200

names = {'main_title': 'MAMA: MESA Adaptive Moving Average',

'sub_tile': 'S&P 500 (^GSPC)', 'y_tiles': ['price', 'Volume [$10^{6}$]']}

make_candle(df.iloc[-start:, :5], df.iloc[-start:][['MAMA', 'FAMA']], names = names)

"""

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2,1), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = { }

fb_bbands2_ = dict(y1=fill_weights[0]*np.ones(mid_panel.shape[0]),

y2=fill_weights[1]*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands2_['panel'] = 1

fb_bbands= [fb_bbands2_]

i = 0

for name_, data_ in mid_panel.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=1, color=all_colors[i])

i = i + 1

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

axes[2].set_ylabel('CCI')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

start = -300

end = -200#df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'CCI: reading above 100 could be overbought;reading below -100 could be oversold'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['CCI20']],

chart_type='hollow_and_filled',names = names,

fill_weights = (-120, 120))