Moving average bands (MAB) and moving average band width (MABW)

References

█ OVERVIEW

In "Moving Average Bands" (part 1, July 2021 issue) and "Moving Average Band Width" (part 2, August 2021 issue), author Vitali Apirine explains how moving average bands (MAB) can be used as a trend-following indicator by displaying the movement of a shorter-term moving average in relation to the movement of a longer-term moving average. The distance between the bands will widen as volatility increases and will narrow as volatility decreases.

In part 2, the moving average band width (MABW) measures the percentage difference between the bands. Changes in this difference may indicate a forthcoming move or change in the trend.

█ STRATEGY

- Rules 1:

- Enter when the 10-day moving average (EMA) breaks above the upper MA band

- Exit when the EMA crosses below the lower MA band

- Rules 2:

- Enter when the 10-day moving average (EMA) breaks above the upper MA band, preceded by the moving average band width (MABW) making a 20-day lowest low at least once within the last 10 days

- Exit on a trailing stop of 3 ATRs (14-day) from the trade's highest point

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

Download data

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#CBOE Volatility Index (^VIX) Chicago Options - Chicago Options Delayed Price. Currency in USD

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC', '^VIX']

tickers = benchmark_tickers + ['GSK', 'BST', 'PFE']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-10 10:27:39.606085 ^GSPC (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 10:27:39.817370 ^VIX (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 10:27:40.192326 GSK (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 10:27:40.423825 BST (1980, 7) 2014-10-29 00:00:00 2022-09-09 00:00:00

2022-09-10 10:27:40.759307 PFE (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

ticker = 'GSK'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-09-02 | 31.600000 | 31.969999 | 31.469999 | 31.850000 | 8152600 | 0.0 | 0.0 |

| 2022-09-06 | 31.650000 | 31.760000 | 31.370001 | 31.469999 | 5613900 | 0.0 | 0.0 |

| 2022-09-07 | 31.209999 | 31.590000 | 31.160000 | 31.490000 | 4822000 | 0.0 | 0.0 |

| 2022-09-08 | 30.910000 | 31.540001 | 30.830000 | 31.510000 | 6620900 | 0.0 | 0.0 |

| 2022-09-09 | 31.950001 | 31.969999 | 31.730000 | 31.889999 | 3556800 | 0.0 | 0.0 |

Calculate

from core.finta import TA

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

TA.MABW

<function core.finta.TA.MABW(ohlc: pandas.core.frame.DataFrame, fast_period: int = 10, slow_period: int = 50, multiplier: float = 1.0, column: str = 'close', adjust: bool = True) -> pandas.core.frame.DataFrame>

df_ta = TA.MABW(df, fast_period = 10, slow_period = 50, multiplier = 1.0)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

24915

df_ta = TA.EMA(df, period = 20, column="close")

df_ta.name='EMA'

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

21

- Rules 1:

- Enter when the 10-day moving average (EMA) breaks above the upper MA band

- Exit when the EMA crosses below the lower MA band

- Rules 2:

- Enter when the 10-day moving average (EMA) breaks above the upper MA band, preceded by the moving average band width (MABW) making a 20-day lowest low at least once within the last 10 days

- Exit on a trailing stop of 3 ATRs (14-day) from the trade's highest point

df['SIGNAL'] = ((df['EMA']>=df['MAB_UPPER']) & (df['EMA'].shift(1)<df['MAB_UPPER'].shift(1))).astype(int)

df['B'] = df['SIGNAL']*(df["High"] + df["Low"])/2

df['SIGNAL'].value_counts()

0 5675

1 35

Name: SIGNAL, dtype: int64

df['MAB_WIDTH'].rolling(20).min()

Date

1999-12-31 NaN

2000-01-03 NaN

2000-01-04 NaN

2000-01-05 NaN

2000-01-06 NaN

...

2022-09-02 3.225288

2022-09-06 3.608219

2022-09-07 4.284088

2022-09-08 5.417958

2022-09-09 6.731750

Name: MAB_WIDTH, Length: 5710, dtype: float64

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | MAB_UPPER | MAB_MIDDLE | MAB_LOWER | MAB_WIDTH | MAB_LLV | EMA | SIGNAL | B | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||

| 1999-12-31 | 19.60 | 19.67 | 19.52 | 19.56 | 139400 | NaN | 19.560000 | NaN | NaN | NaN | 19.560000 | 0 | 0.0 |

| 2000-01-03 | 19.58 | 19.71 | 19.25 | 19.45 | 556100 | NaN | 19.499500 | NaN | NaN | NaN | 19.502250 | 0 | 0.0 |

| 2000-01-04 | 19.45 | 19.45 | 18.90 | 18.95 | 367200 | NaN | 19.278605 | NaN | NaN | NaN | 19.299467 | 0 | 0.0 |

| 2000-01-05 | 19.21 | 19.58 | 19.08 | 19.58 | 481700 | NaN | 19.377901 | NaN | NaN | NaN | 19.380453 | 0 | 0.0 |

| 2000-01-06 | 19.38 | 19.43 | 18.90 | 19.30 | 853800 | NaN | 19.355538 | NaN | NaN | NaN | 19.360992 | 0 | 0.0 |

| Open | High | Low | Close | Volume | MAB_UPPER | MAB_MIDDLE | MAB_LOWER | MAB_WIDTH | MAB_LLV | EMA | SIGNAL | B | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||

| 2022-09-02 | 31.60 | 31.97 | 31.47 | 31.85 | 8152600 | 41.981303 | 33.059733 | 33.259197 | 23.184605 | 1.291809 | 34.599350 | 0 | 0.0 |

| 2022-09-06 | 31.65 | 31.76 | 31.37 | 31.47 | 5613900 | 41.787135 | 32.770690 | 32.970993 | 23.585774 | 1.291809 | 34.301317 | 0 | 0.0 |

| 2022-09-07 | 31.21 | 31.59 | 31.16 | 31.49 | 4822000 | 41.593738 | 32.537838 | 32.702503 | 23.934548 | 1.291809 | 34.033572 | 0 | 0.0 |

| 2022-09-08 | 30.91 | 31.54 | 30.83 | 31.51 | 6620900 | 41.399202 | 32.350958 | 32.454833 | 24.221746 | 1.291809 | 33.793232 | 0 | 0.0 |

| 2022-09-09 | 31.95 | 31.97 | 31.73 | 31.89 | 3556800 | 41.216672 | 32.267147 | 32.242303 | 24.433689 | 1.291809 | 33.611972 | 0 | 0.0 |

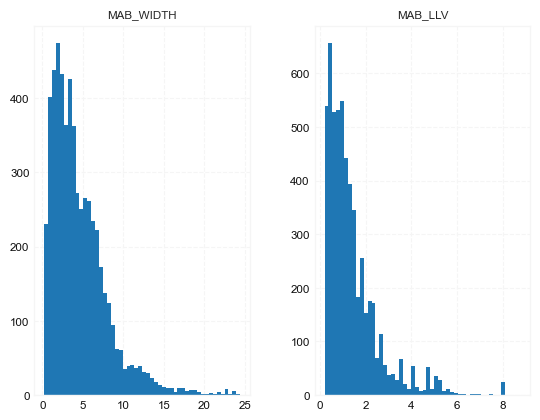

df[['MAB_WIDTH', 'MAB_LLV']].hist(bins=50)

array([[<AxesSubplot:title={'center':'MAB_WIDTH'}>,

<AxesSubplot:title={'center':'MAB_LLV'}>]], dtype=object)

from core.visuals import *

start = -1000

end = df.shape[0]

df_sub = df.iloc[start:end]

# df_sub = df[(df.index<='2019-04-01') & (df.index>='2019-01-24')]

names = {'main_title': f'{ticker}'}

lines0 = basic_lines(df_sub[['MAB_UPPER', 'EMA', 'MAB_LOWER']],

colors = [],

**dict(panel=0, width=1.5, secondary_y=False))

lines1 = basic_lines(df_sub[['MAB_WIDTH', 'MAB_LLV']],

colors = ['cadetblue'],

**dict(panel=1, width=1))

lines2 = basic_lines(df_sub[[ 'B']],

colors = ['navy'],

**dict(panel=0, type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False))

lines_ = dict(**lines0, **lines1)

lines_.update(lines2)

#shadows_ = basic_shadows(bands=[-0.01, 0.01], nsamples=df.iloc[start:end].shape[0], **dict(panel=1, color="lightskyblue",alpha=0.1,interpolate=True))

shadows_ = []

fig_config_ = dict(figratio=(18,10), volume=True, volume_panel=2,panel_ratios=(4,2, 2), tight_layout=True, returnfig=True,)

ax_cfg_ = {0:dict(basic=[5, 2, ['MAB_UPPER', 'EMA', 'MAB_LOWER']],

title=dict(label = 'MA', fontsize=9, style='italic', loc='left'),

),

2:dict(basic=[2, 0, ['MAB_WIDTH', 'MAB_LLV']]

),

}

names = {'main_title': f'{ticker}'}

aa_, bb_ = make_panels(main_data = df_sub[['Open', 'High', 'Low', 'Close', 'Volume']],

added_plots = lines_,

fill_betweens = shadows_,

fig_config = fig_config_,

axes_config = ax_cfg_,

names = names)