Detecting High-Volume Breakouts: volume positive negative (VPN)

References

█ OVERVIEW

For this month's Traders' Tips, the focus is Markos Katsanos' article in this issue, "Detecting High-Volume Breakouts." Here, we present the April 2021 Traders' Tips code with possible implementations in various software.

In his article in this issue, "Detecting High-Volume Breakouts," author Markos Katsanos introduces an indicator called volume positive negative (VPN) that attempts to minimize entries in false breakouts. The indicator compares volume on "up" days versus the volume on "down" days and is normalized to oscillate between 100 and -100.

█ STRATEGY

The trading strategy:

setups:

- calculate VPN using period = 30, ema_period = 3

-

calculate RSI using close price and period = 5

- BUY at the next day open when:

- VPN > 10 AND

- RSI < max RSI AND

- close > average of close in period =

- SELL at the next day open when:

- VPN crosses under MA_VPN AND

- Close < Highest( Close, 5 )- 3 * AvgTrueRange( Period )

Strategy: TASC APR 2021 Strategy

// TASC APR 2021

// Detecting High-Volume Breakouts

// Markos Katsanos

inputs:

Period( 30 ),

Smooth( 3 ),

VPNCrit( 10 ),

MAB( 30 ),

RSILen( 5 ),

MinC( 1 ),

MinVol( 100000 ),

MinVolAvgLen( 5 ),

VolAvgLen( 50 ),

MinVC( 0.5 ),

BarToExitOn( 15 ),

VolDivisor( 1000000 ),

RSIMaxVal( 90 );

variables:

VPN( 0 ),

MAVPN( 0 ),

RSIVal( 0 ),

LQD( false ),

BuyCond1( false );

VPN = XAverage( _TASC_2021_APR_Fx( Period ), Smooth );

MAVPN = Average( VPN, MAB );

RSIVal = RSI( Close, RSILen );

switch ( BarType )

begin

case 2,3,4: { Daily, Weekly, or Monthly bars }

// Price, Volume and Liquidity Filter

LQD = Close > MinC

and Average( Volume, MinVolAvgLen ) > MinVol

and Average( Close * Volume, MinVolAvgLen )

/ VolDivisor > MinVC;

// buy conditions

BuyCond1 = LQD and

Average( Volume, VolAvgLen ) >

Average( Volume, VolAvgLen )[50];

default: { all other bars }

// Price, Volume and Liquidity Filter

LQD = Close > MinC

and Average( Ticks, MinVolAvgLen ) > MinVol

and Average( Close * Ticks, MinVolAvgLen )

/ VolDivisor > MinVC;

// buy conditions

BuyCond1 = LQD and

Average( Ticks, VolAvgLen ) >

Average( Ticks, VolAvgLen )[50];

end;

// buy

if BuyCond1

and VPN crosses above VPNCrit

and RSIVal < RSIMaxVal

and Close > Average( Close, Period ) then

begin

Buy next bar market;

end;

// sell

if VPN crosses under MAVPN

and Close < Highest( Close, 5 )

- 3 * AvgTrueRange( Period ) then

begin

Sell next bar at market;

end;

// time exit

if BarsSinceEntry = BarToExitOn then

Sell ( "Time LX" ) next bar at market; ---

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

Download data

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#CBOE Volatility Index (^VIX) Chicago Options - Chicago Options Delayed Price. Currency in USD

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC', '^VIX']

tickers = benchmark_tickers + ['GSK', 'BST', 'PFE']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-10 20:13:22.879724 ^GSPC (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 20:13:23.187752 ^VIX (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 20:13:23.452504 GSK (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 20:13:23.567257 BST (1980, 7) 2014-10-29 00:00:00 2022-09-09 00:00:00

2022-09-10 20:13:23.813840 PFE (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

ticker = 'GSK'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-09-02 | 31.600000 | 31.969999 | 31.469999 | 31.850000 | 8152600 | 0.0 | 0.0 |

| 2022-09-06 | 31.650000 | 31.760000 | 31.370001 | 31.469999 | 5613900 | 0.0 | 0.0 |

| 2022-09-07 | 31.209999 | 31.590000 | 31.160000 | 31.490000 | 4822000 | 0.0 | 0.0 |

| 2022-09-08 | 30.910000 | 31.540001 | 30.830000 | 31.510000 | 6620900 | 0.0 | 0.0 |

| 2022-09-09 | 31.950001 | 31.969999 | 31.730000 | 31.889999 | 3556800 | 0.0 | 0.0 |

Calculate volume positive negative (VPN)

from core.finta import TA

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

df_ta = TA.VPN(df, period=30, ema_period=5, mav_period=10)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

59

df['RSI'] = TA.RSI(df, period = 5, column='close')

df['SMA'] = TA.SMA(df, period = 30, column='close')

df['EMA'] = TA.SMA(df, period = 9, column='close')

#entry1

# 30-period VPN crosses over 10 AND 5-period RSI < 90 AND close > 30-period SMA

df['SIGNAL'] = ((df['VPN']>10) & (df['VPN'].shift(1)<=10) & (df['RSI']<90) & (df["Close"]>df["SMA"])).astype(int)

df['B'] = df['SIGNAL']*(df["High"] + df["Low"])/2

df['SIGNAL'].value_counts()

0 5636

1 74

Name: SIGNAL, dtype: int64

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | VPN | MA_VPN | RSI | SMA | EMA | SIGNAL | B | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 1999-12-31 | 19.60 | 19.67 | 19.52 | 19.56 | 139400 | NaN | NaN | NaN | NaN | NaN | 0 | 0.0 |

| 2000-01-03 | 19.58 | 19.71 | 19.25 | 19.45 | 556100 | NaN | NaN | 0.000000 | NaN | NaN | 0 | 0.0 |

| 2000-01-04 | 19.45 | 19.45 | 18.90 | 18.95 | 367200 | NaN | NaN | 0.000000 | NaN | NaN | 0 | 0.0 |

| 2000-01-05 | 19.21 | 19.58 | 19.08 | 19.58 | 481700 | NaN | NaN | 57.251908 | NaN | NaN | 0 | 0.0 |

| 2000-01-06 | 19.38 | 19.43 | 18.90 | 19.30 | 853800 | NaN | NaN | 43.436293 | NaN | NaN | 0 | 0.0 |

| Open | High | Low | Close | Volume | VPN | MA_VPN | RSI | SMA | EMA | SIGNAL | B | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 2022-09-02 | 31.60 | 31.97 | 31.47 | 31.85 | 8152600 | -50.125580 | -47.664866 | 13.537814 | 36.800667 | 32.918889 | 0 | 0.0 |

| 2022-09-06 | 31.65 | 31.76 | 31.37 | 31.47 | 5613900 | -51.498332 | -48.032324 | 10.729787 | 36.460333 | 32.667778 | 0 | 0.0 |

| 2022-09-07 | 31.21 | 31.59 | 31.16 | 31.49 | 4822000 | -53.880278 | -48.631443 | 11.931579 | 36.108667 | 32.441111 | 0 | 0.0 |

| 2022-09-08 | 30.91 | 31.54 | 30.83 | 31.51 | 6620900 | -56.951026 | -49.569456 | 13.389069 | 35.724000 | 32.194444 | 0 | 0.0 |

| 2022-09-09 | 31.95 | 31.97 | 31.73 | 31.89 | 3556800 | -57.834300 | -50.835813 | 37.826446 | 35.372000 | 32.050000 | 0 | 0.0 |

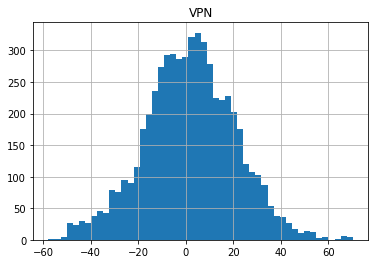

df[['VPN']].hist(bins=50)

array([[<AxesSubplot:title={'center':'VPN'}>]], dtype=object)

from core.visuals import *

start = -350

end = df.shape[0]

df_sub = df.iloc[start:end]

# df_sub = df[(df.index<='2019-04-01') & (df.index>='2019-01-24')]

names = {'main_title': f'{ticker}'}

lines0 = basic_lines(df_sub[['SMA', 'EMA']],

colors = [],

**dict(panel=0, width=1.5, secondary_y=False))

lines1 = basic_lines(df_sub[['RSI']],

colors = ['cadetblue'],

**dict(panel=1, width=1))

lines3 = basic_lines(df_sub[['VPN', 'MA_VPN']],

colors = ['cadetblue', 'lightcoral'],

**dict(panel=2, width=1))

lines2 = basic_lines(df_sub[[ 'B']],

colors = ['navy'],

**dict(panel=0, type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False))

lines_ = dict(**lines0, **lines1)

lines_.update(lines2)

lines_.update(lines3)

shadows_ = basic_shadows(bands=[30, 70], nsamples=df_sub.shape[0], **dict(panel=1, color="lightskyblue",alpha=0.1,interpolate=True))

#shadows_ = []

fig_config_ = dict(figratio=(18,10), volume=False, volume_panel=2,panel_ratios=(4,2, 2), tight_layout=True, returnfig=True,)

ax_cfg_ = {0:dict(basic=[4, 2, ['SMA', 'EMA']],

title=dict(label = 'SMA', fontsize=9, style='italic', loc='left'),

),

2:dict(basic=[1, 0, ['RSI']]

),

4:dict(basic=[2, 0, ['VPN', 'MA_VPN']]

),

}

names = {'main_title': f'{ticker}'}

aa_, bb_ = make_panels(main_data = df_sub[['Open', 'High', 'Low', 'Close', 'Volume']],

added_plots = lines_,

fill_betweens = shadows_,

fig_config = fig_config_,

axes_config = ax_cfg_,

names = names)

Simulate

TRADE_CONFIG = dict(INIT_CAPITAL = 10000 ,

MIN_TRADE_SIZE = 100 ,

MAX_TRADE_SIZE = 1000 ,

HOLD_DAYS = 40, #max hold days

STOP_LOSS = 0.085, #10% drop

KEEP_PROFIT = 0.065,

MAX_OPEN = 1, #allow only 1 open position

COST = 0.0035,

)

Entry 1:

30-period VPN crosses over 10 AND 5-period RSI < 90 AND close > 30-period SMA

df['SIGNAL'].value_counts()

0 5636

1 74

Name: SIGNAL, dtype: int64

trades = []

for i in range(df.shape[0]-5):

row = df.iloc[i]

if row['SIGNAL']>0:

print('enter: ', i)

row_j = df.iloc[i+1]

item = dict(signal_date = row.name,

enter_date = row_j.name,

enter_price = row_j['High']

)

for j in range(i+2, min(i+TRADE_CONFIG['HOLD_DAYS'], df.shape[0])):

row_j = df.iloc[j]

price_ = row_j['Low']

pct_chg = price_/item['enter_price']

if (pct_chg<= (1 - TRADE_CONFIG['STOP_LOSS'])) | (pct_chg >= (1 + TRADE_CONFIG['KEEP_PROFIT'])):

break

item['exit_date'] = row_j.name

item['exit_price'] = price_

item['hold_days'] = j - i

i = j

print('exit:', i)

trades.append(item)

enter: 209

exit: 236

enter: 287

exit: 302

enter: 330

exit: 369

enter: 370

exit: 409

enter: 441

exit: 476

enter: 460

exit: 477

enter: 827

exit: 837

enter: 860

exit: 886

enter: 870

exit: 883

enter: 917

exit: 931

enter: 1081

exit: 1120

enter: 1185

exit: 1224

enter: 1226

exit: 1265

enter: 1342

exit: 1381

enter: 1364

exit: 1403

enter: 1425

exit: 1464

enter: 1512

exit: 1551

enter: 1538

exit: 1577

enter: 1551

exit: 1589

enter: 1591

exit: 1630

enter: 1771

exit: 1810

enter: 1933

exit: 1972

enter: 1945

exit: 1982

enter: 2016

exit: 2024

enter: 2088

exit: 2127

enter: 2134

exit: 2141

enter: 2265

exit: 2276

enter: 2336

exit: 2358

enter: 2345

exit: 2359

enter: 2446

exit: 2484

enter: 2504

exit: 2534

enter: 2569

exit: 2601

enter: 2583

exit: 2601

enter: 2648

exit: 2687

enter: 2666

exit: 2695

enter: 2688

exit: 2727

enter: 2971

exit: 3010

enter: 3023

exit: 3062

enter: 3097

exit: 3136

enter: 3100

exit: 3139

enter: 3104

exit: 3143

enter: 3277

exit: 3316

enter: 3285

exit: 3324

enter: 3297

exit: 3336

enter: 3385

exit: 3424

enter: 3421

exit: 3460

enter: 3480

exit: 3519

enter: 3534

exit: 3573

enter: 3555

exit: 3587

enter: 3614

exit: 3653

enter: 3751

exit: 3761

enter: 3790

exit: 3826

enter: 3919

exit: 3935

enter: 3971

exit: 4010

enter: 3986

exit: 4025

enter: 3990

exit: 4029

enter: 4098

exit: 4137

enter: 4161

exit: 4200

enter: 4303

exit: 4335

enter: 4461

exit: 4484

enter: 4528

exit: 4567

enter: 4587

exit: 4626

enter: 4634

exit: 4673

enter: 4637

exit: 4676

enter: 4787

exit: 4826

enter: 4791

exit: 4830

enter: 4923

exit: 4962

enter: 5112

exit: 5151

enter: 5270

exit: 5309

enter: 5375

exit: 5414

enter: 5390

exit: 5429

enter: 5435

exit: 5474

enter: 5491

exit: 5530

enter: 5601

exit: 5640

df_trades = pd.DataFrame(data = trades)

df_trades.shape

(74, 6)

def cal_pnl(trade):

shares = int(TRADE_CONFIG['INIT_CAPITAL']/trade['enter_price'])

if shares < TRADE_CONFIG['MIN_TRADE_SIZE']:

shares = 0

elif shares > TRADE_CONFIG['MAX_TRADE_SIZE']:

shares = TRADE_CONFIG['MAX_TRADE_SIZE']

pnl = shares*(trade['exit_price'] - trade['enter_price']) - shares*trade['enter_price']*TRADE_CONFIG['COST']

return pnl

df_trades['pnl'] = df_trades.apply(lambda x: cal_pnl(x), axis=1)

df_trades['pnl'].sum(), (df_trades['pnl']>0).mean()

(-14886.980070000005, 0.44594594594594594)

df_trades

| signal_date | enter_date | enter_price | exit_date | exit_price | hold_days | pnl | |

|---|---|---|---|---|---|---|---|

| 0 | 2000-10-27 | 2000-10-30 | 21.62 | 2000-12-06 | 19.58 | 27 | -977.439540 |

| 1 | 2001-02-21 | 2001-02-22 | 20.67 | 2001-03-14 | 18.56 | 15 | -1054.072635 |

| 2 | 2001-04-24 | 2001-04-25 | 19.46 | 2001-06-19 | 19.83 | 39 | 154.869570 |

| 3 | 2001-06-20 | 2001-06-21 | 20.81 | 2001-08-15 | 19.98 | 39 | -433.360800 |

| 4 | 2001-10-05 | 2001-10-08 | 20.95 | 2001-11-26 | 18.95 | 35 | -988.976025 |

| 5 | 2001-11-01 | 2001-11-02 | 20.51 | 2001-11-27 | 18.70 | 17 | -916.429295 |

| 6 | 2003-04-21 | 2003-04-22 | 15.59 | 2003-05-05 | 16.82 | 10 | 753.453835 |

| 7 | 2003-06-06 | 2003-06-09 | 16.43 | 2003-07-15 | 14.76 | 26 | -1050.323040 |

| 8 | 2003-06-20 | 2003-06-23 | 16.71 | 2003-07-10 | 15.21 | 13 | -931.974030 |

| 9 | 2003-08-27 | 2003-08-28 | 15.54 | 2003-09-17 | 16.57 | 14 | 627.317230 |

| 10 | 2004-04-22 | 2004-04-23 | 17.03 | 2004-06-18 | 17.35 | 39 | 152.851865 |

| 11 | 2004-09-21 | 2004-09-22 | 17.71 | 2004-11-15 | 18.49 | 39 | 404.960460 |

| 12 | 2004-11-17 | 2004-11-18 | 18.45 | 2005-01-13 | 18.82 | 39 | 165.540350 |

| 13 | 2005-05-05 | 2005-05-06 | 21.26 | 2005-06-30 | 20.40 | 39 | -439.172700 |

| 14 | 2005-06-07 | 2005-06-08 | 21.22 | 2005-08-02 | 20.04 | 39 | -590.761170 |

| 15 | 2005-09-01 | 2005-09-02 | 21.13 | 2005-10-27 | 21.72 | 39 | 244.089285 |

| 16 | 2006-01-06 | 2006-01-09 | 22.66 | 2006-03-06 | 22.38 | 39 | -158.455710 |

| 17 | 2006-02-14 | 2006-02-15 | 22.15 | 2006-04-11 | 22.31 | 39 | 37.196225 |

| 18 | 2006-03-06 | 2006-03-07 | 22.63 | 2006-04-28 | 24.32 | 38 | 710.360595 |

| 19 | 2006-05-02 | 2006-05-03 | 24.64 | 2006-06-27 | 23.03 | 39 | -686.977200 |

| 20 | 2007-01-19 | 2007-01-22 | 24.70 | 2007-03-16 | 24.25 | 39 | -216.725800 |

| 21 | 2007-09-11 | 2007-09-12 | 24.67 | 2007-11-05 | 23.07 | 39 | -682.969725 |

| 22 | 2007-09-27 | 2007-09-28 | 24.17 | 2007-11-19 | 21.93 | 37 | -960.057735 |

| 23 | 2008-01-09 | 2008-01-10 | 24.97 | 2008-01-22 | 21.70 | 8 | -1342.958000 |

| 24 | 2008-04-23 | 2008-04-24 | 20.65 | 2008-06-18 | 20.17 | 39 | -267.301100 |

| 25 | 2008-06-27 | 2008-06-30 | 20.92 | 2008-07-09 | 22.77 | 7 | 849.300840 |

| 26 | 2009-01-05 | 2009-01-06 | 18.31 | 2009-01-21 | 16.26 | 11 | -1154.290410 |

| 27 | 2009-04-17 | 2009-04-20 | 14.91 | 2009-05-19 | 16.07 | 22 | 742.236050 |

| 28 | 2009-04-30 | 2009-05-01 | 15.25 | 2009-05-20 | 16.25 | 14 | 620.039375 |

| 29 | 2009-09-23 | 2009-09-24 | 19.78 | 2009-11-16 | 21.10 | 38 | 631.638850 |

| 30 | 2009-12-15 | 2009-12-16 | 21.93 | 2010-01-29 | 19.75 | 30 | -1026.823525 |

| 31 | 2010-03-22 | 2010-03-23 | 20.09 | 2010-05-06 | 17.33 | 32 | -1406.666555 |

| 32 | 2010-04-12 | 2010-04-13 | 20.35 | 2010-05-06 | 17.33 | 18 | -1517.791475 |

| 33 | 2010-07-14 | 2010-07-15 | 19.45 | 2010-09-08 | 20.61 | 39 | 561.249450 |

| 34 | 2010-08-09 | 2010-08-10 | 19.83 | 2010-09-20 | 21.13 | 29 | 620.219880 |

| 35 | 2010-09-09 | 2010-09-10 | 20.86 | 2010-11-03 | 20.75 | 39 | -87.661790 |

| 36 | 2011-10-21 | 2011-10-24 | 24.92 | 2011-12-16 | 25.24 | 39 | 93.344780 |

| 37 | 2012-01-06 | 2012-01-09 | 25.10 | 2012-03-05 | 25.61 | 39 | 168.015700 |

| 38 | 2012-04-24 | 2012-04-25 | 26.40 | 2012-06-19 | 26.68 | 39 | 70.912800 |

| 39 | 2012-04-27 | 2012-04-30 | 26.75 | 2012-06-22 | 26.63 | 39 | -79.682125 |

| 40 | 2012-05-03 | 2012-05-04 | 26.82 | 2012-06-28 | 25.88 | 39 | -384.599640 |

| 41 | 2013-01-11 | 2013-01-14 | 26.37 | 2013-03-11 | 26.88 | 39 | 158.310195 |

| 42 | 2013-01-24 | 2013-01-25 | 26.79 | 2013-03-21 | 27.70 | 39 | 304.455655 |

| 43 | 2013-02-11 | 2013-02-12 | 27.19 | 2013-04-09 | 28.41 | 39 | 412.814445 |

| 44 | 2013-06-18 | 2013-06-19 | 32.07 | 2013-08-13 | 31.75 | 39 | -134.428195 |

| 45 | 2013-08-08 | 2013-08-09 | 31.98 | 2013-10-03 | 31.29 | 39 | -250.202160 |

| 46 | 2013-10-31 | 2013-11-01 | 32.87 | 2013-12-27 | 32.95 | 39 | -10.653680 |

| 47 | 2014-01-21 | 2014-01-22 | 34.37 | 2014-03-18 | 34.56 | 39 | 20.214450 |

| 48 | 2014-02-20 | 2014-02-21 | 35.64 | 2014-04-07 | 32.55 | 32 | -900.127200 |

| 49 | 2014-05-15 | 2014-05-16 | 35.62 | 2014-07-11 | 34.28 | 39 | -410.107600 |

| 50 | 2014-11-28 | 2014-12-01 | 30.99 | 2014-12-12 | 27.91 | 10 | -1026.685730 |

| 51 | 2015-01-27 | 2015-01-28 | 29.99 | 2015-03-19 | 31.95 | 36 | 617.726655 |

| 52 | 2015-07-31 | 2015-08-03 | 29.56 | 2015-08-24 | 26.98 | 16 | -907.009480 |

| 53 | 2015-10-14 | 2015-10-15 | 28.48 | 2015-12-09 | 27.45 | 39 | -396.517680 |

| 54 | 2015-11-04 | 2015-11-05 | 29.16 | 2015-12-31 | 28.05 | 39 | -414.524520 |

| 55 | 2015-11-10 | 2015-11-11 | 28.75 | 2016-01-07 | 27.07 | 39 | -617.876875 |

| 56 | 2016-04-18 | 2016-04-19 | 31.13 | 2016-06-13 | 29.65 | 39 | -510.054555 |

| 57 | 2016-07-18 | 2016-07-19 | 32.00 | 2016-09-12 | 31.23 | 39 | -275.184000 |

| 58 | 2017-02-08 | 2017-02-09 | 29.99 | 2017-03-27 | 32.03 | 32 | 644.366655 |

| 59 | 2017-09-25 | 2017-09-26 | 31.40 | 2017-10-26 | 28.21 | 23 | -1049.368200 |

| 60 | 2017-12-29 | 2018-01-02 | 28.98 | 2018-02-27 | 29.11 | 39 | 9.856650 |

| 61 | 2018-03-27 | 2018-03-28 | 31.74 | 2018-05-22 | 32.56 | 39 | 223.306650 |

| 62 | 2018-06-04 | 2018-06-05 | 32.79 | 2018-07-30 | 33.01 | 39 | 31.991440 |

| 63 | 2018-06-07 | 2018-06-08 | 33.19 | 2018-08-02 | 32.33 | 39 | -293.825665 |

| 64 | 2019-01-11 | 2019-01-14 | 32.09 | 2019-03-11 | 33.51 | 39 | 406.690035 |

| 65 | 2019-01-17 | 2019-01-18 | 32.46 | 2019-03-15 | 33.88 | 39 | 402.368120 |

| 66 | 2019-07-29 | 2019-07-30 | 35.84 | 2019-09-23 | 36.00 | 39 | 9.642240 |

| 67 | 2020-04-28 | 2020-04-29 | 37.46 | 2020-06-23 | 36.98 | 39 | -162.555260 |

| 68 | 2020-12-10 | 2020-12-11 | 34.59 | 2021-02-08 | 32.11 | 39 | -751.707785 |

| 69 | 2021-05-13 | 2021-05-14 | 36.49 | 2021-07-09 | 37.71 | 39 | 299.286090 |

| 70 | 2021-06-04 | 2021-06-07 | 36.76 | 2021-07-30 | 37.65 | 39 | 207.084480 |

| 71 | 2021-08-09 | 2021-08-10 | 38.41 | 2021-10-04 | 36.48 | 39 | -536.753100 |

| 72 | 2021-10-27 | 2021-10-28 | 40.28 | 2021-12-22 | 41.86 | 39 | 356.876960 |

| 73 | 2022-04-05 | 2022-04-06 | 44.86 | 2022-06-01 | 42.33 | 39 | -596.516220 |

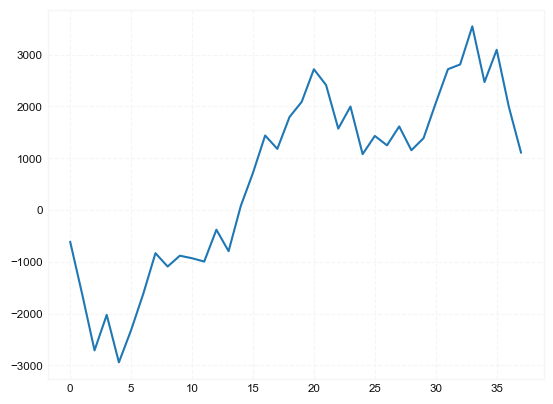

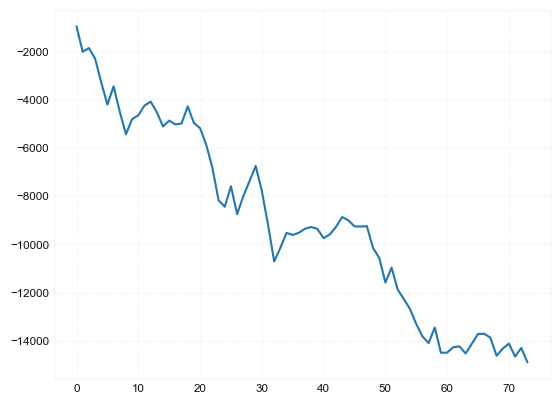

df_trades['pnl'].cumsum().plot()

<AxesSubplot:>

Entry 2:

- BUY when all the following criteria are met

- 30-period SMA above 9-period EMA

- 5-period RSI < 50

- 30-period VPN crosses over 30-period moving average of 30-period VPN

#entry2:

#(df['VPN']>10) & (df['VPN'].shift(1)<=10) &

df['SIGNAL'] = (df['EMA']<df['SMA']) & (df['RSI']<50) & (df['VPN'] >= df['MA_VPN']) & (df['VPN'].shift(1) < df['MA_VPN'].shift(1))

df['B'] = df['SIGNAL']*(df["High"] + df["Low"])/2

df['SIGNAL'].value_counts()

False 5672

True 38

Name: SIGNAL, dtype: int64

trades = []

for i in range(df.shape[0]-5):

row = df.iloc[i]

if row['SIGNAL']>0:

print('enter: ', i)

row_j = df.iloc[i+1]

item = dict(signal_date = row.name,

enter_date = row_j.name,

enter_price = row_j['High']

)

for j in range(i+2, min(i+TRADE_CONFIG['HOLD_DAYS'], df.shape[0])):

row_j = df.iloc[j]

price_ = row_j['Low']

pct_chg = price_/item['enter_price']

if (pct_chg<= (1 - TRADE_CONFIG['STOP_LOSS'])) | (pct_chg >= (1 + TRADE_CONFIG['KEEP_PROFIT'])):

break

item['exit_date'] = row_j.name

item['exit_price'] = price_

item['hold_days'] = j - i

i = j

print('exit:', i)

trades.append(item)

enter: 103

exit: 142

enter: 416

exit: 431

enter: 638

exit: 640

enter: 796

exit: 807

enter: 1039

exit: 1052

enter: 1055

exit: 1077

enter: 1058

exit: 1090

enter: 1161

exit: 1180

enter: 1379

exit: 1418

enter: 1387

exit: 1426

enter: 1492

exit: 1531

enter: 1721

exit: 1760

enter: 1976

exit: 1991

enter: 2041

exit: 2080

enter: 2236

exit: 2247

enter: 2309

exit: 2321

enter: 2621

exit: 2649

enter: 2766

exit: 2805

enter: 2825

exit: 2839

enter: 2931

exit: 2970

enter: 3466

exit: 3496

enter: 3671

exit: 3710

enter: 3862

exit: 3901

enter: 3886

exit: 3925

enter: 3944

exit: 3959

enter: 4037

exit: 4076

enter: 4240

exit: 4279

enter: 4260

exit: 4299

enter: 4417

exit: 4456

enter: 4434

exit: 4473

enter: 4510

exit: 4538

enter: 4767

exit: 4806

enter: 4858

exit: 4897

enter: 5088

exit: 5100

enter: 5222

exit: 5240

enter: 5479

exit: 5493

enter: 5673

exit: 5688

enter: 5699

exit: 5707

df_trades = pd.DataFrame(data = trades)

df_trades.shape

(38, 6)

df_trades['pnl'] = df_trades.apply(lambda x: cal_pnl(x), axis=1)

df_trades['pnl'].sum(), (df_trades['pnl']>0).mean()

(1103.5304500000034, 0.5526315789473685)

df_trades

| signal_date | enter_date | enter_price | exit_date | exit_price | hold_days | pnl | |

|---|---|---|---|---|---|---|---|

| 0 | 2000-05-30 | 2000-05-31 | 20.39 | 2000-07-25 | 19.21 | 39 | -613.168850 |

| 1 | 2001-08-24 | 2001-08-27 | 19.75 | 2001-09-21 | 17.79 | 15 | -1026.737250 |

| 2 | 2002-07-19 | 2002-07-22 | 13.50 | 2002-07-23 | 12.10 | 2 | -1070.965000 |

| 3 | 2003-03-06 | 2003-03-07 | 13.47 | 2003-03-21 | 14.44 | 11 | 684.758410 |

| 4 | 2004-02-23 | 2004-02-24 | 17.48 | 2004-03-11 | 15.94 | 13 | -915.874960 |

| 5 | 2004-03-16 | 2004-03-17 | 15.98 | 2004-04-16 | 17.03 | 22 | 621.293750 |

| 6 | 2004-03-19 | 2004-03-22 | 16.13 | 2004-05-05 | 17.32 | 32 | 701.664355 |

| 7 | 2004-08-17 | 2004-08-18 | 16.23 | 2004-09-14 | 17.56 | 19 | 784.288120 |

| 8 | 2005-06-28 | 2005-06-29 | 20.65 | 2005-08-23 | 20.19 | 39 | -257.621100 |

| 9 | 2005-07-11 | 2005-07-12 | 20.47 | 2005-09-02 | 20.97 | 39 | 209.037240 |

| 10 | 2005-12-07 | 2005-12-08 | 21.77 | 2006-02-03 | 21.74 | 39 | -48.743505 |

| 11 | 2006-11-03 | 2006-11-06 | 23.74 | 2007-01-03 | 23.67 | 39 | -64.450890 |

| 12 | 2007-11-09 | 2007-11-12 | 22.75 | 2007-12-03 | 24.23 | 15 | 614.764625 |

| 13 | 2008-02-14 | 2008-02-15 | 20.57 | 2008-04-11 | 19.79 | 39 | -414.069570 |

| 14 | 2008-11-20 | 2008-11-21 | 15.87 | 2008-12-08 | 17.31 | 11 | 872.206650 |

| 15 | 2009-03-10 | 2009-03-11 | 13.81 | 2009-03-26 | 14.74 | 12 | 638.325460 |

| 16 | 2010-06-04 | 2010-06-07 | 17.82 | 2010-07-15 | 19.17 | 28 | 722.360430 |

| 17 | 2010-12-30 | 2010-12-31 | 21.05 | 2011-02-25 | 20.58 | 39 | -258.245625 |

| 18 | 2011-03-25 | 2011-03-28 | 20.72 | 2011-04-14 | 22.07 | 14 | 615.745360 |

| 19 | 2011-08-25 | 2011-08-26 | 23.49 | 2011-10-20 | 24.26 | 39 | 292.308625 |

| 20 | 2013-10-11 | 2013-10-14 | 31.09 | 2013-11-22 | 33.16 | 30 | 629.540385 |

| 21 | 2014-08-06 | 2014-08-07 | 30.60 | 2014-10-01 | 29.77 | 39 | -305.494600 |

| 22 | 2015-05-11 | 2015-05-12 | 30.32 | 2015-07-07 | 27.87 | 39 | -840.963480 |

| 23 | 2015-06-15 | 2015-06-16 | 29.04 | 2015-08-10 | 30.38 | 39 | 425.995840 |

| 24 | 2015-09-04 | 2015-09-08 | 28.16 | 2015-09-28 | 25.67 | 15 | -918.938800 |

| 25 | 2016-01-20 | 2016-01-21 | 27.34 | 2016-03-16 | 28.40 | 39 | 351.973150 |

| 26 | 2016-11-07 | 2016-11-08 | 29.31 | 2017-01-04 | 28.88 | 39 | -181.611485 |

| 27 | 2016-12-06 | 2016-12-07 | 27.99 | 2017-02-02 | 29.11 | 39 | 364.866495 |

| 28 | 2017-07-24 | 2017-07-25 | 32.21 | 2017-09-18 | 30.84 | 39 | -459.647850 |

| 29 | 2017-08-16 | 2017-08-17 | 30.54 | 2017-10-11 | 31.36 | 39 | 233.186970 |

| 30 | 2017-12-04 | 2017-12-05 | 27.56 | 2018-01-16 | 29.53 | 28 | 678.221480 |

| 31 | 2018-12-12 | 2018-12-13 | 31.53 | 2019-02-08 | 33.70 | 39 | 652.907465 |

| 32 | 2019-04-25 | 2019-04-26 | 33.93 | 2019-06-20 | 34.36 | 39 | 91.506030 |

| 33 | 2020-03-24 | 2020-03-25 | 31.63 | 2020-04-09 | 34.07 | 12 | 736.057220 |

| 34 | 2020-10-02 | 2020-10-05 | 34.11 | 2020-10-28 | 30.56 | 18 | -1075.129805 |

| 35 | 2021-10-11 | 2021-10-12 | 37.48 | 2021-10-29 | 39.95 | 14 | 622.126120 |

| 36 | 2022-07-20 | 2022-07-21 | 41.82 | 2022-08-10 | 37.35 | 15 | -1103.312430 |

| 37 | 2022-08-25 | 2022-08-26 | 34.06 | 2022-09-07 | 31.16 | 8 | -884.628530 |

df_trades['pnl'].cumsum().plot()

<AxesSubplot:>