Adaptive Moving Averages

References

Definition

In "Adaptive Moving Averages" in this issue, author Vitali Apirine introduces an adaptive moving average (AMA) technique based on Perry Kaufman's KAMA (Kaufman adaptive moving average). His update to the original KAMA allows the new method to account for the location of the close relative to the high–low range. The author describes a trading system that combines the AMA and KAMA, suggesting that the combination may reduce the number of whipsaws relative to using either moving average by itself.

█ STRATEGY

if AMA crosses over KAMA then

Buy TradeSize shares next bar at Market

else if AMA crosses under KAMA then

Sell Short TradeSize shares next bar at Market ;

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#CBOE Volatility Index (^VIX) Chicago Options - Chicago Options Delayed Price. Currency in USD

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC', '^VIX']

tickers = benchmark_tickers + ['GSK', 'DAL', 'PFE']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-10 18:29:09.119977 ^GSPC (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 18:29:09.377239 ^VIX (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 18:29:09.603672 GSK (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 18:29:09.786497 DAL (3867, 7) 2007-05-03 00:00:00 2022-09-09 00:00:00

2022-09-10 18:29:10.163955 PFE (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

ticker = 'DAL'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-09-02 | 31.440001 | 31.830000 | 30.700001 | 30.940001 | 8626500 | 0.0 | 0 |

| 2022-09-06 | 31.340000 | 31.650000 | 30.660000 | 31.190001 | 7630800 | 0.0 | 0 |

| 2022-09-07 | 31.290001 | 32.340000 | 31.270000 | 32.230000 | 9035900 | 0.0 | 0 |

| 2022-09-08 | 31.719999 | 32.490002 | 31.549999 | 32.119999 | 11085400 | 0.0 | 0 |

| 2022-09-09 | 32.430000 | 32.759998 | 32.240002 | 32.660000 | 10958900 | 0.0 | 0 |

TradeStation

Indicator: Adaptive Moving Average

// TASC APR 2018

// Adaptive Moving Average

// Indicator

// Vitali Apirine

inputs:

Periods( 10 ),

FastAvgLength( 2 ),

SlowAvgLength( 30 ) ;

variables:

AMA( 0 ),

KAMA( 0 ) ;

AMA = _AMA( Periods, FastAvgLength,

SlowAvgLength ) ;

KAMA = AdaptiveMovAvg( Close, Periods,

FastAvgLength, SlowAvgLength ) ;

Plot1( AMA, "AMA", Cyan ) ;

Plot2( KAMA, "KAMA", Magenta ) ;

if AlertEnabled then

begin

if AMA crosses over KAMA then

Alert( "AMA crossing over KAMA" )

else if AMA crosses under KAMA then

Alert( "AMA crossing under KAMA" ) ;

end ;

Strategy: Adaptive Moving Average

// TASC APR 2018

// Adaptive Moving Average

// Strategy

// Vitali Apirine

inputs:

Periods( 10 ),

FastAvgLength( 2 ),

SlowAvgLength( 30 ),

Capital( 100000 ) ;

variables:

AMA( 0 ),

KAMA( 0 ),

TradeSize( 0 ) ;

AMA = _AMA( Periods, FastAvgLength,

SlowAvgLength ) ;

KAMA = AdaptiveMovAvg( Close, Periods,

FastAvgLength, SlowAvgLength ) ;

TradeSize = MaxList( 1, Capital / Close ) ;

if AMA crosses over KAMA then

Buy TradeSize shares next bar at Market

else if AMA crosses under KAMA then

Sell Short TradeSize shares next bar at Market ;

Function: _AMA

// TASC APR 2018

// _AMA

// Function

// Vitali Apirine

inputs:

Periods( numericsimple ),

FastAvgLength( numericsimple ),

SlowAvgLength( numericsimple ) ;

variables:

PDS( Periods + 1 ),

FastSC( 2 / ( FastAvgLength + 1 ) ),

SlowSC( 2 / ( SlowAvgLength + 1 ) ),

SSC( 0 ),

CST( 0 ),

MLTP( 0 );

MLTP = AbsValue( ( Close - Lowest( Low, PDS ) )

- ( Highest( High, PDS ) - Close ))

/ ( Highest( High, PDS ) - Lowest( Low, PDS ) ) ;

SSC = MLTP * ( FastSC - SlowSC ) + SlowSC ;

CST = Square( SSC ) ;

if CurrentBar = 1 then

_AMA = Close[1] + CST * ( Close - Close[1] )

else

_AMA = _AMA[1] + CST * ( Close - _AMA[1] ) ;

def cal_ama(ohlc: pd.DataFrame,

period: int = 10,

fast_period: int = 2,

slow_period: int = 30,

) -> pd.Series:

"""

ADAPTIVE MOVING AVERAGE. Author: Vitali Apirine, TASC April 2018

source: https://traders.com/documentation/feedbk_docs/2018/04/traderstips.html

created on: 2022-09-10

"""

ohlc = ohlc.copy()

ohlc.columns = [c.lower() for c in ohlc.columns]

highest_high = ohlc["high"].rolling(center=False, window=period).max()

lowest_low = ohlc["low"].rolling(center=False, window=period).min()

close = ohlc["close"]

pds = period + 1

fast_sc = 2/(fast_period + 1)

slow_sc = 2/(slow_period + 1)

mltp = np.abs((close - lowest_low) - (highest_high - close))/(highest_high - lowest_low)

ssc = mltp * (fast_sc - slow_sc) + slow_sc

cst = ssc*ssc

_ama = np.zeros(len(ohlc))

for i in range(len(ohlc)):

if i < period:

_ama[i] = close[i-1] + cst[i] * (close[i] - close[i-1])

else:

_ama[i] = _ama[i-1] + cst[i] * (close[i] - _ama[i-1])

return pd.Series(_ama,index=ohlc.index, name=f"AMA")

Calculate

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_ama

<function __main__.cal_ama(ohlc: pandas.core.frame.DataFrame, period: int = 10, fast_period: int = 2, slow_period: int = 30) -> pandas.core.series.Series>

df['AMA'] = cal_ama(df, period = 10, fast_period = 2, slow_period = 30)

from core.finta import TA

TA.KAMA

<function core.finta.TA.KAMA(ohlc: pandas.core.frame.DataFrame, er_period: int = 10, ema_fast: int = 2, ema_slow: int = 30, period: int = 20, column: str = 'close') -> pandas.core.series.Series>

df['KAMA'] = TA.KAMA(df, er_period = 10, ema_fast = 2, ema_slow=30, period=10, column='close')

#AMA crosses over KAMA

df['SIGNAL'] = ((df['AMA']>=df['KAMA']) & (df['AMA'].shift(1)<df['KAMA'].shift(1))).astype(int)

df['B'] = df['SIGNAL']*(df["High"] + df["Low"])/2

df['SIGNAL'].value_counts()

0 3754

1 113

Name: SIGNAL, dtype: int64

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | AMA | KAMA | SIGNAL | B | |

|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||

| 2007-05-03 | 19.32 | 19.50 | 18.25 | 18.40 | 8052800 | NaN | NaN | 0 | 0.0 |

| 2007-05-04 | 18.88 | 18.96 | 18.39 | 18.64 | 5437300 | NaN | NaN | 0 | 0.0 |

| 2007-05-07 | 18.83 | 18.91 | 17.94 | 18.08 | 2646300 | NaN | NaN | 0 | 0.0 |

| 2007-05-08 | 17.76 | 17.76 | 17.14 | 17.44 | 4166100 | NaN | NaN | 0 | 0.0 |

| 2007-05-09 | 17.54 | 17.94 | 17.44 | 17.58 | 7541100 | NaN | NaN | 0 | 0.0 |

| Open | High | Low | Close | Volume | AMA | KAMA | SIGNAL | B | |

|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||

| 2022-09-02 | 31.44 | 31.83 | 30.70 | 30.94 | 8626500 | 31.657433 | 32.392120 | 0 | 0.0 |

| 2022-09-06 | 31.34 | 31.65 | 30.66 | 31.19 | 7630800 | 31.610105 | 32.339471 | 0 | 0.0 |

| 2022-09-07 | 31.29 | 32.34 | 31.27 | 32.23 | 9035900 | 31.616398 | 32.337489 | 0 | 0.0 |

| 2022-09-08 | 31.72 | 32.49 | 31.55 | 32.12 | 11085400 | 31.618872 | 32.328516 | 0 | 0.0 |

| 2022-09-09 | 32.43 | 32.76 | 32.24 | 32.66 | 10958900 | 31.669552 | 32.345109 | 0 | 0.0 |

from core.visuals import *

start = -100

end = df.shape[0]

df_sub = df.iloc[start:end]

# df_sub = df[(df.index<='2019-04-01') & (df.index>='2019-01-24')]

names = {'main_title': f'{ticker}'}

lines0 = basic_lines(df_sub[['AMA', 'KAMA']],

colors = [],

**dict(panel=0, width=1.5, secondary_y=False))

lines2 = basic_lines(df_sub[[ 'B']],

colors = ['navy'],

**dict(panel=0, type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False))

lines_ = dict(**lines0, **lines2)

#shadows_ = basic_shadows(bands=[-0.01, 0.01], nsamples=df.iloc[start:end].shape[0], **dict(panel=1, color="lightskyblue",alpha=0.1,interpolate=True))

shadows_ = []

fig_config_ = dict(figratio=(18,10), volume=True, volume_panel=1,panel_ratios=(4,2), tight_layout=True, returnfig=True,)

ax_cfg_ = {0:dict(basic=[4, 2, ['AMA', 'KAMA']],

title=dict(label = 'AMA-KAMA', fontsize=9, style='italic', loc='left'),

),

}

names = {'main_title': f'{ticker}'}

aa_, bb_ = make_panels(main_data = df_sub[['Open', 'High', 'Low', 'Close', 'Volume']],

added_plots = lines_,

fill_betweens = shadows_,

fig_config = fig_config_,

axes_config = ax_cfg_,

names = names)

Simulate

TRADE_CONFIG = dict(INIT_CAPITAL = 10000 ,

MIN_TRADE_SIZE = 100 ,

MAX_TRADE_SIZE = 1000 ,

HOLD_DAYS = 40, #max hold days

STOP_LOSS = 0.085, #10% drop

KEEP_PROFIT = 0.065,

MAX_OPEN = 1, #allow only 1 open position

COST = 0.0035,

)

df['SIGNAL'].value_counts()

0 3754

1 113

Name: SIGNAL, dtype: int64

trades = []

for i in range(df.shape[0]-5):

row = df.iloc[i]

if row['SIGNAL']>0:

print('enter: ', i)

row_j = df.iloc[i+1]

item = dict(signal_date = row.name,

enter_date = row_j.name,

enter_price = row_j['High']

)

for j in range(i+2, min(i+TRADE_CONFIG['HOLD_DAYS'], df.shape[0])):

row_j = df.iloc[j]

price_ = row_j['Low']

pct_chg = price_/item['enter_price']

if (pct_chg<= (1 - TRADE_CONFIG['STOP_LOSS'])) | (pct_chg >= (1 + TRADE_CONFIG['KEEP_PROFIT'])):

break

item['exit_date'] = row_j.name

item['exit_price'] = price_

item['hold_days'] = j - i

i = j

print('exit:', i)

trades.append(item)

enter: 35

exit: 52

enter: 76

exit: 83

enter: 102

exit: 110

enter: 138

exit: 140

enter: 147

exit: 149

enter: 176

exit: 178

enter: 210

exit: 212

enter: 304

exit: 306

enter: 336

exit: 339

enter: 368

exit: 374

enter: 379

exit: 381

enter: 397

exit: 399

enter: 469

exit: 471

enter: 525

exit: 528

enter: 563

exit: 586

enter: 572

exit: 594

enter: 585

exit: 588

enter: 592

exit: 597

enter: 618

exit: 623

enter: 636

exit: 652

enter: 662

exit: 664

enter: 703

exit: 729

enter: 762

exit: 769

enter: 804

exit: 808

enter: 836

exit: 853

enter: 899

exit: 907

enter: 1006

exit: 1028

enter: 1020

exit: 1024

enter: 1041

exit: 1052

enter: 1100

exit: 1107

enter: 1120

exit: 1142

enter: 1142

exit: 1147

enter: 1156

exit: 1178

enter: 1183

exit: 1192

enter: 1194

exit: 1210

enter: 1237

exit: 1258

enter: 1249

exit: 1268

enter: 1277

exit: 1282

enter: 1294

exit: 1313

enter: 1366

exit: 1397

enter: 1391

exit: 1395

enter: 1412

exit: 1421

enter: 1443

exit: 1469

enter: 1498

exit: 1508

enter: 1535

exit: 1563

enter: 1599

exit: 1619

enter: 1680

exit: 1692

enter: 1706

exit: 1720

enter: 1735

exit: 1749

enter: 1754

exit: 1783

enter: 1834

exit: 1866

enter: 1881

exit: 1891

enter: 1942

exit: 1951

enter: 1964

exit: 1973

enter: 1981

exit: 1988

enter: 2003

exit: 2029

enter: 2021

exit: 2026

enter: 2048

exit: 2055

enter: 2061

exit: 2082

enter: 2093

exit: 2109

enter: 2121

exit: 2135

enter: 2164

exit: 2184

enter: 2192

exit: 2194

enter: 2213

exit: 2236

enter: 2233

exit: 2259

enter: 2277

exit: 2295

enter: 2312

exit: 2351

enter: 2355

exit: 2394

enter: 2366

exit: 2393

enter: 2384

exit: 2400

enter: 2409

exit: 2448

enter: 2436

exit: 2475

enter: 2517

exit: 2543

enter: 2534

exit: 2563

enter: 2609

exit: 2629

enter: 2659

exit: 2676

enter: 2693

exit: 2702

enter: 2731

exit: 2747

enter: 2761

exit: 2800

enter: 2785

exit: 2806

enter: 2810

exit: 2829

enter: 2818

exit: 2834

enter: 2867

exit: 2875

enter: 2888

exit: 2915

enter: 2958

exit: 2997

enter: 2983

exit: 3000

enter: 2997

exit: 3000

enter: 3021

exit: 3038

enter: 3043

exit: 3063

enter: 3113

exit: 3126

enter: 3126

exit: 3150

enter: 3157

exit: 3196

enter: 3165

exit: 3199

enter: 3227

exit: 3233

enter: 3233

exit: 3237

enter: 3288

exit: 3290

enter: 3352

exit: 3366

enter: 3383

exit: 3397

enter: 3405

exit: 3417

enter: 3450

exit: 3460

enter: 3465

exit: 3475

enter: 3504

exit: 3510

enter: 3515

exit: 3554

enter: 3534

exit: 3563

enter: 3606

exit: 3631

enter: 3611

exit: 3626

enter: 3624

exit: 3643

enter: 3653

exit: 3656

enter: 3668

exit: 3672

enter: 3713

exit: 3721

enter: 3745

exit: 3765

enter: 3795

exit: 3799

enter: 3829

exit: 3861

df_trades = pd.DataFrame(data = trades)

df_trades.shape

(113, 6)

def cal_pnl(trade):

shares = int(TRADE_CONFIG['INIT_CAPITAL']/trade['enter_price'])

if shares < TRADE_CONFIG['MIN_TRADE_SIZE']:

shares = 0

elif shares > TRADE_CONFIG['MAX_TRADE_SIZE']:

shares = TRADE_CONFIG['MAX_TRADE_SIZE']

pnl = shares*(trade['exit_price'] - trade['enter_price']) - shares*trade['enter_price']*TRADE_CONFIG['COST']

return pnl

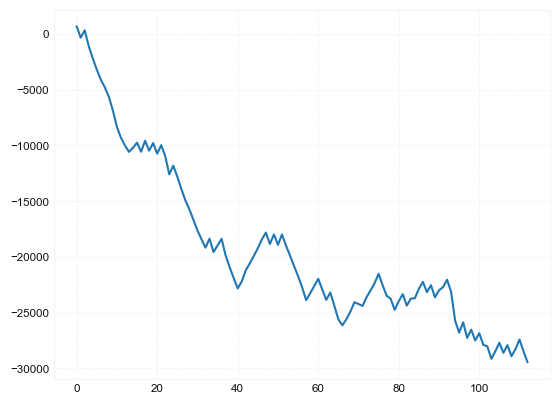

df_trades['pnl'] = df_trades.apply(lambda x: cal_pnl(x), axis=1)

df_trades['pnl'].sum(), (df_trades['pnl']>0).mean()

(-29470.04119500001, 0.4336283185840708)

df_trades

| signal_date | enter_date | enter_price | exit_date | exit_price | hold_days | pnl | |

|---|---|---|---|---|---|---|---|

| 0 | 2007-06-22 | 2007-06-25 | 17.53 | 2007-07-18 | 18.79 | 17 | 683.227650 |

| 1 | 2007-08-21 | 2007-08-22 | 16.57 | 2007-08-30 | 14.94 | 7 | -1017.860985 |

| 2 | 2007-09-27 | 2007-09-28 | 15.95 | 2007-10-09 | 17.06 | 8 | 659.913550 |

| 3 | 2007-11-16 | 2007-11-19 | 17.54 | 2007-11-20 | 15.13 | 2 | -1408.692300 |

| 4 | 2007-11-30 | 2007-12-03 | 17.76 | 2007-12-04 | 15.86 | 2 | -1104.696080 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 108 | 2021-11-24 | 2021-11-26 | 36.95 | 2021-12-01 | 33.40 | 4 | -993.417750 |

| 109 | 2022-01-31 | 2022-02-01 | 40.57 | 2022-02-10 | 43.31 | 8 | 639.109230 |

| 110 | 2022-03-17 | 2022-03-18 | 37.92 | 2022-04-14 | 41.33 | 20 | 861.924640 |

| 111 | 2022-05-27 | 2022-05-31 | 42.45 | 2022-06-03 | 38.06 | 4 | -1066.565125 |

| 112 | 2022-07-19 | 2022-07-20 | 33.08 | 2022-09-01 | 29.94 | 32 | -983.245560 |

113 rows × 7 columns

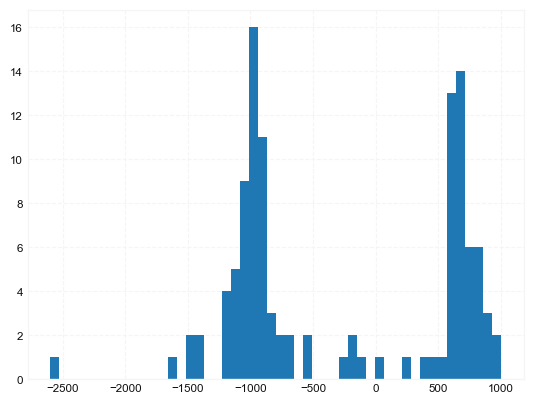

df_trades['pnl'].hist(bins=50)

<AxesSubplot:>

df_trades['pnl'].cumsum().plot()

<AxesSubplot:>