Combining Bollinger Bands With Candlesticks

References

█ OVERVIEW

In "Combining Bollinger Bands With Candlesticks" in this issue, author Pawel Kosinski introduces us to a trading strategy that combines standard Bollinger Bands with the bullish engulfing candlestick pattern. Along the way we get a glimpse into the author's process for trading strategy design and testing.

The strategy uses 20-period Bollinger Bands set at 2.2 standard deviations from the center average and four times a 14-period average true range for a maximum loss stop.

Quantacula Studio's candlesticks extension can automatically flag all common candlestick patterns. We used the extension to create a model based on Pawel Kosinski's concepts described in his article in this issue. Our model buys after the price touches the lower Bollinger Band, and a Bullish Engulfing candlestick pattern has also occurred. Performing a quick backtest on the Nasdaq 100 yielded modest profits of 21.7% over a 10-year period.

We decided to tweak the entry based on a simple technique we like to use. Instead of buying the next day at market open, we buy using a limit order set to the closing price of the signal bar. Most of the time, when prices gap up, they eventually retest the previous day's close during the trading day. This technique does cause some trades to "get away from you" when they never retest, but overall the value proposition is positive. Applying this simple change doubled the net profit to 42% in our backtest.

█ STRATEGY

Buy Order tab:

Formula:

stop:= Ref(C, -1) - (4 * ATR(14));

RR:= (BBandTop(C, 20, S, 2.2)-H)/ (H-RR);

el:= C > Ref(H, -1) AND Ref( EngulfingBull(), -1) AND

Ref( Alert( L < BBandBot(C, 20, S, 2.2), 2), -1) AND RR > 1.0;

xl:= H > BBandTop(C, 20, S, 2.2);

trade:= If( PREV<=0, If(el, stop, 0),

If( L<= PREV, -1, If( xl, -2, PREV)));

trade > 0 AND Ref(trade <= 0, -1)

Sell Order tab:

Formula:

stop:= Ref(C, -1) - (4 * ATR(14));

RR:= (BBandTop(C, 20, S, 2.2)-H)/ (H-RR);

el:= C > Ref(H, -1) AND Ref( EngulfingBull(), -1) AND

Ref( Alert( L < BBandBot(C, 20, S, 2.2), 2), -1) AND RR > 1.0;

xl:= H > BBandTop(C, 20, S, 2.2);

trade:= If( PREV<=0, If(el, stop, 0),

If( L<= PREV, -1, If( xl, -2, PREV)));

trade < 0

Order Type: Stop Limit

Stop or Limit Price:

stop:= Ref(C, -1) - (4 * ATR(14));

RR:= (BBandTop(C, 20, S, 2.2)-H)/ (H-RR);

el:= C > Ref(H, -1) AND Ref( EngulfingBull(), -1) AND

Ref( Alert( L < BBandBot(C, 20, S, 2.2), 2), -1) AND RR > 1.0;

xl:= H > BBandTop(C, 20, S, 2.2);

trade:= If( PREV<=0, If(el, stop, 0),

If( L<= PREV, -1, If( xl, -2, PREV)));

If( trade = -1, Ref(trade, -1), C)

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

Download data

##### Download data#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#CBOE Volatility Index (^VIX) Chicago Options - Chicago Options Delayed Price. Currency in USD

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC', '^VIX']

tickers = benchmark_tickers + ['GSK', 'BST', 'PFE','DAL']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-10 01:06:11.715775 ^GSPC (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 01:06:12.011806 ^VIX (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 01:06:12.412567 GSK (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 01:06:12.663710 BST (1980, 7) 2014-10-29 00:00:00 2022-09-09 00:00:00

2022-09-10 01:06:13.052159 PFE (5710, 7) 1999-12-31 00:00:00 2022-09-09 00:00:00

2022-09-10 01:06:13.314652 DAL (3867, 7) 2007-05-03 00:00:00 2022-09-09 00:00:00

ticker = 'DAL'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-09-02 | 31.440001 | 31.830000 | 30.700001 | 30.940001 | 8626500 | 0.0 | 0 |

| 2022-09-06 | 31.340000 | 31.650000 | 30.660000 | 31.190001 | 7630800 | 0.0 | 0 |

| 2022-09-07 | 31.290001 | 32.340000 | 31.270000 | 32.230000 | 9035900 | 0.0 | 0 |

| 2022-09-08 | 31.719999 | 32.490002 | 31.549999 | 32.119999 | 11074800 | 0.0 | 0 |

| 2022-09-09 | 32.430000 | 32.759998 | 32.240002 | 32.435001 | 4745097 | 0.0 | 0 |

Calculate the technical indicators and Find signals

def bull_engulfing(c: pd.Series, o: pd.Series)-> pd.Series:

"""

c: pd.Series. close price

o: pd.Series. open price

BULL ENGULFING: meet all of the following

current OPEN > current CLOSE

pre CLOSE > pre OPEN

current CLOSE > pre OPEN

current OPEN > pre CLOSE

"""

be = (c>o) & (c.shift(1)<o.shift(1)) & (c>o.shift(1)) & (o<c.shift(1))

return pd.Series(be, name='BULL_ENGULF')

def bbands_trigger(c:pd.Series, l:pd.Series, bb_lower:pd.Series) -> pd.Series:

"""

c: pd.Series. close price

l: pd.Series. low price

bb_lower: lower band of Bollinger bands

Bollinger Bands Trigger: meet all of the following

pre CLOSE < pre BBANDS lower band

current CLOSE > current BBANDS lower band

current LOW < current BBANDS lower band

"""

bt = (c.shift(1)<bb_lower.shift(1)) & (c > bb_lower) & (l < bb_lower)

return pd.Series(bt, name='BBANDS_TRIGGER')

from core.finta import TA

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

TA.BBANDS

<function core.finta.TA.BBANDS(ohlc: pandas.core.frame.DataFrame, period: int = 20, MA: pandas.core.series.Series = None, column: str = 'close', std_multiplier: float = 2) -> pandas.core.frame.DataFrame>

df_ta = TA.BBANDS(df, period = 20, std_multiplier=2.2, column="close")

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

15467

df['BULL_ENGULF'] = bull_engulfing(df["Close"], df["Open"])

df['BBANDS_TRIGGER'] = bbands_trigger(df["Close"], df["Low"], df["BB_LOWER"])

df['SIGNAL'] = (df['BULL_ENGULF'] & df['BBANDS_TRIGGER']).astype(int)

df['B'] = df['SIGNAL']*(df["High"] + df["Low"])/2

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | BB_UPPER | BB_MIDDLE | BB_LOWER | BBWIDTH | PERCENT_B | BULL_ENGULF | BBANDS_TRIGGER | SIGNAL | B | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||||

| 2007-05-03 | 19.32 | 19.50 | 18.25 | 18.40 | 8052800 | NaN | NaN | NaN | NaN | NaN | False | False | 0 | 0.0 |

| 2007-05-04 | 18.88 | 18.96 | 18.39 | 18.64 | 5437300 | NaN | NaN | NaN | NaN | NaN | False | False | 0 | 0.0 |

| 2007-05-07 | 18.83 | 18.91 | 17.94 | 18.08 | 2646300 | NaN | NaN | NaN | NaN | NaN | False | False | 0 | 0.0 |

| 2007-05-08 | 17.76 | 17.76 | 17.14 | 17.44 | 4166100 | NaN | NaN | NaN | NaN | NaN | False | False | 0 | 0.0 |

| 2007-05-09 | 17.54 | 17.94 | 17.44 | 17.58 | 7541100 | NaN | NaN | NaN | NaN | NaN | False | False | 0 | 0.0 |

| Open | High | Low | Close | Volume | BB_UPPER | BB_MIDDLE | BB_LOWER | BBWIDTH | PERCENT_B | BULL_ENGULF | BBANDS_TRIGGER | SIGNAL | B | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||||

| 2022-09-02 | 31.44 | 31.83 | 30.70 | 30.94 | 8626500 | 36.133696 | 33.2025 | 30.271304 | 0.176565 | 0.114065 | False | False | 0 | 0.0 |

| 2022-09-06 | 31.34 | 31.65 | 30.66 | 31.19 | 7630800 | 36.150830 | 33.0745 | 29.998170 | 0.186024 | 0.193710 | False | False | 0 | 0.0 |

| 2022-09-07 | 31.29 | 32.34 | 31.27 | 32.23 | 9035900 | 36.128493 | 33.0255 | 29.922507 | 0.187915 | 0.371817 | False | False | 0 | 0.0 |

| 2022-09-08 | 31.72 | 32.49 | 31.55 | 32.12 | 11074800 | 36.031337 | 32.9350 | 29.838663 | 0.188027 | 0.368393 | False | False | 0 | 0.0 |

| 2022-09-09 | 32.43 | 32.76 | 32.24 | 32.44 | 4745097 | 35.917212 | 32.8590 | 29.800788 | 0.186141 | 0.431496 | False | False | 0 | 0.0 |

df['SIGNAL'].value_counts()

0 3864

1 3

Name: SIGNAL, dtype: int64

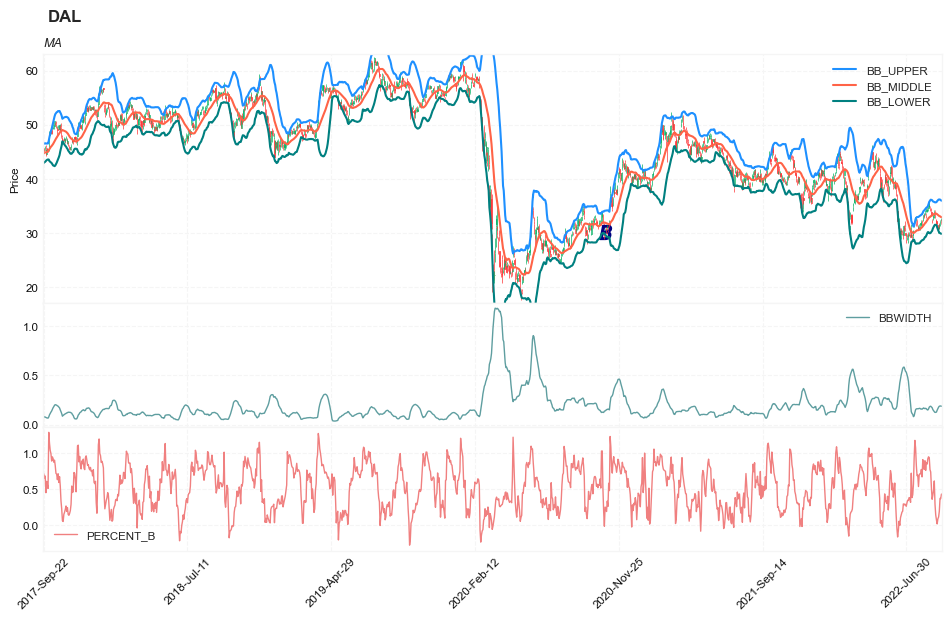

Visual

from core.visuals import *

start = -1250

end = df.shape[0]

df_sub = df.iloc[start:end]

# df_sub = df[(df.index<='2019-04-01') & (df.index>='2019-01-24')]

names = {'main_title': f'{ticker}'}

lines0 = basic_lines(df_sub[['BB_UPPER', 'BB_MIDDLE', 'BB_LOWER']],

colors = [],

**dict(panel=0, width=1.5, secondary_y=False))

lines1 = basic_lines(df_sub[['BBWIDTH']],

colors = ['cadetblue'],

**dict(panel=1, width=1))

lines3 = basic_lines(df_sub[['PERCENT_B']],

colors = ['lightcoral'],

**dict(panel=2, width=1))

lines2 = basic_lines(df_sub[[ 'B']],

colors = ['navy'],

**dict(panel=0, type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False))

lines_ = dict(**lines0, **lines1)

lines_.update(lines2)

lines_.update(lines3)

#shadows_ = basic_shadows(bands=[-0.01, 0.01], nsamples=df.iloc[start:end].shape[0], **dict(panel=1, color="lightskyblue",alpha=0.1,interpolate=True))

shadows_ = []

fig_config_ = dict(figratio=(18,10), volume=False, volume_panel=2,panel_ratios=(4,2, 2), tight_layout=True, returnfig=True,)

ax_cfg_ = {0:dict(basic=[5, 2, ['BB_UPPER', 'BB_MIDDLE', 'BB_LOWER']],

title=dict(label = 'MA', fontsize=9, style='italic', loc='left'),

),

2:dict(basic=[1, 0, ['BBWIDTH']]

),

4:dict(basic=[1, 0, ['PERCENT_B']]

),

}

names = {'main_title': f'{ticker}'}

aa_, bb_ = make_panels(main_data = df_sub[['Open', 'High', 'Low', 'Close', 'Volume']],

added_plots = lines_,

fill_betweens = shadows_,

fig_config = fig_config_,

axes_config = ax_cfg_,

names = names)

Simulate

TRADE_CONFIG = dict(INIT_CAPITAL = 10000 ,

MIN_TRADE_SIZE = 100 ,

MAX_TRADE_SIZE = 1000 ,

HOLD_DAYS = 40, #max hold days

STOP_LOSS = 0.085, #10% drop

KEEP_PROFIT = 0.065,

MAX_OPEN = 1, #allow only 1 open position

COST = 0.0035,

)

df['SIGNAL'].value_counts()

0 3864

1 3

Name: SIGNAL, dtype: int64

trades = []

for i in range(df.shape[0]-5):

row = df.iloc[i]

if row['SIGNAL']>0:

print('enter: ', i)

row_j = df.iloc[i+1]

item = dict(signal_date = row.name,

enter_date = row_j.name,

enter_price = row_j['High']

)

for j in range(i+2, min(i+TRADE_CONFIG['HOLD_DAYS'], df.shape[0])):

row_j = df.iloc[j]

price_ = row_j['Low']

pct_chg = price_/item['enter_price']

if (pct_chg<= (1 - TRADE_CONFIG['STOP_LOSS'])) | (pct_chg >= (1 + TRADE_CONFIG['KEEP_PROFIT'])):

break

item['exit_date'] = row_j.name

item['exit_price'] = price_

item['hold_days'] = j - i

i = j

print('exit:', i)

trades.append(item)

enter: 960

exit: 965

enter: 2208

exit: 2216

enter: 3398

exit: 3405

df_trades = pd.DataFrame(data = trades)

df_trades.shape

(3, 6)

def cal_pnl(trade):

shares = int(TRADE_CONFIG['INIT_CAPITAL']/trade['enter_price'])

if shares < TRADE_CONFIG['MIN_TRADE_SIZE']:

shares = 0

elif shares > TRADE_CONFIG['MAX_TRADE_SIZE']:

shares = TRADE_CONFIG['MAX_TRADE_SIZE']

pnl = shares*(trade['exit_price'] - trade['enter_price']) - shares*trade['enter_price']*TRADE_CONFIG['COST']

return pnl

df_trades['pnl'] = df_trades.apply(lambda x: cal_pnl(x), axis=1)

df_trades

| signal_date | enter_date | enter_price | exit_date | exit_price | hold_days | pnl | |

|---|---|---|---|---|---|---|---|

| 0 | 2011-02-23 | 2011-02-24 | 10.05 | 2011-03-02 | 8.99 | 5 | -1089.699125 |

| 1 | 2016-02-09 | 2016-02-10 | 39.79 | 2016-02-22 | 42.59 | 8 | 667.844485 |

| 2 | 2020-10-29 | 2020-10-30 | 30.99 | 2020-11-09 | 34.68 | 7 | 1153.254270 |