Backtesting A Mean-Reversion Strategy In Python

References

█ OVERVIEW

For this month's Traders' Tips, the focus is Anthony Garner's article in this issue, "Backtesting A Mean-Reversion Strategy In Python." Here, we present the May 2019 Traders' Tips code with possible implementations in various software.

In "Backtesting A Mean-Reversion Strategy In Python" in this issue, author Anthony Garner introduces a strategy based on the concept of buying an oversold asset and selling an overbought asset. To quantify this, he uses the classic z-score calculation. In addition, he adds a component to evaluate the existing trend as well as position sizing to allow for reinvestment.

Here is TradeStation EasyLanguage code for an indicator and strategy based on the author's concepts. We also included a function for calculating the z-score that can be used in your own code.

█ STRATEGY

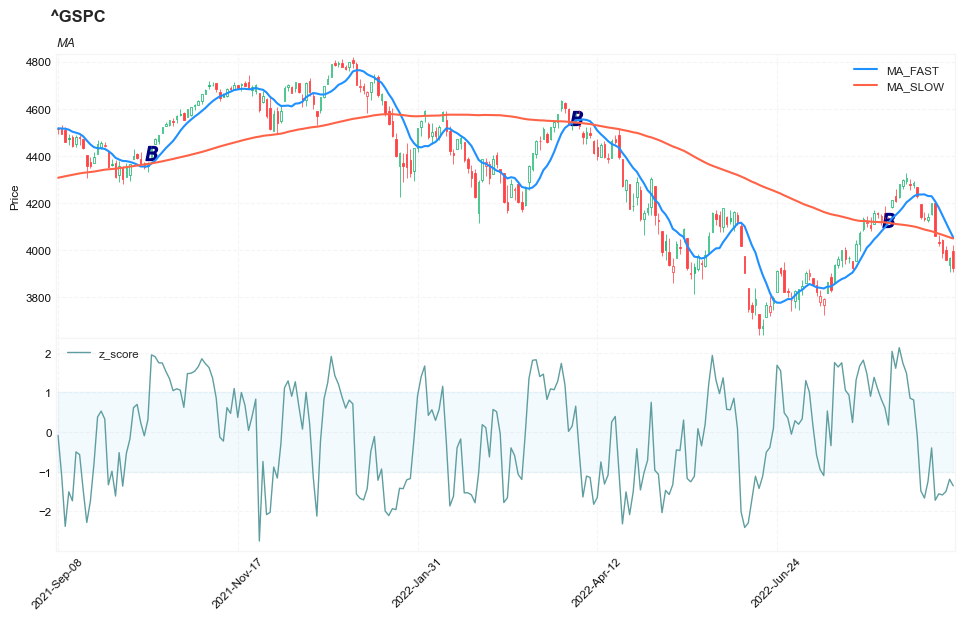

- trade setup

- starting pricinpal: 10000

- min trade size: 100

- max trade size: 10000

- signal setup

- calculate the z-score of period = 10

- calculate ma_fast of period = 10

- calculate ma_slow of period = 100

- Trade at the next day of ENTER/EXIT signal

- BUY signal: z-score < -1 AND ma_fast > ma_slow

- SELL: z-score > -0.5

- SELL SHORT signal: z-score > 1 AND ma_fast < ma_slow

- BUY to COVER: z-score < 0.5

- ma_fast crosses over ma_slow: BUY to COVER

- ma_fast crosses under ma)slow: SELL

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

Download data

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#CBOE Volatility Index (^VIX) Chicago Options - Chicago Options Delayed Price. Currency in USD

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC', '^VIX']

tickers = benchmark_tickers + ['GSK', 'BST', 'PFE']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-04 18:54:52.134508 ^GSPC (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-04 18:54:52.509531 ^VIX (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-04 18:54:52.889206 GSK (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-04 18:54:53.195667 BST (1976, 7) 2014-10-29 00:00:00 2022-09-02 00:00:00

2022-09-04 18:54:53.639234 PFE (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

ticker = '^GSPC'

# ticker = 'PFE'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-29 | 4034.580078 | 4062.989990 | 4017.419922 | 4030.610107 | 2963020000 | 0 | 0 |

| 2022-08-30 | 4041.250000 | 4044.979980 | 3965.209961 | 3986.159912 | 3190580000 | 0 | 0 |

| 2022-08-31 | 4000.669922 | 4015.370117 | 3954.530029 | 3955.000000 | 3797860000 | 0 | 0 |

| 2022-09-01 | 3936.729980 | 3970.229980 | 3903.649902 | 3966.850098 | 3754570000 | 0 | 0 |

| 2022-09-02 | 3994.659912 | 4018.429932 | 3906.209961 | 3924.260010 | 4134920000 | 0 | 0 |

Calculate the technical indicators

def _zscore(_data, _len):

roll_ = _data.rolling(window=_len, min_periods = _len)

z_ = (_data - roll_.mean())/roll_.std()

return z_

from core.finta import TA

z_period = 10

fast_period = 10

slow_period = 100

help(TA.SMA)

Help on function SMA in module core.finta:

SMA(ohlc: pandas.core.frame.DataFrame, period: int = 41, column: str = 'close') -> pandas.core.series.Series

Simple moving average - rolling mean in pandas lingo. Also known as 'MA'.

The simple moving average (SMA) is the most basic of the moving averages used for trading.

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

df_ta = TA.SMA(df, period = fast_period, column="close")

df_ta.name='MA_FAST'

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

df_ta = TA.SMA(df, period = slow_period, column="close")

df_ta.name='MA_SLOW'

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

38

df['z_score'] = _zscore(df['Close'], z_period)

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | MA_FAST | MA_SLOW | z_score | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 1999-12-31 | 1464.47 | 1472.42 | 1458.19 | 1469.25 | 374050000 | NaN | NaN | NaN |

| 2000-01-03 | 1469.25 | 1478.00 | 1438.36 | 1455.22 | 931800000 | NaN | NaN | NaN |

| 2000-01-04 | 1455.22 | 1455.22 | 1397.43 | 1399.42 | 1009000000 | NaN | NaN | NaN |

| 2000-01-05 | 1399.42 | 1413.27 | 1377.68 | 1402.11 | 1085500000 | NaN | NaN | NaN |

| 2000-01-06 | 1402.11 | 1411.90 | 1392.10 | 1403.45 | 1092300000 | NaN | NaN | NaN |

| Open | High | Low | Close | Volume | MA_FAST | MA_SLOW | z_score | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 2022-08-29 | 4034.58 | 4062.99 | 4017.42 | 4030.61 | 2963020000 | 4178.634 | 4068.3812 | -1.558438 |

| 2022-08-30 | 4041.25 | 4044.98 | 3965.21 | 3986.16 | 3190580000 | 4146.730 | 4063.4313 | -1.587777 |

| 2022-08-31 | 4000.67 | 4015.37 | 3954.53 | 3955.00 | 3797860000 | 4114.826 | 4057.9792 | -1.498243 |

| 2022-09-01 | 3936.73 | 3970.23 | 3903.65 | 3966.85 | 3754570000 | 4083.137 | 4052.7649 | -1.191407 |

| 2022-09-02 | 3994.66 | 4018.43 | 3906.21 | 3924.26 | 4134920000 | 4052.715 | 4047.8822 | -1.357369 |

Find signals

- BUY signal: z-score < -1 AND ma_fast > ma_slow

- SELL: z-score > -0.5

- SELL SHORT signal: z-score > 1 AND ma_fast < ma_slow

- BUY to COVER: z-score < 0.5

- ma_fast crosses over ma_slow: BUY to COVER

- ma_fast crosses under ma_slow: SELL

df.dropna(how='any', inplace=True)

#1: BUY signal: z-score < -1 AND ma_fast > ma_slow

#2: ma_fast crosses over ma_slow: BUY to COVER

#-1: SELL SHORT signal: z-score > 1 AND ma_fast < ma_slow

#-2: ma_fast crosses under ma_slow: SELL

enter_zscore = 1

exit_zscore = 0.5

signals = [0]

for i in range(1, df.shape[0]):

row = df.iloc[i]

z_ = row['z_score']

ma_f = row['MA_FAST']

ma_s = row['MA_SLOW']

row_j = df.iloc[i-1]

pre_ma_f = row_j['MA_FAST']

pre_ma_s = row_j['MA_SLOW']

s_ = 0

if (z_ < -enter_zscore) & (ma_f > ma_s):

s_ = 1

elif (z_ > enter_zscore) & (ma_f < ma_s):

s_ = -1

elif (pre_ma_f < pre_ma_s) & (ma_f >= ma_s):

s_ = 2

elif (pre_ma_f > pre_ma_s) & (ma_f <= ma_s):

s_ = -2

signals.append(s_)

df['SIGNAL'] = signals

Visual

df['SIGNAL'].value_counts()

0 4380

1 690

-1 460

2 39

-2 38

Name: SIGNAL, dtype: int64

df['B1'] = (df['SIGNAL']==1).astype(int)*(df['High'] + df['Low'])/2

df['B2'] = (df['SIGNAL']==2).astype(int)*(df['High'] + df['Low'])/2

df['S1'] = (df['SIGNAL']==-1).astype(int)*(df['High'] + df['Low'])/2

df['S2'] = (df['SIGNAL']==-2).astype(int)*(df['High'] + df['Low'])/2

from core.visuals import *

start = -250

end = df.shape[0]

names = {'main_title': f'{ticker}'}

lines0 = basic_lines(df.iloc[start:end][['MA_FAST', 'MA_SLOW']],

colors = [],

**dict(panel=0, width=1.5, secondary_y=False))

lines1 = basic_lines(df.iloc[start:end][['z_score']],

colors = ['cadetblue'],

**dict(panel=1, width=1, secondary_y=False))

lines2 = basic_lines(df.iloc[start:end][[ 'B2']],

colors = ['navy'],

**dict(panel=0, type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False))

lines_ = dict(**lines0, **lines1)

lines_.update(lines2)

shadows_ = basic_shadows(bands=[-1, 1], nsamples=df.iloc[start:end].shape[0], **dict(panel=1, color="lightskyblue",alpha=0.1,interpolate=True))

fig_config_ = dict(figratio=(18,10), volume=False, volume_panel=2,panel_ratios=(4,3), tight_layout=True, returnfig=True,)

ax_cfg_ = {0:dict(basic=[4, 2, ['MA_FAST', 'MA_SLOW']],

title=dict(label = 'MA', fontsize=9, style='italic', loc='left'),

),

2:dict(basic=[1, 0, ['z_score',]]

),

}

names = {'main_title': f'{ticker}'}

aa_, bb_ = make_panels(main_data = df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

added_plots = lines_,

fill_betweens = shadows_,

fig_config = fig_config_,

axes_config = ax_cfg_,

names = names)

Simulate

TRADE_CONFIG = dict(InitialCapital = 10000 ,

LeverageToUse = 2 ,

MinTradeSize = 100 ,

MaxTradeSize = 1000

)