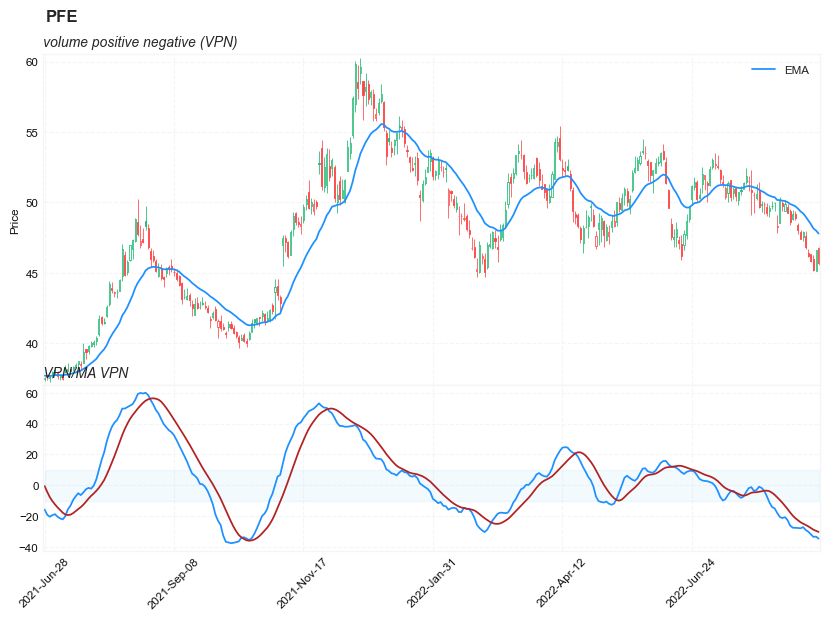

Detecting High-Volume Breakouts: volume positive negative (VPN)

References

█ OVERVIEW

For this month's Traders' Tips, the focus is Markos Katsanos' article in this issue, "Detecting High-Volume Breakouts." Here, we present the April 2021 Traders' Tips code with possible implementations in various software.

In his article in this issue, "Detecting High-Volume Breakouts," author Markos Katsanos introduces an indicator called volume positive negative (VPN) that attempts to minimize entries in false breakouts. The indicator compares volume on "up" days versus the volume on "down" days and is normalized to oscillate between 100 and -100.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#CBOE Volatility Index (^VIX) Chicago Options - Chicago Options Delayed Price. Currency in USD

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC', '^VIX']

tickers = benchmark_tickers + ['GSK', 'BST', 'PFE']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-04 13:00:04.892846 ^GSPC (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-04 13:00:05.222089 ^VIX (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-04 13:00:05.642901 GSK (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-04 13:00:05.906042 BST (1976, 7) 2014-10-29 00:00:00 2022-09-02 00:00:00

2022-09-04 13:00:06.314786 PFE (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

ticker = 'PFE'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-29 | 46.380001 | 46.689999 | 46.119999 | 46.230000 | 13400500 | 0.0 | 0.0 |

| 2022-08-30 | 46.340000 | 46.349998 | 45.799999 | 45.849998 | 16303000 | 0.0 | 0.0 |

| 2022-08-31 | 46.009998 | 46.290001 | 45.130001 | 45.230000 | 26416800 | 0.0 | 0.0 |

| 2022-09-01 | 45.139999 | 46.650002 | 45.139999 | 46.630001 | 19947600 | 0.0 | 0.0 |

| 2022-09-02 | 46.740002 | 46.799999 | 45.529999 | 45.700001 | 14662700 | 0.0 | 0.0 |

Define volume positive negative (VPN) calculation function

from core.finta import TA

def cal_vpn(ohlc: pd.DataFrame,

period: int = 30,

ema_period: int = 3,

mav_period: int = 30,

adjust: bool = True

) -> pd.Series:

"""

source: https://traders.com/Documentation/FEEDbk_docs/2021/04/TradersTips.html

Volume Positive Negative:

pds:= Input( "Periods", 5, 100, 30);

apr:= Typical();

at:= ATR(pds) * 0.1;

vpd:= If( apr >= Ref(apr, -1) + at, V, 0);

vnd:= If( apr <= Ref(apr, -1) - at, V, 0);

VP:= Sum(vpd, pds);

VN:= Sum(vnd, pds);

VPN:= (((VP - VN)/Mov(V, pds, S))/pds) * 100;

VPN;

Mov(VPN, 3, E)

#------------------------------------------

MF Momentum( Avg3( High, Low, Close ), 1)

MC Mul2( 0.1, ATR( High, Low, Close, 30 ) )

VP Sum( IfThenElse( A>B( MF, MC ), Volume, 0 ), 30 )

VN Sum( IfThenElse( A<B( MF, Neg(MC) ), Volume, 0), 30 )

VPN ExpAvg( Mul2( Divide( Divide( Sub( VP, VN ), Avg( Volume, 30 ) ), 30), 100 ), 3 )

MAVPN Avg( VPN, 30 )

"""

ohlc = ohlc.copy()

ohlc.columns = [c.lower() for c in ohlc.columns]

v = ohlc['volume']

mav_ = v.rolling(period).mean()

tp_ = TA.TP(ohlc) #typical price: (high + low + close)/3

atr_ = TA.ATR(ohlc, period = period)#Average True Range is moving average of True Range

mf_ = tp_.diff(1) #momentum of typical price

mc_ = atr_*0.1

vol_up = (mf_ > mc_).astype(int)*v

vol_down = (mf_ < (-1*mc_)).astype(int)*v

vp_ = vol_up.rolling(period).sum()

vn_ = vol_down.rolling(period).sum()

mav_[mav_<=0] = 1

vpn_ = ((vp_ - vn_)/mav_/period*100).ewm(span=ema_period, adjust=adjust).mean()

ma_vpn_ = vpn_.rolling(mav_period).mean()

return pd.DataFrame(data = {'VPN': vpn_.values,

'MA_VPN': ma_vpn_.values,

},

index=ohlc.index, )

Calculate volume positive negative (VPN)

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_vpn

<function __main__.cal_vpn(ohlc: pandas.core.frame.DataFrame, period: int = 30, ema_period: int = 3, mav_period: int = 30, adjust: bool = True) -> pandas.core.series.Series>

df_ta = cal_vpn(df, period=30, ema_period=5, mav_period=10)

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

38

from core.finta import TA

df_ta = TA.EMA(df, period = 20, column="close")

df_ta.name='EMA'

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

42

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | VPN | MA_VPN | EMA | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 1999-12-31 | 14.25 | 14.31 | 14.11 | 14.22 | 5939817 | NaN | NaN | 14.220000 |

| 2000-01-03 | 14.06 | 14.20 | 13.87 | 13.98 | 12873345 | NaN | NaN | 14.094000 |

| 2000-01-04 | 13.70 | 13.81 | 13.16 | 13.46 | 14208974 | NaN | NaN | 13.861199 |

| 2000-01-05 | 13.54 | 13.98 | 13.51 | 13.68 | 12981591 | NaN | NaN | 13.808890 |

| 2000-01-06 | 13.70 | 14.36 | 13.68 | 14.17 | 11115273 | NaN | NaN | 13.896239 |

| Open | High | Low | Close | Volume | VPN | MA_VPN | EMA | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 2022-08-29 | 46.38 | 46.69 | 46.12 | 46.23 | 13400500 | -29.861533 | -26.409703 | 48.728796 |

| 2022-08-30 | 46.34 | 46.35 | 45.80 | 45.85 | 16303000 | -31.559215 | -27.517568 | 48.454625 |

| 2022-08-31 | 46.01 | 46.29 | 45.13 | 45.23 | 26416800 | -33.228053 | -28.602111 | 48.147518 |

| 2022-09-01 | 45.14 | 46.65 | 45.14 | 46.63 | 19947600 | -33.037627 | -29.311578 | 48.002992 |

| 2022-09-02 | 46.74 | 46.80 | 45.53 | 45.70 | 14662700 | -34.363353 | -30.020268 | 47.783659 |

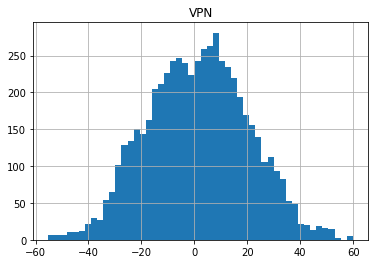

df[['VPN']].hist(bins=50)

array([[<AxesSubplot:title={'center':'VPN'}>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

# all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

all_colors = ['dodgerblue', 'firebrick','limegreen','skyblue','lightgreen', 'navy','yellow','plum', 'yellowgreen']

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, add_data, mid_panel=None, chart_type='candle', names=None, figratio=(14,9)):

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=False, volume_panel=1,

panel_ratios=(4,2), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = {

# 'S': mpf.make_addplot(add_data['S'], panel=0, color='blue', type='scatter', marker=r'${S}$' , markersize=100, secondary_y=False),

# 'B': mpf.make_addplot(add_data['B'], panel=0, color='blue', type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False),

'EMA': mpf.make_addplot(add_data['EMA'], panel=0, color='dodgerblue', secondary_y=False),

}

fb_bbands= []

if mid_panel is not None:

i = 0

for name_, data_ in mid_panel.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=1, color=all_colors[i], secondary_y=False)

i = i + 1

fb_bbands2_ = dict(y1=-10*np.ones(mid_panel.shape[0]),

y2=10*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

fb_bbands2_['panel'] = 1

fb_bbands.append(fb_bbands2_)

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between=fb_bbands)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

axes[0].legend([None]*4)

handles = axes[0].get_legend().legendHandles

axes[0].legend(handles=handles[2:],labels=['EMA'])

axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

axes[2].set_title('VPN/MA VPN', fontsize=10, style='italic', loc='left')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

start = -300

end = df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'volume positive negative (VPN) '}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['EMA']],

df.iloc[start:end][['VPN', 'MA_VPN']],

chart_type='hollow_and_filled',names = names)