Relative Strength Moving Averages With Hann Windowing (RSIH)

References

█ OVERVIEW

In his article in TASC's January 2022 edition Traders' Tips, "(Yet Another) Improved RSI," John Ehlers explains how he enhances the RSI by taking advantage of Hann windowing. The RSIH indicator provides a smoother calculation than the classic RSI and has a zero mean. The inherent smoothing in the computation removes the need for supplemental filtering. The best length to use for the RSIH is described to be one that is on the order of the dominant cycle period in the data.

█ CONCEPTS

By employing a Hann windowed finite impulse response filter (FIR), John Ehlers has enhanced the "Relative Strength Indicator" (RSI) to provide an improved oscillator with exceptional smoothness.

█ CALCULATIONS

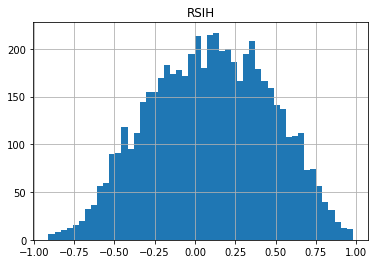

The method of calculations using "closes up" and "closes down" from Welles Wilder's RSI described in his 1978 book is still inherent to Ehlers enhanced formula. However, a finite impulse response (FIR) Hann windowing technique is employed following the closes up/down calculations instead of the original Wilder infinite impulse response averaging filter. The resulting oscillator waveform is confined between +/-1.0 with a 0.0 centerline regardless of chart interval, as opposed to Wilder's original formulation, which was confined between 0 and 100 with a centerline of 50. On any given trading timeframe, the value of Ehlers' enhanced RSI found above the centerline typically represents an overvalued region, while undervalued regions are typically found below the centerline.

Load basic packages

import pandas as pd

import numpy as np

import os

import gc

import copy

from pathlib import Path

from datetime import datetime, timedelta, time, date

#this package is to download equity price data from yahoo finance

#the source code of this package can be found here: https://github.com/ranaroussi/yfinance/blob/main

import yfinance as yf

pd.options.display.max_rows = 100

pd.options.display.max_columns = 100

import warnings

warnings.filterwarnings("ignore")

import pytorch_lightning as pl

random_seed=1234

pl.seed_everything(random_seed)

Global seed set to 1234

1234

#S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC)

#Russell 2000 (^RUT), Crude Oil Nov 21 (CL=F), Gold Dec 21 (GC=F)

#Treasury Yield 10 Years (^TNX)

#benchmark_tickers = ['^GSPC', '^DJI', '^IXIC', '^RUT', 'CL=F', 'GC=F', '^TNX']

benchmark_tickers = ['^GSPC']

tickers = benchmark_tickers + ['GSK', 'BST', 'PFE']

#https://github.com/ranaroussi/yfinance/blob/main/yfinance/base.py

# def history(self, period="1mo", interval="1d",

# start=None, end=None, prepost=False, actions=True,

# auto_adjust=True, back_adjust=False,

# proxy=None, rounding=False, tz=None, timeout=None, **kwargs):

dfs = {}

for ticker in tickers:

cur_data = yf.Ticker(ticker)

hist = cur_data.history(period="max", start='2000-01-01')

print(datetime.now(), ticker, hist.shape, hist.index.min(), hist.index.max())

dfs[ticker] = hist

2022-09-04 15:36:33.419826 ^GSPC (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-04 15:36:33.792559 GSK (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

2022-09-04 15:36:33.966659 BST (1976, 7) 2014-10-29 00:00:00 2022-09-02 00:00:00

2022-09-04 15:36:34.294939 PFE (5706, 7) 1999-12-31 00:00:00 2022-09-02 00:00:00

ticker = '^GSPC'

dfs[ticker].tail(5)

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-29 | 4034.580078 | 4062.989990 | 4017.419922 | 4030.610107 | 2963020000 | 0 | 0 |

| 2022-08-30 | 4041.250000 | 4044.979980 | 3965.209961 | 3986.159912 | 3190580000 | 0 | 0 |

| 2022-08-31 | 4000.669922 | 4015.370117 | 3954.530029 | 3955.000000 | 3797860000 | 0 | 0 |

| 2022-09-01 | 3936.729980 | 3970.229980 | 3903.649902 | 3966.850098 | 3754570000 | 0 | 0 |

| 2022-09-02 | 3994.659912 | 4018.429932 | 3906.209961 | 3924.260010 | 4134920000 | 0 | 0 |

Define (Yet Another) Improved RSI Enhanced With Hann Windowing calculation function

import math

def cal_rsih(ohlc: pd.DataFrame,

period: int = 14,

column: str = "close") -> pd.Series:

"""

source: https://traders.com/Documentation/FEEDbk_docs/2022/01/TradersTips.html

// TASC JAN 2022, RSIH - RSI with Hann Windowing, John F. Ehlers

inputs:

RSILength(14);

// Accumulate "Closes Up" and "Closes Down"

CU = 0;

CD = 0;

for count = 1 to RSILength begin

if Close[count - 1] - Close[count] > 0 then

CU = CU + (1 - Cosine(360*count / (RSILength + 1)))

*(Close[count - 1] - Close[count]);

if Close[count] - Close[count - 1] > 0 then

CD = CD + (1 - Cosine(360*count / (RSILength + 1)))

*(Close[count] - Close[count - 1]);

end;

if CU + CD <> 0 then

MyRSI = (CU - CD) / (CU + CD);

"""

def _hann(c, rsi_len):

cu = 0

cd = 0

for i in range(1, rsi_len):

j = i + 1

delta = c[i] - c[i-1] #e.g. i=1, delta = c[0] - c[-1] => current close minus previous close.

if delta>0:

cu = cu + (1 - math.cos(360*j/(rsi_len + 1)))*delta

else:

cd = cd - (1 - math.cos(360*j/(rsi_len + 1)))*delta

re = 0

if (cu + cd) != 0:

re = (cu - cd)/(cu + cd)

return re

c = ohlc[column]

rsi_ = c.rolling(window=period, min_periods=period).apply(lambda x: _hann(x, period))

return pd.Series(rsi_,index=ohlc.index, name=f"RSIH")

import math

def cal_rsih(ohlc: pd.DataFrame,

period: int = 14,

column: str = "close") -> pd.Series:

"""

source: https://traders.com/Documentation/FEEDbk_docs/2022/01/TradersTips.html

lengthInput = input.int(14, "Length:", minval = 2)

rsih(length) =>

var float PIx2 = 2 * math.pi

// Accumulate "Closes Up" and "Closes Down"

cu = 0.0

cd = 0.0

for count = 1 to length

change = close[count] - close[count - 1]

absChange = math.abs(change)

cosPart = math.cos(PIx2 * count / (length + 1))

if change < 0

cu := cu + (1 - cosPart) * absChange

else if change > 0

cd := cd + (1 - cosPart) * absChange

result = nz((cu - cd) / (cu + cd))

"""

def _hann(_data, _len):

pi_ = 2*math.pi

#Accumulate "Closes Up" and "Closes Down"

cu = 0.0

cd = 0.0

for i in range(1, _len):

delta = _data[i] - _data[i-1]

delta_abs = np.abs(delta)

cos_ = math.cos(pi_*i/(_len + 1))

if delta>0:

cu = cu + (1 - cos_)*delta_abs

else:

cd = cd + (1 - cos_)*delta_abs

re = 0

if (cu + cd) != 0:

re = (cu - cd)/(cu + cd)

return re

c = ohlc[column]

rsi_ = c.rolling(window=period, min_periods=period).apply(lambda x: _hann(x, period))

return pd.Series(rsi_,index=ohlc.index, name=f"RSIH")

def _hann(_data, _len):

out_ = np.zeros(_len)

for i in range(_len):

out_[i] = _data[i]*(1-math.cos(2*math.pi*(i+1)/(_len + 1)))

Calculate (Yet Another) Improved RSI Enhanced With Hann Windowing

the 2 functions in above cells render very different results. use the 2nd function

df = dfs[ticker][['Open', 'High', 'Low', 'Close', 'Volume']]

df = df.round(2)

cal_rsih

<function __main__.cal_rsih(ohlc: pandas.core.frame.DataFrame, period: int = 14, column: str = 'close') -> pandas.core.series.Series>

df_ta = cal_rsih(df, period=14, column="Close")

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

164

from core.finta import TA

df_ta = TA.EMA(df, period = 14, column="close")

df_ta.name='EMA'

df = df.merge(df_ta, left_index = True, right_index = True, how='inner' )

del df_ta

gc.collect()

21

display(df.head(5))

display(df.tail(5))

| Open | High | Low | Close | Volume | RSIH | EMA | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 1999-12-31 | 1464.47 | 1472.42 | 1458.19 | 1469.25 | 374050000 | NaN | 1469.250000 |

| 2000-01-03 | 1469.25 | 1478.00 | 1438.36 | 1455.22 | 931800000 | NaN | 1461.733929 |

| 2000-01-04 | 1455.22 | 1455.22 | 1397.43 | 1399.42 | 1009000000 | NaN | 1437.929796 |

| 2000-01-05 | 1399.42 | 1413.27 | 1377.68 | 1402.11 | 1085500000 | NaN | 1426.971510 |

| 2000-01-06 | 1402.11 | 1411.90 | 1392.10 | 1403.45 | 1092300000 | NaN | 1420.834784 |

| Open | High | Low | Close | Volume | RSIH | EMA | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2022-08-29 | 4034.58 | 4062.99 | 4017.42 | 4030.61 | 2963020000 | -0.520148 | 4147.551970 |

| 2022-08-30 | 4041.25 | 4044.98 | 3965.21 | 3986.16 | 3190580000 | -0.573418 | 4126.033040 |

| 2022-08-31 | 4000.67 | 4015.37 | 3954.53 | 3955.00 | 3797860000 | -0.595874 | 4103.228635 |

| 2022-09-01 | 3936.73 | 3970.23 | 3903.65 | 3966.85 | 3754570000 | -0.593899 | 4085.044817 |

| 2022-09-02 | 3994.66 | 4018.43 | 3906.21 | 3924.26 | 4134920000 | -0.602275 | 4063.606841 |

df[['RSIH']].hist(bins=50)

array([[<AxesSubplot:title={'center':'RSIH'}>]], dtype=object)

#https://github.com/matplotlib/mplfinance

#this package help visualize financial data

import mplfinance as mpf

import matplotlib.colors as mcolors

# all_colors = list(mcolors.CSS4_COLORS.keys())#"CSS Colors"

# all_colors = list(mcolors.TABLEAU_COLORS.keys()) # "Tableau Palette",

# all_colors = list(mcolors.BASE_COLORS.keys()) #"Base Colors",

all_colors = ['dodgerblue', 'firebrick','limegreen','skyblue','lightgreen', 'navy','yellow','plum', 'yellowgreen']

#https://github.com/matplotlib/mplfinance/issues/181#issuecomment-667252575

#list of colors: https://matplotlib.org/stable/gallery/color/named_colors.html

#https://github.com/matplotlib/mplfinance/blob/master/examples/styles.ipynb

def make_3panels2(main_data, add_data, mid_panel=None, chart_type='candle', names=None, figratio=(14,9)):

style = mpf.make_mpf_style(base_mpf_style='yahoo', #charles

base_mpl_style = 'seaborn-whitegrid',

# marketcolors=mpf.make_marketcolors(up="r", down="#0000CC",inherit=True),

gridcolor="whitesmoke",

gridstyle="--", #or None, or - for solid

gridaxis="both",

edgecolor = 'whitesmoke',

facecolor = 'white', #background color within the graph edge

figcolor = 'white', #background color outside of the graph edge

y_on_right = False,

rc = {'legend.fontsize': 'small',#or number

#'figure.figsize': (14, 9),

'axes.labelsize': 'small',

'axes.titlesize':'small',

'xtick.labelsize':'small',#'x-small', 'small','medium','large'

'ytick.labelsize':'small'

},

)

if (chart_type is None) or (chart_type not in ['ohlc', 'line', 'candle', 'hollow_and_filled']):

chart_type = 'candle'

len_dict = {'candle':2, 'ohlc':3, 'line':1, 'hollow_and_filled':2}

kwargs = dict(type=chart_type, figratio=figratio, volume=True, volume_panel=2,

panel_ratios=(4,2, 2), tight_layout=True, style=style, returnfig=True)

if names is None:

names = {'main_title': '', 'sub_tile': ''}

added_plots = {

# 'S': mpf.make_addplot(add_data['S'], panel=0, color='blue', type='scatter', marker=r'${S}$' , markersize=100, secondary_y=False),

# 'B': mpf.make_addplot(add_data['B'], panel=0, color='blue', type='scatter', marker=r'${B}$' , markersize=100, secondary_y=False),

'EMA': mpf.make_addplot(add_data['EMA'], panel=0, color='dodgerblue', width=1 ,secondary_y=False),

}

if mid_panel is not None:

i = 0

for name_, data_ in mid_panel.iteritems():

added_plots[name_] = mpf.make_addplot(data_, panel=1, width=1,color=all_colors[i])

i = i + 1

# fb_bbands2_ = dict(y1=-0.5*np.ones(mid_panel.shape[0]),

# y2=0.5*np.ones(mid_panel.shape[0]),color="lightskyblue",alpha=0.1,interpolate=True)

# fb_bbands2_['panel'] = 1

# fb_bbands.append(fb_bbands2_)

fb_bbands = []

fb_span_up = dict(y1=np.zeros(mid_panel.shape[0]),y2=mid_panel['RSIH'].values,where=mid_panel['RSIH']<0,color="#FF008055",alpha=0.2, panel=1, interpolate=True)

fb_span_dn = dict(y1=np.zeros(mid_panel.shape[0]),y2=mid_panel['RSIH'].values,where=mid_panel['RSIH']>0,color="palegreen",alpha=0.2, panel=1, interpolate=True)

fb_bbands= [fb_span_up, fb_span_dn]

fig, axes = mpf.plot(main_data, **kwargs,

addplot=list(added_plots.values()),

fill_between = fb_bbands,

)

# add a new suptitle

fig.suptitle(names['main_title'], y=1.05, fontsize=12, x=0.1285)

# axes[0].legend([None]*4)

# handles = axes[0].get_legend().legendHandles

# axes[0].legend(handles=handles[2:],labels=['RS_EMA', 'EMA'])

# axes[0].set_title(names['sub_tile'], fontsize=10, style='italic', loc='left')

# axes[0].set_ylabel(names['y_tiles'][0])

# axes[2].set_ylabel(names['y_tiles'][1])

return fig, axes

start = -250

end = -160#df.shape[0]

names = {'main_title': f'{ticker}',

'sub_tile': 'RSI with Hann'}

aa_, bb_ = make_3panels2(df.iloc[start:end][['Open', 'High', 'Low', 'Close', 'Volume']],

df.iloc[start:end][['EMA']],

df.iloc[start:end][['RSIH']],

chart_type='hollow_and_filled',names = names)