Markov-Switching Regime Detection

Markov-switching dynamic regression (Statsmodels MarkovRegression) models are fitted to detect latent regimes in a market-derived target series (S&P 500).

Multiple specifications (different number of regimes, lag features, switching variance) are compared, and the best model is selected by BIC. From this model, insights are derived regarding the regimes persistence, transition dynamics, and regime-conditional behavior.

Data & target construction

- Universe: S&P 500 index (

^GSPC) - Source:

yfinance - Sample downloaded: 6546 daily records from 2000-01-03 to 2026-01-12

- Forward window: 20 trading days

Forward 20-day max return target

For each date \(t\) with close \(C_t\):

\[target_t = 100 \times \frac{\max(C_{t+1}, \dots, C_{t+20}) - C_t}{C_t}\]Observed target statistics (after dropping tail NaNs):

- Mean: 2.92%

- Std: 2.73%

- Range: [-5.27%, 28.48%]

Lagged features

We build autoregressive inputs from the target:

lag1 = target_{t-1}lag20 = target_{t-20}

Final modeling dataset: 6506 observations.

Train/test split (time-based)

- Train: 6406 samples (2000-02-01 → 2025-07-22)

- Test: 100 samples (2025-07-23 → 2025-12-11)

Model zoo (what we fit)

All models are estimated using statsmodels.tsa.MarkovRegression on the training set:

2_regime: 2 regimes, switching intercept5_regime: 5 regimes, switching intercept3_regime_exog: 3 regimes, switching intercept + exog (lag1,lag20)3_regime_var: 3 regimes, switching variance + exog (lag20)3_regime_full: 3 regimes, switching variance + exog (lag1,lag20)

Model comparison

Lower AIC/BIC indicates better fit (with BIC penalizing complexity more strongly).

| Model | Description | K | Params | LogLik | AIC | BIC |

|---|---|---|---|---|---|---|

3_regime_full | 3 regimes, switching variance, lag1 & lag20 | 3 | 18 | -9137.95 | 18311.89 | 18433.66 |

3_regime_exog | 3 regimes, switching intercept & exog (lag1, lag20) | 3 | 16 | -10240.30 | 20512.60 | 20620.84 |

5_regime | 5 regimes, switching intercept | 5 | 26 | -11358.68 | 22769.37 | 22945.26 |

3_regime_var | 3 regimes, switching variance, lag20 | 3 | 15 | -11771.77 | 23573.55 | 23675.02 |

2_regime | 2 regimes, switching intercept | 2 | 5 | -13831.51 | 27673.02 | 27706.85 |

Selected best model (lowest BIC): 3_regime_full

Best model: 3_regime_full

Specification

- 3 regimes

- switching variance enabled

- exogenous regressors:

lag1,lag20 - trend/intercept included

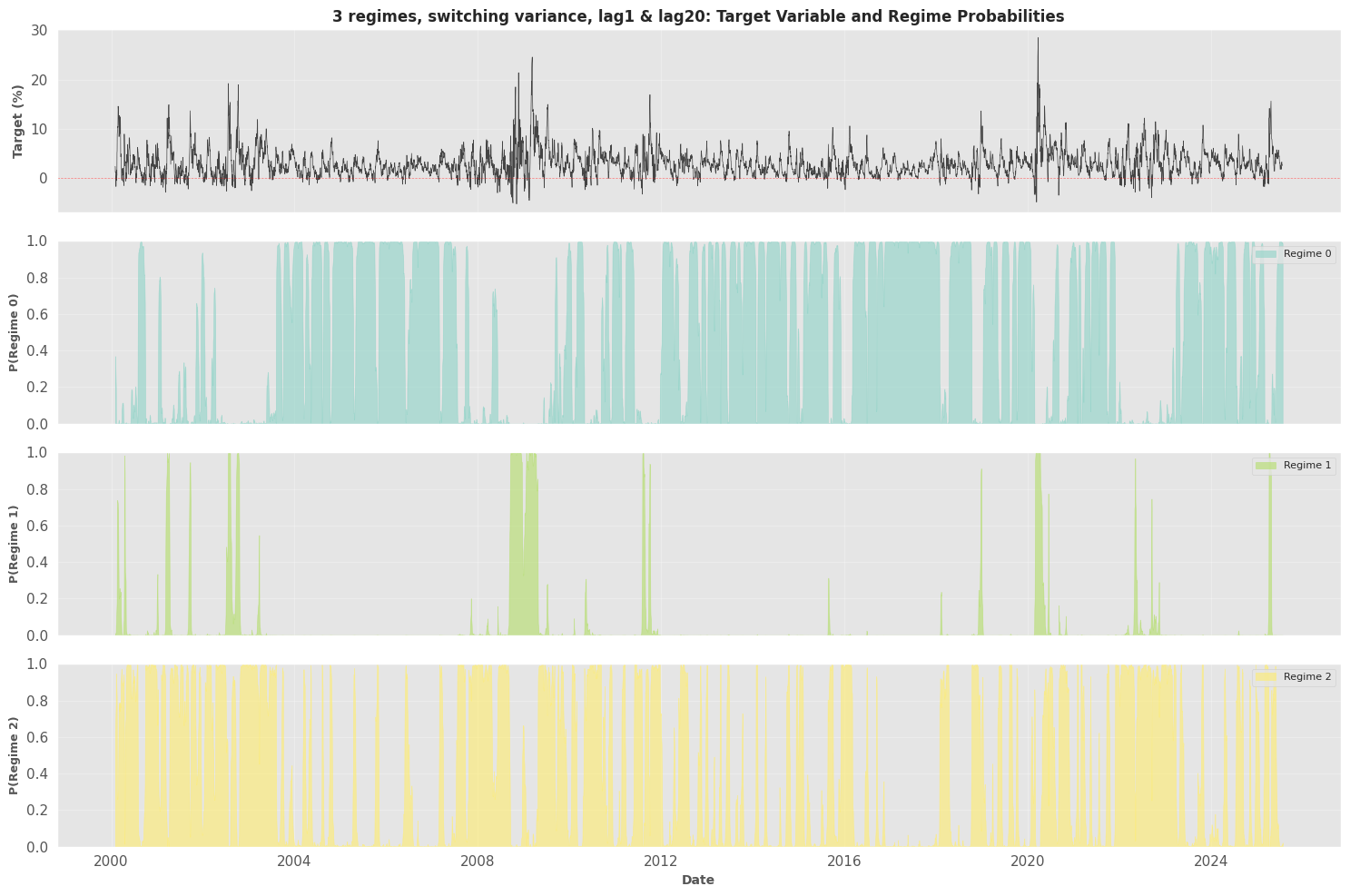

Regime persistence (expected durations)

- Regime 0: 40.55 days

- Regime 1: 16.11 days

- Regime 2: 25.15 days

Transition probability matrix (smoothed estimates)

| From \ To | 0 | 1 | 2 |

|---|---|---|---|

| 0 | 0.9753 | 0.0003 | 0.0315 |

| 1 | 0.0000 | 0.9379 | 0.0083 |

| 2 | 0.0247 | 0.0617 | 0.9602 |

Interpretation (high level):

- Regime 0 and Regime 2 are highly persistent (diagonal near 0.96–0.98).

- Regime 1 is rarer and shorter-lived, with persistence ~0.94 and more frequent transitions out.

Regime period statistics (training set)

Regimes are assigned via \(\arg\max_i P(S_t=i)\) using smoothed marginal probabilities.

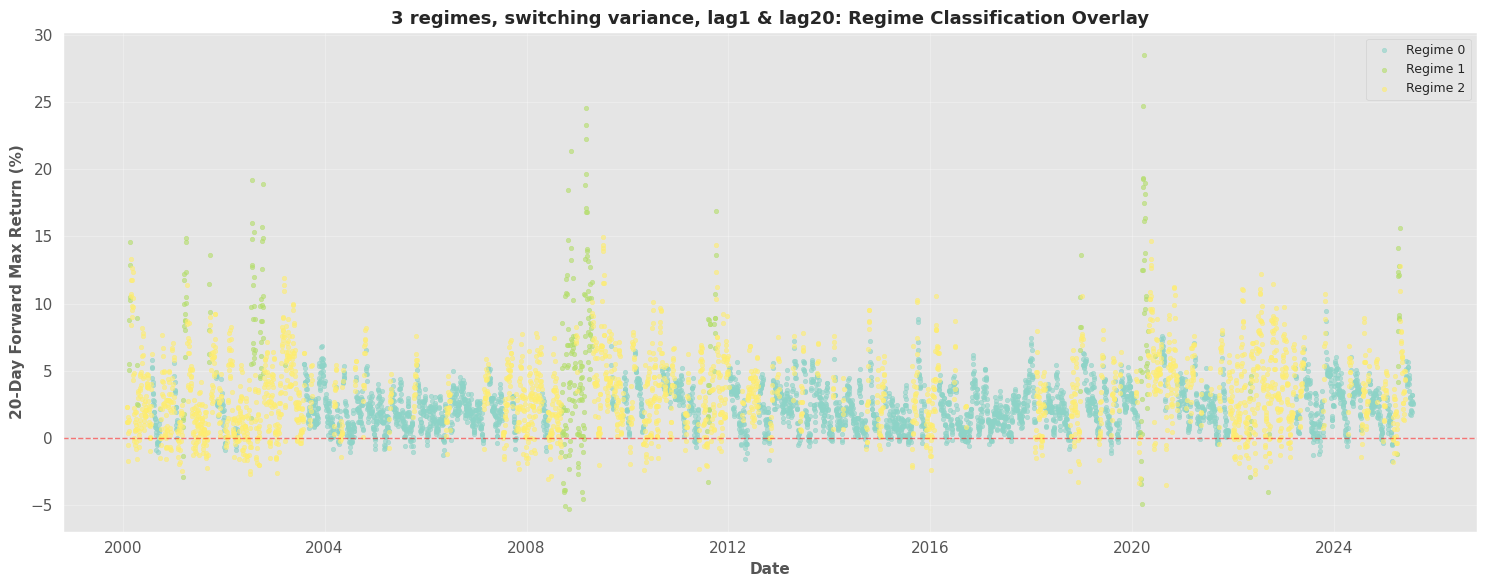

Regime 0 (dominant, “low dispersion”)

- Frequency: 3428 days (53.5%)

- Mean target: 2.248%

- Std: 1.572%

- Min/Max: -1.706% / 9.420%

- Longest streak: 343 consecutive days

Regime 1 (rare, “high opportunity / high dispersion”)

- Frequency: 320 days (5.0%)

- Mean target: 6.948%

- Std: 5.925%

- Min/Max: -5.268% / 28.478%

- Longest streak: 74 consecutive days

Regime 2 (common, “medium dispersion”)

- Frequency: 2658 days (41.5%)

- Mean target: 3.322%

- Std: 2.837%

- Min/Max: -3.513% / 14.941%

- Longest streak: 131 consecutive days

======================================================================

MARKOV SWITCHING DYNAMIC REGRESSION ANALYSIS

======================================================================

Downloading data for ^GSPC...

Downloaded 6546 records from 2000-01-03 to 2026-01-12

Calculated forward 20-day max return

Target stats: mean=2.92%, std=2.73%

Range: [-5.27%, 28.48%]

Created lagged features: ['lag1', 'lag20']

Final dataset size: 6506 observations

Data Split:

Training: 6406 samples (2000-02-01 to 2025-07-22)

Testing: 100 samples (2025-07-23 to 2025-12-11)

======================================================================

FITTING MARKOV SWITCHING MODELS

======================================================================

[1/5] Fitting 2-regime model (switching intercept)...

AIC: 27673.02, BIC: 27706.85

[2/5] Fitting 5-regime model (switching intercept)...

AIC: 22769.37, BIC: 22945.26

[3/5] Fitting 3-regime model with lag features...

AIC: 20512.60, BIC: 20620.84

[4/5] Fitting 3-regime model with switching variance...

AIC: 23573.55, BIC: 23675.02

[5/5] Fitting comprehensive 3-regime model...

AIC: 18311.89, BIC: 18433.66

======================================================================

MODEL COMPARISON

======================================================================

Model Description K_Regimes N_Params Log_Likelihood AIC BIC HQIC

3_regime_full 3 regimes, switching variance, lag1 & lag20 3 18 -9137.947100 18311.894201 18433.664027 18354.041756

3_regime_exog 3 regimes, switching intercept & exog (lag1, lag20) 3 16 -10240.298946 20512.597891 20620.837737 20550.062385

5_regime 5 regimes, switching intercept 5 26 -11358.683365 22769.366730 22945.256478 22830.246531

3_regime_var 3 regimes, switching variance, lag20 3 15 -11771.772696 23573.545393 23675.020248 23608.668355

2_regime 2 regimes, switching intercept 2 5 -13831.511662 27673.023324 27706.848275 27684.730978

Lower AIC/BIC indicates better model fit

======================================================================

BEST MODEL: 3_regime_full

======================================================================

Markov Switching Model Results

==============================================================================

Dep. Variable: target No. Observations: 6406

Model: MarkovRegression Log Likelihood -9137.947

Date: Tue, 13 Jan 2026 AIC 18311.894

Time: 08:01:47 BIC 18433.664

Sample: 0 HQIC 18354.042

- 6406

Covariance Type: approx

Regime 0 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.1733 0.027 6.438 0.000 0.121 0.226

x1 0.8986 0.008 111.822 0.000 0.883 0.914

x2 -0.0019 0.006 -0.290 0.772 -0.014 0.011

sigma2 0.3700 0.017 21.965 0.000 0.337 0.403

Regime 1 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 1.6765 0.462 3.629 0.000 0.771 2.582

x1 0.7863 0.041 19.089 0.000 0.706 0.867

x2 -0.0150 0.039 -0.387 0.699 -0.091 0.061

sigma2 12.9299 1.883 6.868 0.000 9.240 16.620

Regime 2 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.5306 0.053 9.986 0.000 0.426 0.635

x1 0.8607 0.011 78.397 0.000 0.839 0.882

x2 -0.0106 0.010 -1.098 0.272 -0.030 0.008

sigma2 1.8866 0.165 11.414 0.000 1.563 2.211

Regime transition parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

p[0->0] 0.9753 0.004 252.383 0.000 0.968 0.983

p[1->0] 0.0003 0.034 0.009 0.992 -0.067 0.068

p[2->0] 0.0315 0.005 6.662 0.000 0.022 0.041

p[0->1] 1.933e-06 0.003 0.001 0.999 -0.005 0.005

p[1->1] 0.9379 0.027 35.374 0.000 0.886 0.990

p[2->1] 0.0083 0.003 3.074 0.002 0.003 0.014

==============================================================================

Warnings:

[1] Covariance matrix calculated using numerical (complex-step) differentiation.

======================================================================

REGIME ANALYSIS: 3 regimes, switching variance, lag1 & lag20

======================================================================

Expected Regime Durations:

Regime 0: 40.55 days (0.16 years)

Regime 1: 16.11 days (0.06 years)

Regime 2: 25.15 days (0.10 years)

Regime Mean Returns:

Transition Probability Matrix:

To_0 To_1 To_2

From_0 0.9753 0.0003 0.0315

From_1 0.0000 0.9379 0.0083

From_2 0.0247 0.0617 0.9602

======================================================================

REGIME PERIOD STATISTICS

======================================================================

Regime 0:

Frequency: 3428 days (53.5%)

Mean return: 2.248%

Std dev: 1.572%

Min: -1.706%

Max: 9.420%

Longest period: 343 consecutive days

Regime 1:

Frequency: 320 days (5.0%)

Mean return: 6.948%

Std dev: 5.925%

Min: -5.268%

Max: 28.478%

Longest period: 74 consecutive days

Regime 2:

Frequency: 2658 days (41.5%)

Mean return: 3.322%

Std dev: 2.837%

Min: -3.513%

Max: 14.941%

Longest period: 131 consecutive days

Generating visualizations...

Saved: markov_regime_probabilities.png

Saved: markov_regime_overlay.png

Caveats

- This pipeline fits regimes on a forward-looking target (20-day forward max return).

- Score/regime labels are model-dependent: “Regime 1” here means the regime with the estimated characteristics above (rare + high dispersion), not a universal mapping.

- The best model was selected by in-sample BIC on the training period.