SMI: Stochastic Momentum Reversion

A highly robust mean-reversion system that identifies deep value entries within medium-term volatility cycles.

View Script - Github Repository

Strategy Profile

| Metric | Value |

|---|---|

| Logic Class | Mean Reversion / Oscillator |

| Primary Tickers | GS, MSFT, HD, V, SHW, CAT, MCD, UNH, AXP |

| Validation Status | Very Robust (-19.4% Degradation) |

| Best Optimization Score | 1.1200 (Sharpe) |

| Global Holdout Sharpe | 1.06 (2023–2025) |

| Risk Profile | Moderate (Counter-Trend Entry) |

Overview

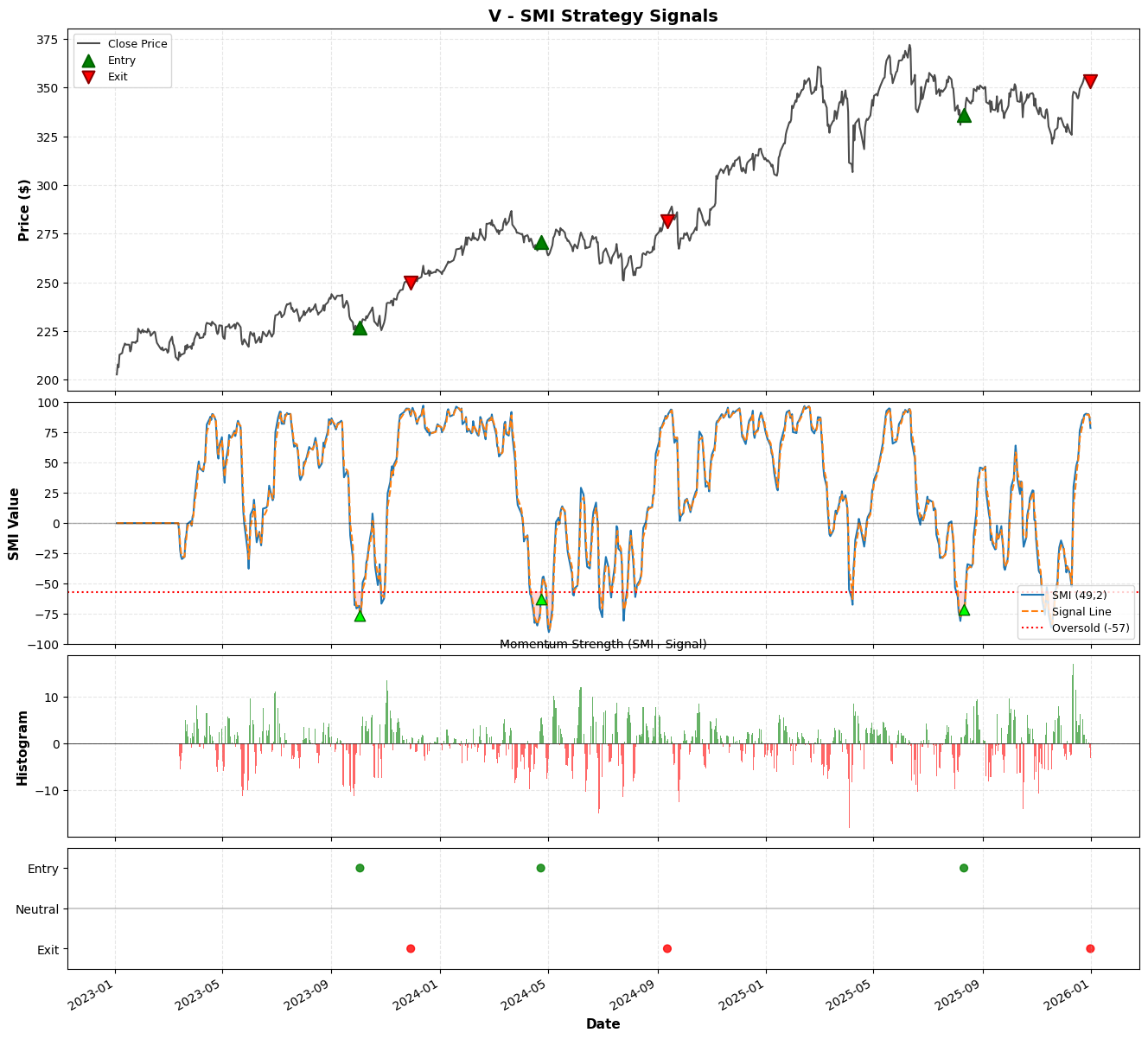

The Stochastic Momentum Index (SMI) measures the position of the close relative to the midpoint of the High/Low range (-100 to +100), rather than the absolute Low used in traditional Stochastics.

This strategy filters for “Deep Oversold” regimes—where price deviates significantly below the midpoint—and triggers entries only when momentum confirms a reversal (signal line crossover). Recent optimization suggests a preference for medium-term lookbacks (approx. 2 months) combined with early profit taking (lower exit thresholds), resulting in high win rates in recent market regimes.

Signal Logic Specification

The strategy employs a precise sequence of market state detection followed by a momentum trigger.

1. Indicator Calculation

- Range Calculation: Determine the Highest High and Lowest Low over a lookback period \(k\).

- Midpoint Deviation: Calculate the difference between the current Close and the Midpoint of that range.

- Double Smoothing: Apply an Exponential Moving Average (EMA) of period \(d\) to the result, and then apply the EMA again. This eliminates noise lag.

- Normalization: The result is scaled between -100 and +100.

2. Entry Logic (Long)

A buy signal requires the convergence of extreme valuation and immediate momentum recovery:

- Deep Value Filter: The SMI value must drop below a strict Oversold Threshold (e.g., -58). This ensures the asset is trading at a significant discount relative to its recent range.

- Momentum Crossover: The SMI line must cross above its own Signal Line (EMA). This confirms the bottom has likely formed.

3. Exit Logic

The trade is closed on trend exhaustion:

- Overextension: The Signal line must be above the Overbought Threshold (e.g., 53).

- Momentum Loss: The SMI line crosses below the Signal Line.

Global Optimization & Parameters

The strategy was optimized using a Walk-Forward framework. The best-performing configuration emphasizes a longer lookback period and a lower exit threshold than standard implementations.

| Parameter | Value | Role | Stability (CV) | Assessment |

|---|---|---|---|---|

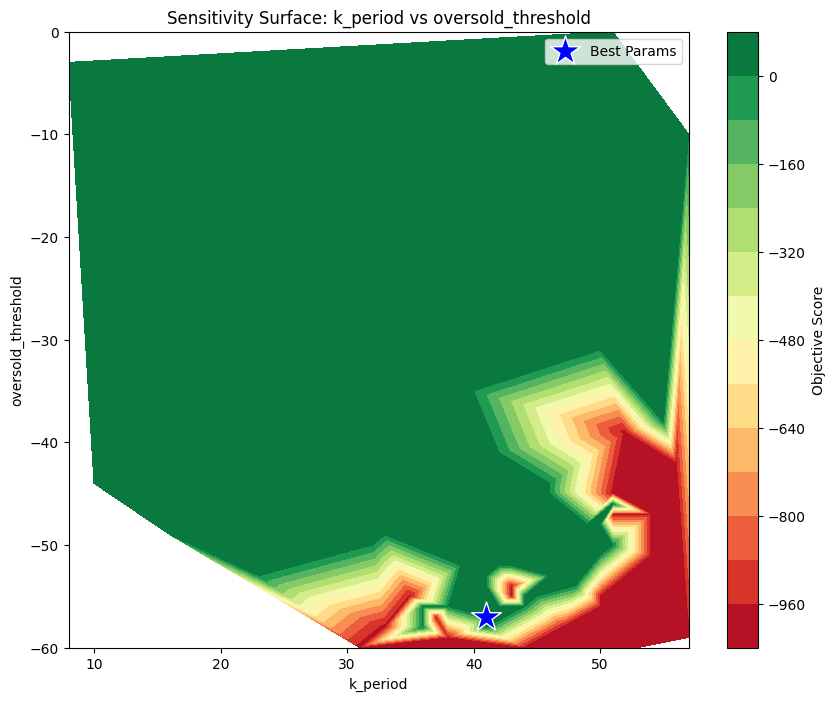

| k_period | 41 | Cycle Lookback | 0.090 | Excellent |

| d_period | 2 | Signal Reactivity | 0.213 | Poor |

| oversold_threshold | -57 | Entry Filter | 0.081 | Excellent |

| overbought_threshold | 37 | Exit Filter | 0.115 | Good |

Interpretation

- Lower Exit Threshold (37): Unlike previous iterations using 50+, the optimal exit threshold is 37. This indicates the strategy performs better by securing profits earlier in the rebound phase rather than waiting for fully overextended conditions.

- Lookback (41): The strategy remains tuned to a ~2-month cycle, filtering out short-term noise.

- Sensitivity: The

d_periodremains unstable, suggesting signal timing is highly sensitive to the smoothing factor.

Robustness Analysis

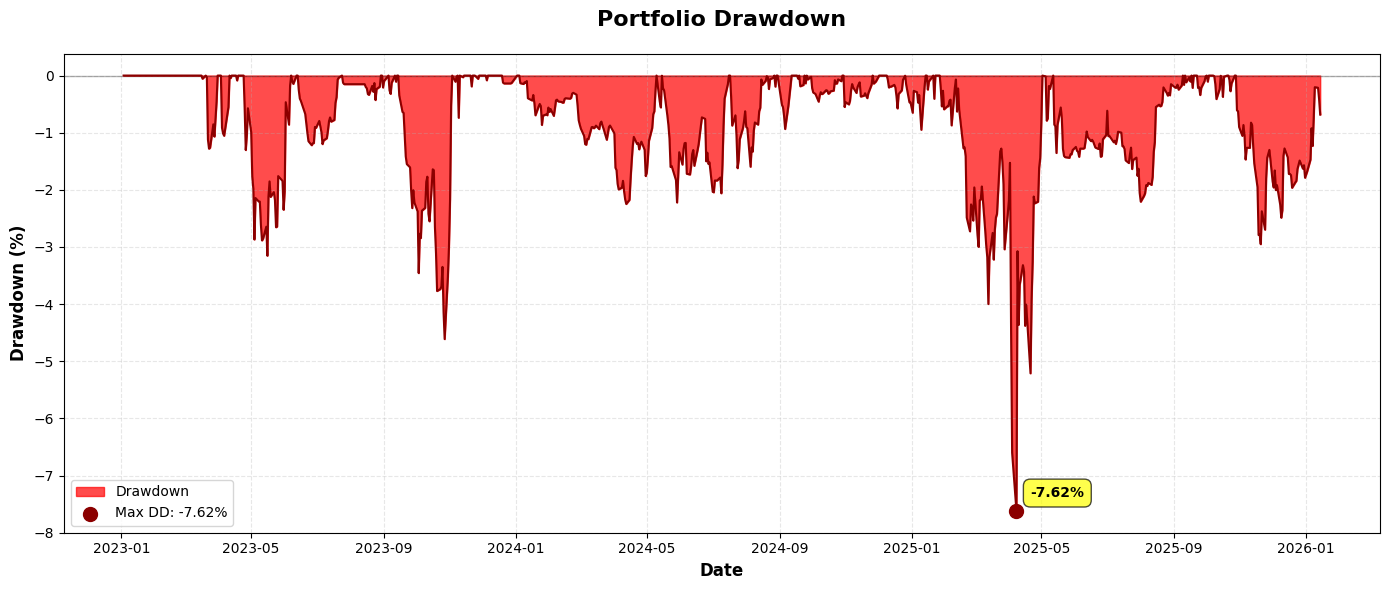

1. Degradation Analysis

- Avg Sharpe Degradation: -19.42%

- Assessment: Very Robust.

- A negative degradation indicates that the strategy performed significantly better in the Out-of-Sample (OOS) periods than in the In-Sample optimization. This suggests the logic is not overfit and adapts well to unseen data.

2. Parameter Importance (MDI)

Feature importance analysis reveals which parameters drive the strategy’s alpha:

| Parameter | Importance | Interpretation |

|---|---|---|

| k_period | 44.13% | The lookback window is the primary determinant of success. |

| oversold_threshold | 34.41% | The entry filter level is the secondary driver. |

| d_period | 15.65% | Signal smoothing contributes moderately. |

| overbought_threshold | 5.81% | The specific exit level is the least important factor. |

- Primary Drivers:

k_period(44%) andoversold_threshold(34%) account for nearly 80% of the strategy’s performance variance. Both parameters exhibit “Excellent” stability, reinforcing confidence in the core logic. - Secondary Drivers: The exit threshold and smoothing factor are less critical to the strategy’s overall edge.

3. Sensitivity Surface (k_period (44%) and oversold_threshold (34%))

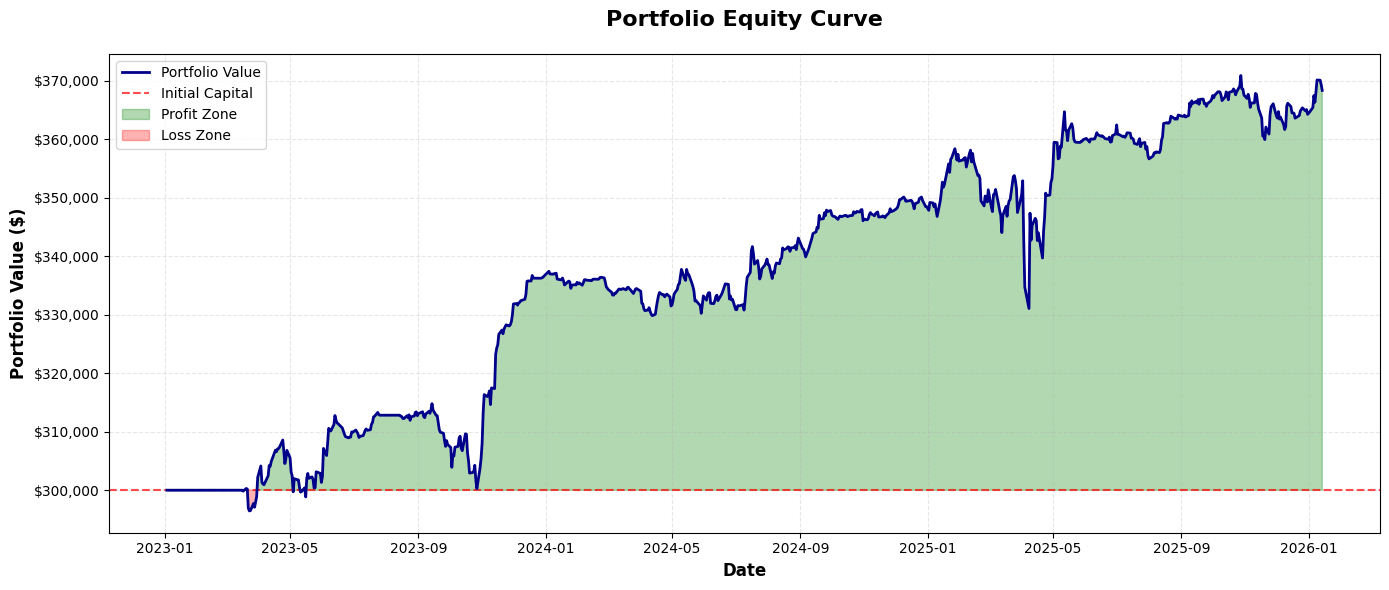

Global Holdout Results (2023–2025)

The strategy was tested on a pristine holdout dataset (post-optimization).

1. Performance Summary

| Metric | Result |

|---|---|

| Total Return | 22.79% |

| Sharpe Ratio | 1.06 |

| Sortino Ratio | 1.41 |

| Max Drawdown | -7.62% |

| Win Rate | 84.62% |

| Profit Factor | 7.89 |

2. Trade Statistics

- Total Trades: 39

- Avg Trade: $1,776.94

- Best/Worst: +$7,929 / -$4,016

3. Portfolio Equity Curve

4. Portfolio Drawdown

5. Strategy Signals (Ticker - V)

View Strategy Signals Script for All Tickers

Conclusion

The SMI strategy demonstrates high statistical robustness. The shift to a lower overbought_threshold (37) has resulted in a system that captures mean-reversion profits more reliably (84% win rate). The negative degradation score strongly suggests the model is capturing a persistent market anomaly rather than fitting to noise.